On Tuesday, April 2, I flew to Washington, D.C., for the premier of Steve Forbes’s and Elizabeth Ames’s documentary, “In Money We Trust?” in the nation’s capital. The event occurred at the Trump International Hotel.

I’m one of several monetary experts interviewed in the film, along with Alan Greenspan, Paul Volker and Steve Forbes himself. You can watch the trailer or the entire 54-minute doc by going to www.inmoneywetrust.org.

My comments on the origin of the Fed can be found starting around minute 17 in the film.

Over 200 people attended the event. Other luminaries in attendance at the premier included Steve Moore, President Trump’s nominee to fill an opening on the Federal Reserve Board.

Afterwards, Steve Moore’s organization, the Committee to Unleash the Economy, hosted a private dinner.

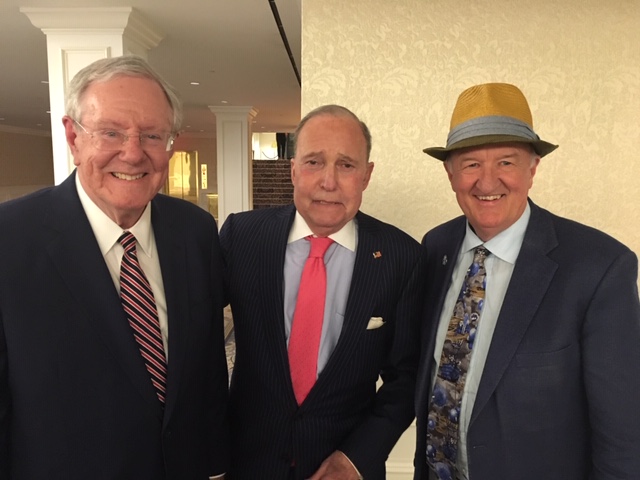

Getting together with Steve Forbes and Larry Kudlow in Washington, D.C.

Larry Kudlow and his wife were the guests of honor. He was very supportive of Steve Moore, and said President Trump was not backing down in nominating Moore, despite controversy over his nomination (read last week’s Skousen CAFÉ).

The Trump Economy on the GO

Most of the questions Kudlow fielded from friends were about foreign trade policy and immigration. Larry is heavily involved in the upcoming trade deal with China, and he has to manage to control the protectionist anti-China faction in the administration (such as Director of Trade Peter Navarro and Commerce Secretary Wilbur Ross).

Larry also is dealing with the potential closing of the border between Mexico in the United States in response to the growing immigration crisis. He reported meeting with leaders of the U.S. Chamber of Commerce and their concern that the border shutdown could severely damage the economy and jeopardize billions of dollars in trade between the two countries. Larry said it was a serious challenge and the administration is trying to work around the problem while seeking to solve the immigration crisis.

Larry wanted to know my views about the Trump economy — is it still doing well despite the trade and immigration issues? He is a big fan of my gross output (GO) statistic and asked me about the latest data.

I told him that GO is the best measure of economic activity. Unlike gross domestic product (GDP), GO includes the value of the supply chain and business-to-business (B2B) spending.

GO also is a leading indicator of economic growth. It does a good job of predicting what GDP will do in the next three months. I told him that GO continues to grow faster than GDP, suggesting that the economy will stay robust. (For more information about GO and the latest press release, go to my website, www.grossoutput.com.)

The Fed and Gold

Moore led a lengthy discussion at dinner about monetary policy and the Fed.

In the documentary, Steve Forbes favors a return to a gold standard whereby the Fed seeks a policy that stabilizes the price of gold over the long term. I noted that in the past year or so, the price of gold indeed has stabilized at around $1,300 an ounce. I said this is an indication that the Fed policy has been working, even though the U.S. central bank has raised interest rates. And while gold has been relatively stable, stock prices continue to move higher. What’s not to like?

I also told the group that we must look not only at the price of money (interest rates) but the supply of money. According to the Fed, the money supply (M2) growth rate has been pretty steady and not excessive. All good news for investors.

Good investing, AEIOU,

![]()

Mark Skousen

Upcoming Events:

Join Hilary Kramer, 70+ other high-caliber wealth experts and me at the Wealth365 Summit online event April 8-13 — it’s free! Wealth365 is more than a conference — it’s the gold standard experience dedicated to authentic and actionable online education in the areas of trading and investing, real estate, entrepreneurship and all things wealth. It’s all 100% online, so you don’t have to leave the comfort of your home or office. Click here now to register for FREE.

American Association of Individual Investors (AAII), April 13, Skirball Center, Los Angeles: Starting at 9 a.m., I’ll be speaking on “Why Bull Markets Are Lasting Longer” and “Ye Shall Prosper In the Land: Three Financial Lessons from the Bible,” in honor of the Passover and Easter the following weekend. Here I will offer a unique presentation on the Biblical principles of prosperity, including (1) The significance of the Abrahamic Covenant now: “Why the Jews Don’t Feel Guilty about Money and Sex, and Christians Do.” (2) Max Weber’s “The Protestant Ethic and the Spirit of Capitalism” and how John Wesley’s “Sermon on Wealth” in 1743 made the West rich; (3)American Exceptionalism (as the Promised Land); and (4) How to apply Ben Franklin’s Trinity of Virtues (Industry, Thrift, Prudence) to investing today. My subscribers are invited. Price is only $5 at the door for first-time Skirball attendees and is the same for students who show a school ID. To secure this rate, please email Fred Wallace at fredwallace77@gmail.com (regular public “walk-up” rate is $18).

Las Vegas Money Show, May 13-15, Bally’s Resort: I’ll be moderating a main stage panel on “Where to Invest Next,” followed by two works on “My Most Successful Money-Making Strategy” and “When Will the Mother of All Bull Markets End?” Other speakers include Keith Fitz-Gerald, John Buckingham, Louis Navellier, Wayne Allyn Root, Brien Lundin, and CNBC’s Jon Najarian (Fast Money). Tickets are free, but you must click here to register. Use code 047455.

You Blew it!

Why Do George Soros, Bill Gates and Warren Buffett Finance the #1 Abortion Factory in America?

Last week my wife and I saw “Unplanned,” the powerful, disturbing and haunting story of a top director at Planned Parenthood who oversaw the killing of 22,000 premature babies. After personally witnessing an abortion, she quit and turned pro-life.

Here is the trailer for the film that I strongly encourage you to see for yourself: https://www.youtube.com/watch?v=gBLWpKbC3ww.

The film is heavy handed at times and does not address the extreme cases of pregnant women who have been raped or face deformed babies.

But abortion on demand simply due to lax morals should not be tolerated. And the idea that young teenagers can’t see an R-rated film without parental approval (such as “Unplanned”) but can get an abortion without their parents’ knowledge or approval is insane. The prevalence of abortion on demand, particularly for teenagers, makes me question what is happening in this country.

Ultimately, abortion will remain legal in many parts of the world but it should be severely restricted. “Legal but rare” is the best we realistically can hope to do. The government, schools, institutions and the media should do everything they can to discourage this highly controversial practice.

Wouldn’t it be great if the next First Lady’s agenda was to support life for the innocent and to declare war against having out-of-wedlock children?

Fortunately, persuasion has made a difference. More and more women who were convinced that an abortion was okay have learned today that, in most cases, it was a tragic mistake that sadly cannot be reversed. The loss of what could have become a beautiful baby full of life, hope and promise is permanent.

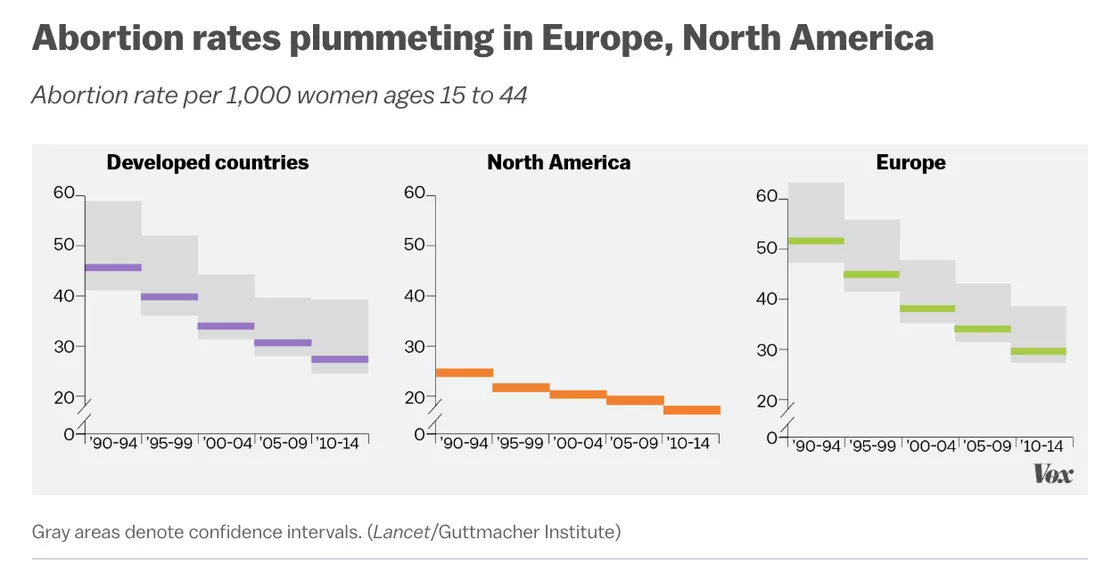

Encouragingly, abortions are on decline around the world, as the following graph demonstrates.

Unfortunately, out-of-wedlock babies are being born in record numbers. So, not all the news is good.

After seeing this film, I was shocked to learn that Planned Parenthood, the #1 provider of abortions in this country, received $1.2 billion in funding from Medicaid and the federal and states governments over the past three years.

In addition, Planned Parenthood also received grants from George Soros, Bill Gates and Warren Buffett. Don’t they know that Planned Parenthood finances the killing fields… the death camps… the Holocaust of the unborn (over 300,000 a year)?

According to the Heritage Foundation, Planned Parenthood performed 83 abortions for every one-adoption referral. It is time to pass the “No Taxpayer Funding for Abortion Act,” which would permanently end taxpayer funding for abortion.