Driven mostly by 32%-plus asset appreciation, Primerica, Inc. (NYSE:PRI) rewarded its shareholders with total returns on investment of nearly 32% over the past 12 months.

The share price rose at a steady pace with minimal fluctuations and merely doubled over a six-year period prior to February 2016. However, whereas volatility has increased since then, the share price growth rate has increased as well. Since hitting its five-year low in early 2016, the share price delivered an exceptional streak of new all-time highs and tripled its value over the past three years.

While the current closing price is just 3% below the analysts’ average target price, the moving averages suggest a potential for additional advancement, especially in light of strong quarterly earnings results. In the aftermath of the fourth-quarter price correction, the 50-day moving average slipped below, and remained below, the 200-day average from early January through early March 2019. However, the rapid share price recovery in 2019 drove the 50-day moving average back above its 200-day counterpart by early March 2019. As of May 13, 2019, the 50-day average was 7.3% above the 200-day average and rising.

Financial Results

On May 7, 2019, Primerica, Inc. announced its financial results for the first quarter of 2019, which ended on March 31, 2019. Total revenues advanced 8% compared to the first quarter of 2018 to $495 million. Adjusted operating revenues rose 6% over the first quarter of 2018 to $490 million.

While net income increased by 20%, earnings per diluted share advanced 26% year-over-year to $1.83. Primerica’s adjusted net income of $75.3 million increased by 14%, while its adjusted earnings per diluted share of $1.74 increased by 19% compared to the same quarter last year.

Additionally, Primerica returned nearly $54 million to its shareholders through repurchasing common stock. This purchase has kept the company on pace to reach its target of repurchasing a total of $225 million for full-year 2019.

Primerica, Inc. (NYSE:PRI)

Headquartered in Duluth, Georgia and founded in 1927, Primerica, Inc., together with its subsidiaries, provides financial products to middle income households in the United States and Canada. The company operates in three segments — Term Life Insurance, Investment and Savings Products and Corporate and Other Distributed Products. Primerica underwrites individual term life insurance products. Additionally, the company also provides mutual funds and various retirement plans, managed investments, variable and fixed annuities, fixed indexed annuities and segregated funds. Furthermore, Primerica offers auto and homeowners’ insurance, as well as other insurance products, including supplemental medical and dental, accidental death, and disability for small businesses. Lastly, the company provides prepaid legal services that assist subscribers with legal matters, such as drafting wills, living wills and powers of attorney, trial defense and motor vehicle-related matters.

Dividends

With the company’s primary focus on capital gains, the dividend payouts are relatively low at this time. The current dividend yield of 1.1%, is significantly lower than the 3.08% average yield of the entire Financials sector. However, Primerica’s current yield is a little closer to the 1.46% simple average yield of the Life Insurance industry segment.

Primerica hiked its annual dividend amount every year since introducing dividend income distributions in 2010. Since the first annualized dividend payout of $0.04, Primerica enhanced its total annual dividend amount 34-fold over the past decade. This pace of dividend growth is equivalent to an average growth rate of more than 42% per year.

While the annual dividend growth rate has slowed in more recent years, the five-year average dividend growth rate is still nearly 20% and the average annual growth rate for the past three years is 19%. However, the company’s share price managed to rise at a slightly faster pace than dividend distributions, which suppressed the dividend yield.

Another cause of the small dividend yield is Primerica’s low dividend payout ratio. Investors generally consider a payout ratio in the 30% to 50% range sustainable. However, Primerica’s current payout ratio is just 15%. Even if it were doubled, Primerica’s current payout ratio would be still at the low end of the sustainable range.

While the dividend distributions make up a small portion of the company’s total returns, investors interested in collecting the next round of dividends on the June 14, 2019, pay date should act quickly. To receive this distribution, investors must hold or purchase shares prior to the May 21, 2019 ex-dividend date.

Share Price

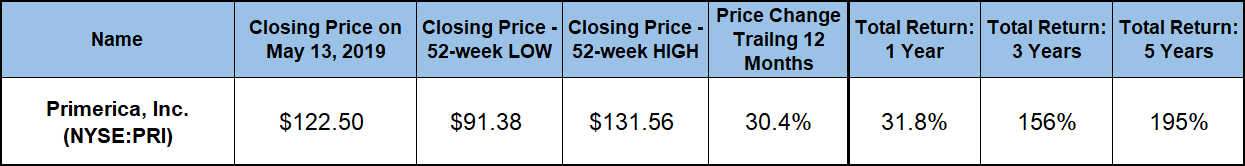

The overall market correction in the last quarter of 2018 interrupted Primerica’s relatively steady asset appreciation over the past five years. However, over the first 90 days of the trailing 12-month period, the share price advanced more than 35% and reached an all-time high before reversing direction and beginning its decline in mid-September. After dropping 28.4% from the mid-September level, the share price reached its 52-week low of $91.38 on December 24, 2018. This closing price was 2.7% lower than the share price from the beginning of the trailing 12-month period.

However, after reversing direction in late December, the share price recovered fully from its fourth-quarter losses by mid-March 2019. The share price continued its uptrend and gained 44% above the December low before reaching its most recent all-time high of $131.56 on May 6, 2019. After peaking in early May, the share price pulled back approximately 3% before plunging nearly 4% during the market selloff on May 13 and closed at $122.50.

Despite the pullback of nearly 7% from the all-time high, the most recent closing price was still more than 30% higher than it had been one year ago and 34.1% above the 52-week low from late December 2018. Additionally, the May 13 closing price was also 174% higher than it was five years ago.

Pushed mainly by the share price advancement, Primerica has rewarded its shareholders with a total return of nearly 32% over the trailing 12 months. Furthermore, the total returns over the past three years were nearly 156%. Lastly, Primerica’s shareholders nearly tripled their investment over the past five years with a total return of 195%.