The Costco Wholesale Corporation (NASDAQ:COST) has been one of only few retail sector companies that managed to deliver strong performance against the onslaught of e-commerce over the past few years.

With a steady focus on delivering a good cost-to-value ratio to its customers, Costco also managed to reward its shareholders with stable capital growth and steady dividend income boosts over the past decade. Just over the trailing 12-month period, Costco rewarded its shareholders with a combined total return on investment of more than 24%.

While the share price volatility increased slightly over the past five years, Costco’s price has not experienced any significant pullbacks since dropping nearly 50% in the aftermath of the 2008 financial crisis. Since that drop, the share price has advanced 530%.

The overall market correction in December 2018 pushed the Costco share price down, which dropped the 50-day moving average below the 200-day average on January 24, 2019. However, a quick share price recovery translated into a sharp rise of the 50-day average as well. After crossing above the 200-day average on April 1, 2019, the 50-day average rose to 4.5% above the 200-day average by April 30. Additionally, the rising share price has remained firmly above both moving averages since early March.

Costco Wholesale Corporation (NASDAQ:COST)

Headquartered in Issaquah, Washington, and founded in 1976, the Costco Wholesale Corporation operates membership warehouses. Costco offers branded and private-label products in a range of merchandise categories. The company provides dry and packaged foods, groceries, snack foods, candies, alcoholic and nonalcoholic beverages. Additionally, Costco offers cleaning supplies, appliances, electronics, health and beauty aids, hardware, garden and patio products, meat, bakery, deli, produce, apparel and small appliances. Additionally, Costco also operates gas stations, pharmacies, optical dispensing centers, food courts and hearing-aid centers at some locations. Furthermore, the company has expanded its operations into the travel business as well. As of February 18, 2019, Costco operated 769 membership warehouses worldwide. In addition to 527 warehouses in the United States, 100 in Canada and 39 in Mexico, Costco operated 28 more locations in the United Kingdom, 26 in Japan, 15 in Korea, 13 in Taiwan, 10 in Australia, 2 in Spain, 1 in Iceland and 1 in France. With revenues of nearly $140 billion in fiscal 2018 and a market capitalization of $100 billion, Costco is the third largest global retailer and the 15th largest Fortune 500 company. In addition to its physical retail locations, Costco also offers online shopping.

Dividends

After increasing its regular annual dividend payout amount every year since beginning to pay dividends in 2004, Costco rewarded its shareholders with a 14% hike for its upcoming quarterly dividend payout. The company enhanced its quarterly dividend from $0.57 in the previous period to $0.65 for the current period. This new quarterly dividend amount corresponds to a $2.60 annualized distribution.

That annual dividend amount would translate to a significant yield for most companies. However, Costco’s share price — which is approaching $250 — suppressed the current yield to just 1.06% from the five year average yield of 2.4%. While the annual dividend advanced nearly 90% over the past five years, that growth rate was still unable to keep up with share price growth.

However, Costco’s current 29% dividend payout ratio indicates that the company uses less than one-third of its earnings to cover dividend distributions. Therefore, the company has plenty reserves to continue rising dividend payouts. Additionally, Costco could raise its dividends at higher rates to increase its yield and keep up with the share price growth rates.

Since dividend introduction in 2004, Costco enhanced its total annual dividend amount 550%, which is equivalent to a 13.3% average annual growth rate. In addition to its increasing regular payouts, Costco distributed significant special dividends in three out of the last eight years — $7 in 2012, $5 in 2015 and $7 in 2017. On average, these special dividend payouts were equivalent to 416% of regular annual payouts in those three years.

Investors interested in collecting the next round of Costco’s dividend distributions should act quickly. To secure eligibility, investors must claim stock ownership before the May 9, 2019, ex-dividend date. Costco will distribute dividends to all eligible shareholders on the March 24, 2019, pay date.

Share Price

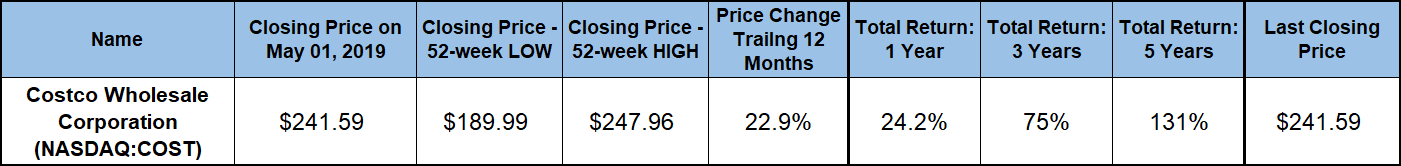

The share price entered the trailing 12-month period riding a general uptrend that began in March 2018. However, after gaining 26% and reaching an all-time high on September 11, 2018, the share price reversed trend and started dropping. By December 20, 2019, the share price gave back all gains from the beginning of the trailing 12 months. The share price continued to drop another 3.3% before bottoming out at $189.99 on Christmas Eve.

The share price reversed direction again and began recovering as quickly as it dropped. By the beginning of April, the share price recovered completely and continued rising to gain more than 30% before reaching its new all-time high of $247.69 on April 24, 2019. Since peaking in late April, the share price pulled back 2.6% to close on May 1, 2019, at $241.59.

This closing price was 23% higher than it was one year earlier and 27.2% above the 52-week low from late December. Furthermore, the share price more than doubled over the past five years for a total increase of nearly 110%

While the share price growth was the primary driver of total returns, the rising dividend income contributed a few points to the 24.2% total return over the past 12 months. The total return over the past three years came in at 75%. Additionally, Costco’s long-term shareholders more than doubled their investment with a total return of 131% over the past five years.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.