Featured Image Source: Norfolk Southern CorporateSite

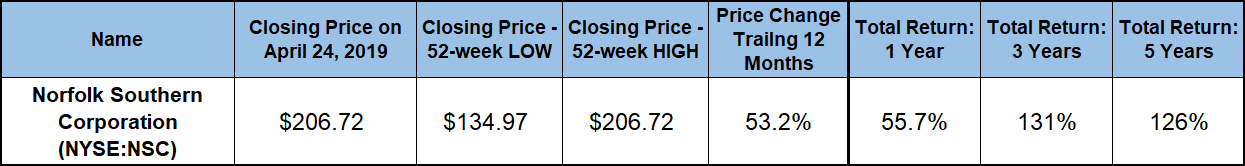

Capitalizing on the economic growth and the increased demand for transportation of goods, the Norfolk Southern Corporation (NYSE:NSC) capped a robust share price growth over the past three years with a 53% enhancement over the trailing 12 months.

The company’s most recent significant share price pullback occurred in 2015 after crude oil prices collapsed and a significant amount of cargo transportation shifted back to trucking. However, the expanding economy allowed Norfolk Southern to improve its revenues on higher volume demands. The company’s share price reflected the higher volumes and increased profitability by rising three-fold since January 2016.

In addition to rising demand for cargo volume as the economic expansion continues, crude oil prices have been rising steadily since the beginning of the year. With oil price exceeding $65 per barrel, some corporations will shift a portion of their transportation needs back from over-the-road to rail and intermodal. This demand increase should benefit Norfolk Southern’s revenue growth and profitability similar to the advances reflected in the company’s most recent financial results.

Financial Results

On April 24, 2019, Norfolk Southern Corporation reported first-quarter 2019 financial results.

Operating revenues advanced 5% versus the same period last year to $2.8 billion. Even with higher revenues, operating expenses of $1.9 billion were $8 million lower compared to the first-quarter 2018. Net income rose 23% year over year to $677 million. Earnings of $2.51 per diluted share were 30% higher than last year and beat analysts’ expectations of $2.18 by more than 15%.

Norfolk Southern Corporation (NYSE:NSC)

Based in Norfolk, Virginia, and founded in 1883, the Norfolk Southern Corporation engages in the rail transportation of raw materials, intermediate products and finished goods. Its Norfolk Southern Railway Company subsidiary operates nearly 20,000 route miles in 22 states and the District of Columbia. Norfolk Southern serves every major container port in the eastern United States and provides connections to other rail carriers. The company is a major transporter of industrial products, including chemicals, agriculture, metals and construction materials. Additionally, the railroad operates the most extensive intermodal network in the Eastern United States and is a principal carrier of coal, automobiles and automotive parts.

Dividends

After two hikes in the past 12 months, Norfolk Southern’s current $0.86 quarterly dividend payout is nearly 20% higher than the $0.72 distribution from the same period last year. The current quarterly dividend amount corresponds to a $3.44 annualized payout and a 1.7% dividend yield. The company failed to hike its annual dividend payout amount only once in the past 18 years. Despite a long streak of dividend boosts and a dividend amount enhancement of nearly 55% over the past five years, Norfolk Southern’s current 1.7% yield is more than 18% lower than the company’s own 2% five-year dividend yield average. While that growth is impressive by any measure, the share price advanced at a much faster pace, which suppressed the dividend yield below industry averages.

Norfolk Southern’s current dividend payout ratio of 33% indicates that the company uses only one-third of its earnings to cover dividend distributions. With its dividend payout ratio on the low end of the sustainable payout ratio range, Norfolk Southern should be able to support its current level of dividend payout growth for the foreseeable future.

Since missing a dividend boost in 2016, the company enhanced its annual dividend payout amount 46% over the past three consecutive years. This advancement corresponds to an average annual growth rate of 13.4%. However, since its most recent dividend cut in 2001 Norfolk Southern’s annual dividend payout advanced more than 14-fold, which is equivalent to an average growth rate of nearly 16% per year over the past 18 years.

Share Price

Despite a significant pullback in the fourth-quarter 2018, the share price recovered fully and delivered outstanding gains over the past year. Disregarding the mid-term volatility, the share price appears to have grown straight up over the past 12 months. The share price started the trailing 12-month period from its 52-week low of $134.97 on April 25, 2018. From this low, the share price continued its uptrend that began in January 2016 and gained more than 38% and reached its new all-time high of $186.71 by mid-September 2018.

However, as the overall market turned lower Norfolk Southern’s share price followed suit and reversed trend. The share price gave back almost all gains from the beginning of the trailing 12 months. Many equities and the overall market bottomed out on December 24, 2018, before reversing direction and heading higher. However, while shedding most of its gains, Norfolk Southern’s share price reversed direction while still 3.6% above its 52-week low from April 2018.

However, following the trend reversal at the end of December 2018, the share price resumed its three-year uptrend pace, recovered all its fourth-quarter 2018 losses and reached a new all-time high on March 29, 2019. The share price continued to rise and set seven additional new highs in April. At the end of trading on March 24, 2019, the share price set its most recent all-time high of $206.72. In addition to being a new all-time peak, the April 24 closing price was more than 53% above the share price level from the beginning of the trailing 12-month period. Furthermore, the share price advanced more than 120% over the past five years.

While the share price drove the biggest share of the total returns over the past several years, the dividend income added a few points to the overall gains. Norfolk Southern delivered a total return on investment of nearly 56% over the trailing 12 months. The 40% share price decline in 2015 limited total returns to 126% over the past five years, which was lower than three-year returns. Over the three-year period, the share price more than doubled. Additionally, dividend income distributions advanced at an average annual rate of 11% over the same period. The combined total return over the past three years exceeded 130%.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.