The SYNNEX Corporation (NYSE:SNX) more than quadrupled its share price prior to a 50% correction in 2018, and the company is looking to deliver another long growth streak over the next few years.

The company managed to deliver relatively stable asset appreciation with minimal volatility over the past decade. Even after a drop of more than 60% during the 2008 financial crisis, the share price recovered fully within seven months. The share price advanced more than 12-fold before reaching its all-time high at the beginning of 2018.

Despite a pullback of more than 50% in 2018, SYNNEX’s fundamentals are solid and the company delivered strong financial results quarter after quarter. The 50-day moving average broke back above the 200-day average at the beginning of March and continues to rise, indicating a potential continuation of the current uptrend. Furthermore, SYNNEX’s current share price has more than 20% room on the upside before it reaches the analysts’ average target price of $128.14.

Financial Results

The SYNNEX Corporation delivered strong year-end results in 2018. Revenues ADVANCED 17.6% to $20 billion, Operating income of $551 million 8.3% higher tan in 2017. Due to positive effects from the Tax Cuts and Jobs Act (TCJA) in late 2017, earnings for 2018 were flat to previous year and 4.3% down on a per diluted share basis from $7.51 in 2017 to $7.19 in 2018. However, adjusted earnings rose more than 28% in 2018. Adjusted earnings per share (EPS) of $10.89 were nearly 23% higher than the $8.86 EPS from the previous year.

Strong performances continued into the first-quarter 2019. Compared to the same period last year, revenues advanced 16.8% to $5.2 billion, operating income rose 45.3% to $162 million and earnings increased more than 260% from $24 million to $87 million. First-quarter adjusted EPS advanced 33% to $2.48.

Synnex Corporation (NYSE:SNX)

Headquartered in Fremont, California, and founded in 1980, the SYNNEX Corporation provides business process services. The Technology Solutions segment distributes peripherals, information technology systems, consumer electronics, system components and software, as well as networking, communications and security equipment. This segment also provides systems design and integration solutions, build-to-order assembly capabilities and cloud services. Additionally, the segment provides outsourced fulfillment, virtual distribution and direct ship to end-user and other logistics services. The segment also offers marketing services, including targeted telemarketing campaigns, direct mail, trade shows, external media advertising, print on demand services and Web-based marketing. The Concentrix segment offers end-to-end business outsourcing services that focus on customer engagement, process optimization, technology innovation, front- and back-office automation and business transformation. Formerly known as SYNNEX Information Technologies, Inc., the company changed its name to SYNNEX Corporation in October 2003.

Dividends

The SYNNEX Corporation started distributing dividends after more than three decades of operation. However, SYNNEX has boosted its annual payout every year and has already tripled its annual dividend payout amount since its first dividend distribution in October 2014. This pace of advancement corresponds to an average growth rate of 24.6% per year.

The current $0.375 quarterly dividend payout amount is 7.1% higher than the $0.35 quarterly distribution from the same period last year. This new quarterly amount is equivalent to a $1.50 annualized dividend distribution and a 1.46% forward dividend yield. The SYNNEX Corporation’s current yield is in line with the 1.47% average yield of the overall services sector and only slightly behind the 1.53% simple average yield of the company’s peers in the Business Services industry segment.

However, while in line with its industry peers’ average yields, the SYNNEX Corporation outperformed its own 0.9% five-year average by nearly 65%. Furthermore, SYNNEX Corporation currently distributes only 20% of its earnings as dividends. This level is substantially above the company’s 14% average payout ratio over the past five years. While SYNNEXX has been increasing its payout ratio, it could continue that trend safely. Based on the current payout level, SYNNEX could increase its payout ratio 50% and still be on the low end of the 30% to 50% payout ratio range that most investors consider sustainable.

Share Price

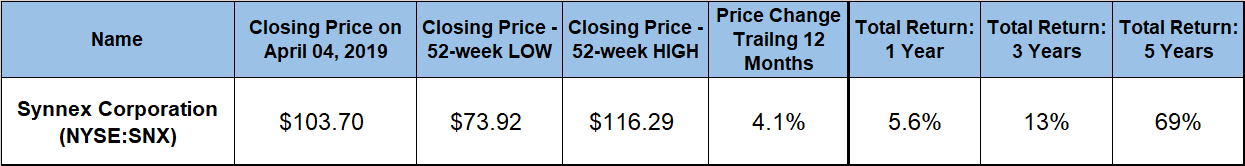

While losing nearly half of its value during the first 10 months of last year, the share price entered the trailing 12 months in April 2018 on a brief uptrend rebound. Consequently, the share price advanced nearly 17% in the first 60 days and reached its 52-week high of $116.29 on June 15, 2018. After peaking in mid-June, the share price inverted its trend, gave back its gains since the beginning of the trailing 12-month period by mid-July and dropped another 26% before hitting its 52-week low of $ 73.92 on December 24, 2018.

However, after the end of the overall market correction in late December, the share price turned corner one more time and headed higher in 2019. By the end of trading on April 5, 2019, the share regained two-thirds of its losses since the June peak to close at $103.70. The April 5 closing price advanced enough to post a 4.1% gain over the past year. Additionally, the April 5 closing price was more than 40% above the 52-week low on Christmas Eve, as well as 54% higher than it was five years ago.

While modest individually, the 1.46% dividend yield and the 4.1% asset appreciation combined for a total return of 5.6% over the past 12 months. Partially affected by the largest share price decline, the low capital gains limited total returns over the past year. However, the SYNNEX Corporation rewarded its shareholders with a total return of 13% over the past three years. Furthermore, shareholders enjoyed total returns of nearly 70% over the extended horizon of the last five years.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.