After losing more than one-third of its value in late 2018, MetLife, Inc. (NYSE: MET) saw its share price recover most of those losses and set up for potential future gains.

Furthermore, the share price is more than four-fold higher than it was after falling more than 80% during the 2008 financial crisis. However, that uptrend experienced a few pullbacks. After gaining nearly 65% over a two-year period, MetLife’s share price reversed trend and leveled off before embarking on a 35% decline in late January 2018.

With share price fluctuations over the last 12 months, the 50-day moving average entered the trailing 12 months nearly 6% below the 200-day average. After closing the gap briefly in early 2018, the share price decline in the second half drove the 50-day average down.

However, since the share price embarked on its current uptrend in late December, the 50-day moving average has broken above the 200-day average as of mid-March. The share price remained below both moving averages at that time but did not break above both averages until April 10, 2019.

The rising share price has been driving the 50-day average higher. Since April 18, the 50-day average more than doubled its gap above the 200-day average from 0.2% to 0.56% on April 29. A better-than-expected earnings report could extend the current share price uptrend further into the current year.

Financial Results

Despite mixed results in the fourth quarter, MetLife delivered positive results for full-year 2018. Total revenues advanced 9% from $62.3 billion prior year to $67.9 billion for 2018. Net income advanced 28% to nearly $5 billion. Earnings per share (EPS) rose 36% to $4.91 and adjusted EPS reached $5.39, which was 37% higher than previous year and 10% above analysts’ expectations.

MetLife has scheduled its first-quarter 2019 financial results call for May 2, 2019, before the markets open. After delivering a $1.35 fourth-Quarter EPS, analysts’ expectation for first-quarter earnings expectations are $1.27, which is in line with expectations for the previous two periods

MetLife, Inc. (NYSE: MET)

Headquartered in New York, New York, and founded in 1863, MetLife, Inc. engages in the insurance, annuities, employee benefits and asset management businesses. The company operates through five segments — United States, Asia, Europe, the Middle East and Africa, Latin America and MetLife Holdings. Through its business segments, the company offers life, dental, group short-term and long-term disability, individual disability, accidental death and dismemberment and other plans to employers. Additionally, MetLife provides pension risk transfers, institutional income annuities, tort settlements, capital markets investments and other insurance products and services. The company also offers automobile, homeowners and personal liability insurance, as well as small business property, liability and business interruption insurance products. Furthermore, MetLife provides fixed annuities and pension products, medical and credit insurance products, fixed and indexed-linked annuities, as well as protection against the costs of long-term health care services

Dividends

The most recent dividend payout boost raised the dividend distribution 4.8% from $0.40 in the first-quarter last year to the current $0.42 payout. This current payout converts to a $1.68 annualized distribution and currently yields 3.85%. The 3.85% forward dividend yield is nearly 12% higher than the company’s own 3.44% dividend yield average over the past five years.

In addition to outpacing its own five-year average, MetLife’s current yield is also 25% higher than the 3.07% average yield of the entire Financials sector. Additionally, MetLife’s current yield also outperformed the 1.61% average yield of its peers in the Life Insurance industry segment by nearly 140%. Furthermore, as the company with the fourth-highest yield in the segment, MetLife even outperformed the 2.33% average yield of the Life Insurance segment’s only dividend-paying companies.

MetLife hiked its annual dividend distribution over the past seven consecutive years. Over that period, MetLife enhanced its annual payout nearly 140%. This level of advancement corresponds to a 13.2% average annual growth rate. While MetLife failed to boost its annual dividend for five years after the 2008 financial crisis, the company still managed to raise its annual dividend nearly nine-fold since introducing dividend payouts in 2000. The average annual growth rate of 12.1% over that period was only slightly lower than the growth rate for the current streak of consecutive annual hikes.

MetLife also managed to reduce its dividend payout ratio from an 86% average over the past five years to just 34% over the past 12 months. The five-year average payout level was significantly above the 30% to 50% sustainable range. However, the current 34% payout ratio indicates that MetLife uses only one third of its earnings to cover dividend distributions. Therefore, MetLife should easily sustain its current rate of annual dividend hikes.

Share Price

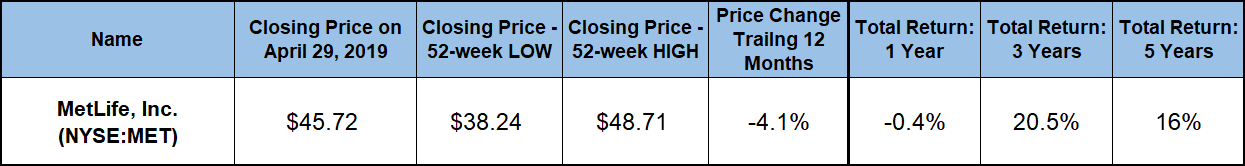

Entering the current 12-month period on a downtrend that began in January 2018, the share price leveled off and traded generally flat between $44 and $47. The share price rose slightly after the beginning of July and reached its 52-week high of $48.79 on September 21, 2019.

However, after peaking in mid-September, the share price declined nearly 22% before reaching its 52-week low of $38.24 on December 24, 2019. After bottoming out on Christmas Eve, the share price reversed trend and headed higher in 2019. Since its 52-week low at the end of December 2018, the share price has recovered more than 70% of those losses. The share price closed on April 29, 2019, at $45.72, which was just 6% below the September peak.

The dividend income distributions offset the small share price loss over the past year and cut total losses to 0.4% over the trailing 12 months. However, over the past three years, MetLife delivered a 20.5% total return.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.