Heading into the long Easter holiday weekend, the bulls were firmly in control of the current market’s direction.

Strong earnings from market bellwether companies like JPMorgan (JPM), CSX Railroad (CSX), Blackrock (BLK), Johnson & Johnson (JNJ), PepsiCo Inc. (PEP), Union Pacific (UNP), Netflix (NFLX), United Rentals (URI), Blackstone Group L.P. (BX) and American Express (AXP) set a positive tone for investors. This upbeat news occurred amid the “Medicare-for-All” meltdown in health care stocks.

Financial headlines from around the globe continue to show major economies struggling to find a bottom due to data about slowing or contracting growth. Interest rates have been grinding lower in Europe and Japan, while holding steady in China and the United States. This week’s release of China’s first-quarter gross domestic product (GDP) growing by 6.4% was an upside surprise.

There is no shortage of mixed signals amid the flood of data points, commodity price swings and first-quarter earnings that will cross the tape this week and next week, too. Investors have to contend with weakening macro data being offset by the highest prices for crude oil in four months. WTI crude for October delivery is trading just under $64/bbl.

Copper prices, historically a leading indicator of future industrial production and construction growth, also are trading higher the past six weeks. High-grade copper for October delivery is trading a shade below $3.00 per pound. Both price trends clearly run counter to the bearish global growth forecasts and zero to negative interest rates in Europe and Japan. China is the largest importer of oil and copper, so its economic growth should be factored into market forecasts.

On the other hand, the yield on the German 10-year bond has fallen to 0.05% and the Japanese 10-year bond is a negative -0.06% while still applying quantitative easing (QE), with the U.S. 10-year Treasury trading at a comparatively luscious 2.56% yield — and drawing foreign capital from around the world as the go-to safe haven for yield.

When adding record dividend increases, stock buybacks, mergers and acquisitions activity, a strong dollar, low inflation and a dovish Fed, the least path of resistance for U.S. stocks has been higher. The United States, which accounts for 25% of total global GDP, is looking more likely to grow GDP at least 2.0% with the rest of the world regaining its footling during the balance of 2019.

The Shanghai Composite is up 30.33% year-to-date and the Euro Stoxx 50 Index is up 15.18% year to date. This is hardly the price action of two economies headed for recession, even as Italy is technically in its own recession. But economic forecasts for GDP growth in Germany for 2020 are expected to rise from a current 0.6% to 1.5% annual pace and is likely to become the catalyst to drive the Stoxx 50 Index higher.

The U.S. stock market is now flirting with all-time highs and one can only wonder how much of the perceived second-half 2019 earnings recovery is priced into stocks. Investors will likely know the answer to that question by the end of the month, since the bulk of the earnings that matter most will have crossed the tape and forward guidance will be available for all to analyze. It is a bit of a coin toss as to whether the market takes out the old highs or triggers a “sell in May and go away” pullback.

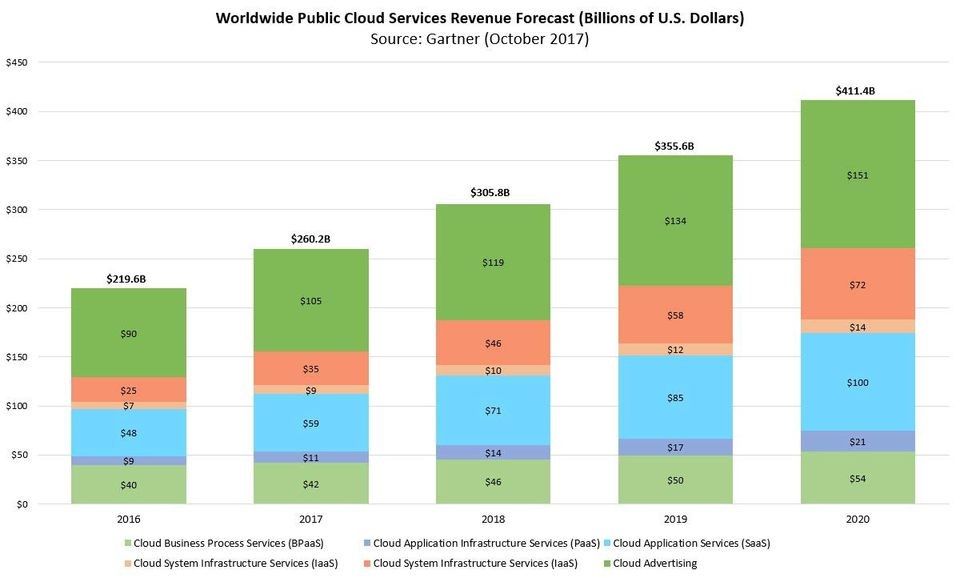

As investors try to make sense of all the perplexing data that feeds the bull/bear debate on an almost hourly basis, there are some truly powerful secular trends in place that are, in my view, quite suitable for those investors seeking good yields and predictable revenue and earnings growth. I’m speaking of the cloud computing market, which is expected to reach $441 billion in size by 2020, according to Gartner.

Gartner predicts that by 2021, 28% of all IT spending will be for cloud-based infrastructure, middleware, application and business process services. A new market study, titled “Discover Global Cloud Computing Market Upcoming Trends, Growth Drivers and Challenges” predicts that over the next five years the Cloud Computing market will register a 30.6% Compounded Annual Growth Rate (CAGR) in terms of revenue. The global market will reach $1.82 trillion by 2024, nearly five-fold higher than when the final numbers come in for 2019.

Within this megatrend lie the Data Center REITs of which there are five distinct companies within the NAREIT All-REIT Index. Equinix, Inc. (EQIX), CoreSite Realty Corporation (CORE), Digital Realty (DLR), CyrusOne (CONE) and QTS Realty Trust (QTS) are the five go-to names in the sector. Just toggle over to www.reit.com to check out these companies in depth. As a group, they generate high single-digit-percentage revenue and double-digit-percentage earnings growth with a history of strong dividend gains.

Moreover, if bought in equal amounts, the fab-five of data center REITs sports a blended dividend yield of 3.35%, contending with utilities and consumer staples for highest defensive sector yields, but with much higher growth prospects. So, while investors try to make heads or tails of global growth prospects, betting on the future of America’s biggest data center operators looks like a sure thing.

To track the opportunities in data center REITs, consider subscribing to my Cash Machine advisory service. I am looking for the best opportunities to recommend and it would be great to have you aboard.