The Global X Internet of Things ETF (SNSR) tracks an index composed of developed market companies that facilitate the fast-growing Internet of Things (IoT) industry.

The fund primarily seeks to invest in companies that are expected to benefit from the broad adoption of the Internet of Things, as enabled by technologies such as Wi-Fi, 5G telecommunications infrastructure and fiber optics. This growth includes the development and manufacturing of semiconductors and sensors, integrated products and solutions and applications serving smart grids, smart homes, connected cars and the industrial internet.

SNSR aims to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Internet of Things Thematic Index. A minimum of 20 stocks are selected for the fund to track. Companies with relevant exposure are weighted by market capitalization, with a maximum of 6% and a minimum of 0.3% for any given holding.

Among the ETF’s top holdings are Garmin Ltd. (NASDAQ: GRMN), DexCom, Inc. (NASDAQ: DXCM), Sensata Technologies Holding PLC (NYSE: ST), Skyworks Solutions, Inc. (NASDAQ: SWKS) and Cypress Semiconductor Corp. (NASDAQ: CY). The fund is mainly invested in U.S. equities, 71.63%, but also has significant stakes in stocks in France, 9.11%, Taiwan, 8.02%, and Switzerland, 5.89%. SNSR’s sectors are heavily weighted towards Technology, 58.34%, and Industrials, 28.41%, and slightly weighted in Health Care, 8.55%, and Consumer Cyclicals, 2.56%.

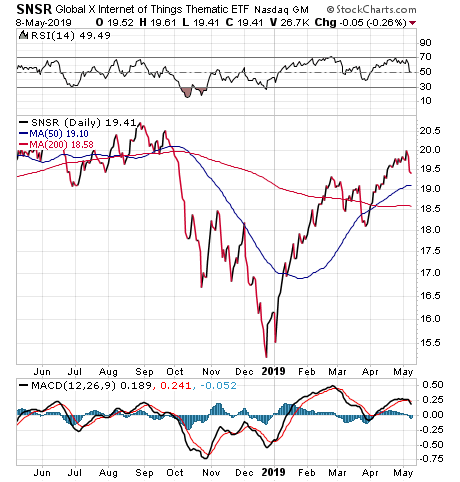

Chart courtesy of www.StockCharts.com

The ETF has $87.85 million assets under management, an average spread of 0.38% and 44 holdings. With an expense ratio of 0.68%, it is relatively expensive to hold in comparison to other exchange-traded funds.

In short, SNSR gives investors exposure to a relatively new sector with high-growth potential. However, bear in mind that the fund is heavily weighted towards one country and two sectors. Investors should conduct their own due diligence to decide whether any given fund and its potential volatility is suitable for their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)