Tesla’s share price drop has deflated its lofty valuation that now leaves bearish and bullish analysts alike focusing on the company’s need to rebuild demand for its vehicles, to seek potentially billions of dollars of new financing and to return to profitability after a huge loss in first-quarter 2019.

CEO Elon Musk shifted attention during his latest earnings call on April 25 toward his new goal of putting 1 million autonomous-driving taxis on the road by 2020, rather than how to solve the company’s weakening vehicle demand, thinning cash position and sagging financial performance. However, Tesla Inc. (NASDAQ:TSLA) literally may have found a way to move forward by reaching an agreement with the Securities and Exchange Commission (SEC) to set ground rules for the kinds of tweets and public statements Musk can make without requiring prior approval from a securities lawyer.

Musk’s remarks during his earnings call about exploring the launch of an autonomous-driving, “robo-taxi” service caused some analysts to question whether he was becoming distracted from addressing challenges in Tesla’s core business. Musk, an unconventional, maverick CEO, broke with tradition by starting his remarks on April 24 to discuss first-quarter 2019 by talking about Tesla’s “first ever Autonomy Investor Day” two days earlier that showcased its in-house design of a computer to support autonomous driving and Artificial Intelligence (AI) based software.

Robo-Taxis Become Musk’s Latest Dream as Tesla’s CEO

All types of Tesla vehicles now have the hardware needed for full self-driving capabilities with plans for updates this year to let its customers use the company’s proposed ride-hailing network fleet, Musk said during the conference call. Tesla would be able to generate income, with each robo-taxi producing revenues of $10,000-$30,000 a year, he added.

“We are the only company in the world producing our own vehicles and batteries, as well as our own in-house chip, for full self-driving,” Musk said as he kicked off his earnings call. “We are in a position unlike anyone else in the industry.”

Musk said he expected Tesla to have the “most profitable” autonomous-driving taxis on the market.

New Logistical Problems Contribute to Tesla’s Share Price Drop

The company incurred a “massive increase” in first-quarter 2019 delivery volume in Europe and China that Musk said reminded him of what took place in North America in 2018. The rapid rise in overseas volume strained Tesla’s logistics operation and resulted in more than half of its global deliveries occurring in the final 10 days of March, he added.

“This was the most difficult logistics problem I have ever seen, and I have seen some tough ones,” Musk said.

As a result, many vehicles slated for delivery in first-quarter 2019 slipped into the second quarter and contributed to the company’s net loss of $702.1 million, or $4.10 a share, in the recently completed quarter, compared to a loss of $709.6 million, or $4.19 a share, for the same period the year before. Those losses were interrupted by a profit of $139.5 million, or $0.81 a share, for the fourth quarter of 2018, as well as a profit in third-quarter 2018, after Tesla cranked up production dramatically.

The first-quarter 2019 loss would have been worse without Tesla boosting its revenue during the period by $216.0 million through the sale of automotive regulatory credits. The unusual move reduced Tesla’s first-quarter loss by the same amount to avoid it reaching $925.6 million.

“In our 20 years of covering tech stocks on the Street, we view this quarter as one of the top debacles we have ever seen,” said Daniel Ives, an analyst and managing director of equity research at New York-based Wedbush Securities.

To address its delivery problems, Tesla announced plans to regionally balance its vehicle manufacturing and aid its working capital. The company’s new guidance calls for significantly trimming its loss in second-quarter 2019 and returning to profitability in the third quarter.

Barclays’ auto analyst Brian A. Johnson wrote in a research note that he is not “buying” Tesla’s guidance for the second and third quarters. Johnson consistently has questioned Tesla’s valuation, rates the stock as underweight, compared to his neutral view of the auto industry overall, and has a price target of $192, roughly 24.6 percent below its closing price of $238.69 on April 30.

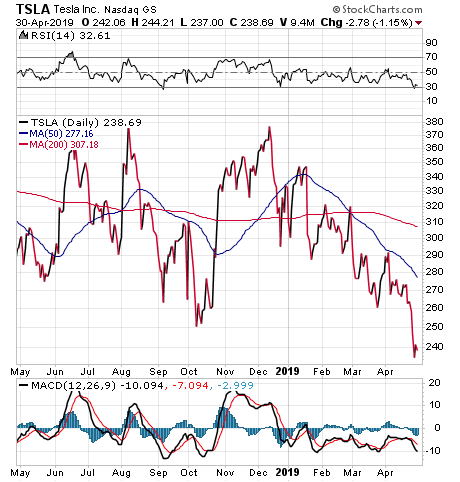

Chart courtesy of StockCharts.com

Big Quarterly Loss Worsens Tesla’s Share Price Drop

Tesla deliveries suffered from an expiration of the federal tax credit for buyers of its electric vehicles, from exhausting the company’s waiting list for vehicles in the United States, as well as from likely cannibalization of the models S and X by the upper end of the Model 3, Johnson wrote.

“Further, Tesla avoided answering nearly all questions related to actual order intake,” Johnson continued.

While Musk seemed confident on the call when discussing second-quarter delivery guidance, the company’s carefully worded shareholder letter stated that reaching 90,000-100,000 vehicles is possible in second-quarter 2019 if order intake increases, Johnson added.

Shrinking Cash Position May Force Tesla to Find New Financing This Year

The quarter closing at $2.2 billion cash, versus Barclays’ estimate of $2.3 billion, helped by lower-than-expected capital expenditures, may mask intra-quarter cash swings that led Tesla to try multiple pricing and strategy changes in the first quarter, Johnson wrote. It is “unclear” how dilutive the issuance of new shares could be to raise equity funding for Tesla in the months ahead and how the company’s share price might be affected, he added.

“Musk all but confirmed that Tesla would be coming to the market for funding, ostensibly under the growth rationale of raising money for robo-taxis,” Johnson wrote. “We model a $700 million equity raise in 2Q.”

Fresh financing in the range of $3 billion or more could be needed to carry Tesla through the trying times, said Ives, of Wedbush Securities. Traditionally bullish on Tesla’s outlook, Ives slashed his rating on the company from “outperform” to neutral in the wake of the company’s earnings call.

Bullish Analyst Slashes Price Target after Tesla Tanks

“Near-term worries” about weakening demand for Tesla’s vehicles and prospects for returning to profitability led to his downgrade, Ives told me in an April 29 phone interview.

Musk’s comments during the earnings call strayed from how to “navigate” through slackening demand, Ives said. The company’s guidance is aggressive, and management is not cutting costs enough or shutting down future endeavors to preserve capital to give it a sustained path to profitability, he added.

“We no longer can look investors in the eye and recommend buying this stock at current levels,” Ives wrote in a research note that cut his price target on the company from $365 to $275.

Will Tesla’s Financial Fundamentals Catch up with its Share Price?

“Tesla always revolved around conviction and now the narrative is starting to run out of juice,” said Hilary Kramer, a Wall Street money manager who leads the Value Authority, GameChangers, Turbo Trader , High Octane Trader and Inner Circle advisory services for individual investors. “This isn’t about Elon Musk or the cars themselves. This is simply a question of whether the future still looks bright enough for the fundamentals to catch up with the stock. Start with the numbers, which look a lot less attractive than they did six months ago when the Model 3 looked like the hottest thing on the road and the company commanded a 57X multiple of what we then assumed would be close to $6 a share in 2019 profit.

“That was only six months ago. Now we’ve had to cut our profit outlook in half as the Model 3 just doesn’t step up as fast as expected. It’s starting to look like sales this year will come in 20 percent lower than once-rosy guidance indicated. The vision of sustainable profitability at this scale has evaporated, at least for the time being. And while management is clearly aware of the discrepancy, all the recent news flow isn’t constructive. A company eager to scale up doesn’t lay off a lot of people or wheedle concessions out of vendors. It doesn’t pull the plug on its local sales operation to cut costs.”

These moves show signs of pressure and do not build investor confidence, Kramer said.

“Tesla has always been about confidence,” Kramer continued. “Whether you’re the biggest Elon Musk fan on the planet or someone who shudders whenever he opens his mouth, the stock doesn’t work unless investors are 110 percent committed to the promise that a company that looks like a cash hole today will change the world in the foreseeable future. Every year that future fails to arrive leaves shareholders exposed to the risk that it will never come.

“From outside, the company is protected by a true reality distortion field. That’s why even today, Tesla trades at 1.5X sales, easily 4-5 times as rich as General Motors (NYSE:GM) or Ford (NYSE:F). It’s why those conventional car makers limp along at barely 6-8X earnings. But if that distortion field falters, Tesla looks as much as a harrowing 90 percent overvalued. Car by car, the math says this is a $4 billion stock, with the dream adding another $36 billion in market cap. That can be an expensive dream.”

Short Selling Poses a Big Risk After Tesla’s Share Price Drop

Kramer advised against shorting the stock after Tesla’s share price drop due to the possibility of Musk and his employees pulling off another of their “perennial eleventh-hour miracles,” as they did late last year by ramping up production and turning a profit in the face of avowed short sellers. Instead, Kramer said she is staying on the sidelines as Tesla tries to rev up the engines of its operations again after its share price drop.

“Until we see the rubber hit the road on the Model 3, we don’t bet on miracles,” Kramer said.

“Tesla makes a quality car, but it isn’t a well-run company,” said Bob Carlson, who leads the Retirement Watch investment advisory service.

The company is struggling, even though it doesn’t have a great deal of competition yet for electric vehicles, Carlson continued. Large global automobile manufacturers will roll out a wave of electric vehicles in the coming years, so Tesla risks “suffering even more” if it hasn’t established itself as the premier electric car company by then, he added.

Settlement of Tweet Dispute with SEC Removes Overhang for Tesla

While the financial results gained the headlines, Tesla and Musk negotiated an agreement with the SEC about the kinds of tweets that would require approval from a securities lawyer before distribution. The SEC had asked a federal judge to find Musk in contempt of a previous order to curb his tweeting of “material” information to investors.

Tesla’s share price had been exposed to further erosion as the SEC relentlessly pursued the company’s CEO Musk for tweets that the agency claimed could be misleading investors. Among tweets from Musk that now require prior approval by securities counsel are written communications about the company’s financial condition, earnings or guidance; potential or proposed mergers, acquisitions or joint ventures; production, delivery or sales numbers; new or proposed business lines; financing or credit lines; and events that would require filing a Form 8-K.

A federal judge in New York approved the agreement on April 26, giving the SEC and Tesla a way forward. Unlike a previous settlement, neither Musk nor Tesla needed to pay any fines.

The focus for Tesla now turns to operations and financing. If the company can resolve those difficulties as it did its conflict with the SEC that started last year, it may find its future brighten again and restore the fading confidence of even once-avid bulls who have started to mute their enthusiasm for Musk and Tesla. Success would put a shine back on Musk’s now-tarnished image as a corporate chief.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.