After recovering all losses from a share price decline in the fourth quarter of 2018, Citigroup, Inc. (NYSE:C) might be positioned to continue capital gains for the remainder of the year and deliver total returns at rates higher than its 2.89% dividend yield.

Since its share price dropped more than 98% in the aftermath of the 2008 financial crisis, Citigroup reorganized and started rebuilding its financial strength. The company reintroduced fast-rising dividend income distributions in 2011 and advanced its share price 360% over the past decade. While the overall market pullback in late 2018 pushed Citigroup’s share price down nearly 35%, the price has recovered all those losses and could be primed for continued growth.

Its 50-day moving average still has not broken above its 200-day moving average in a bullish manner. However, the 50-day average has been rising quickly over the past 60 days. After trailing the 200-average by nearly 12% in mid-February 2019, the 50-day average has closed the gap to just 1.1%. If the share price uptrend continues, the 50-day average could break above the 200-day average within the next two weeks to signal an extension of the bullish trend.

Additionally, the share price has nearly 15% room on the upside before it reaches the analysts’ current $79.12 target price. Also, more than half of the analysts currently covering the stock (17 out of 29) have a “Buy” (12) or a “Strong Buy” (5) recommendation.

Financial Results

On April 15, 2019, Citigroup reported its financial results for the first quarter of 2019. Total revenues of $18.6 billion were 2% lower than the $18.9 billion figure from the same period in the previous year. However, Citibank also reported a 3% year-over-year reduction in expenses from $10.9 billion in the first-quarter 2018 to the current $10.6 billion figure.

The effect of expense reduction exceeded the revenue shortfall, which resulted in a 2% net income increase to $4.7 billion. This income corresponds to a $1.87 earnings per diluted share, which was in line with the analysts’ expectations.

Citigroup, Inc. (NYSE:C)

Based in New York and founded in 1912, Citigroup, Inc. is a diversified financial service holding company that provides various financial products and services for consumers, corporations, governments and institutions. The company operates through two segments, Global Consumer Banking (GCB) and Institutional Clients Group (ICG). The GCB segment offers traditional banking services to retail customers through retail banking, commercial banking, Citi-branded cards and Citi retail services. Additionally, this segment provides various banking, credit card lending and investment services through a network of local branches, offices and electronic delivery systems. The ICG segment provides wholesale banking products and services, including fixed income, equities sales and trading, foreign exchange, prime brokerage, derivative services, equity and fixed income research.

Dividends

Citigroup delivered a streak of steady dividend hikes for more than two decades before the 2008 financial crisis. However, after paying a $5.40 quarterly dividend in the last quarter of 2017, the company cut its quarterly dividend amount to just $0.10 for the first quarter of 2009 and suspended dividend distributions after that.

The company reintroduced dividend payouts in the second quarter of 2011 with a nominal $0.01 quarterly dividend amount. However, since resuming its annual dividend hikes in 2015, Citigroup has enhanced its annual dividend payout 45-fold over the past five years. This steep advancement corresponds to an average growth rate of almost 115% per year. Even discounting the nominal dividend and comparing the current annual payout with the $0.16 paid in 2015, its dividend growth is still impressive. The 11-fold advancement is equivalent to an 83% average annual growth rate over the past four years.

The current $0.45 quarterly payout is 40.6% higher then the $0.32 distribution from the same period last year. This new quarterly amount corresponds to a $1.80 annualized payout and a 2.6% forward dividend yield, which is more than double the company’s own 1.1% five-year average yield.

Share Price

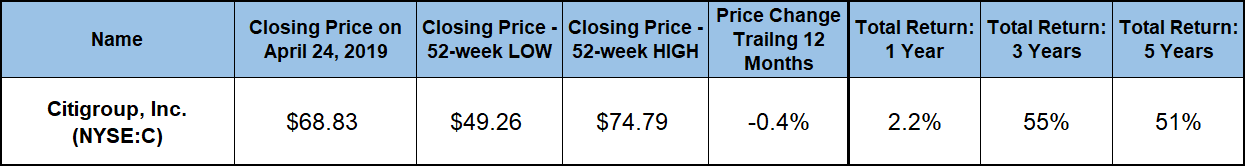

After a relatively steady uptrend of nearly two years, Citigroup’s share price reversed direction and jumped on a downtrend that extended 60 days into the trailing 12-month period. The share price reversed its trend, regained all losses and gained another 8.2% before peaking at the 52-week high of $74.79 on September 20, 2018.

However, the overall market pullback from interest rate uncertainties and fears of escalating trade war with China pushed the Citigroup share price nearly 35% lower. The share price reached its 52-week low of $49.26 on December 24, 2018. After bottoming out on Christmas Eve, the share price reversed direction again and started recovering quickly in early 2019.

By the end of January 2019, the Citigroup stock recovered 60% of its losses from its September peak to the end of December low. The share price continued rising to recover nearly all its losses over the past 12 months and close on April 24, 2019, at $68.83. While still 8% short of the September peak, the April 24 closing price was just 0.4% lower than it was one year earlier. Additionally, to erase all its losses in the fourth quarter of 2018, the share price gained nearly 40% since the 52-week low from December 2018. Furthermore, the April 24 closing price was 44% higher than it was five years ago.

Because the share price recovered only to the same level as it was at one year earlier, Citigroup’s dividend distributions provided the entire 2.2% of total gains over the trailing 12 months. However, a continuation of the share price’s current uptrend easily could bring total returns into the double-digit-percentage levels it was at a few years ago. Citigroup delivered a 51% total return over the past five years. Furthermore, a 30% share price drop in early 2016 made the 55% total return over the past three years higher than the five-year return.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.