After a significant drop in its share price from late 2016 to early 2017, the Tractor Supply Company (NASDAQ: TSCO) was able to double its share price over the past two years and deliver capital gains in excess of 40% over the past 12 months.

The share price began the past decade with an 11-fold increase over an eight-year period prior to the correction that began in mid-2016. During the correction that lasted from May 2016 to July 2017, the share price shed nearly half of its value before reaching its five-year low of $49.99 on July 12, 2017. However, since bottoming out in mid-2017, the share price has more than doubled.

The share price moving averages have been signaling a potential continuation of the current uptrend over nearly the entire trailing 12-month period. The 50-day moving average (MA) recovered to break above its 200-day counterpart on June 1, 2018. After rising for nearly six months, the 50-day MA declined slightly as a consequence of the December 2018 price drop, which was triggered by the overall market correction.

However, unlike many other equities and the overall market indices that fell to their 52-week lows in December 2018, Tractor Supply Company’s share price dipped only marginally and headed higher again after the beginning of February 2019. The share price is still fluctuating and occasionally dipping below the 50-day average. However, the fact that the share price managed to hold above its 50-day MA since March 20 could be a stronger signal of potential for sustained capital gains.

Financial Results

After delivering strong financial performance and beating earnings expectations in all four quarters of 2018, the Tractor Supply Company began 2019 with another strong report.

First-quarter 2019 revenue advanced 8.3% year-over-year to $1.822 billion and outperformed analysts’ expectations of $1.807 billion by 0.83%. Comparable store sales improved 3.9%. The company realized net earnings of nearly $77 million, which corresponds to earnings of $0.63 per diluted share. This earnings per share (EPS) figure outperformed the analysts’ earnings estimates of $0.55 by more than 14.5%.

In order to return cash to shareholders and bolster its share price, the Tractor Supply Company has repurchased approximately 63 million of its shares for a total of nearly $2.6 billion since 2007. Furthermore, the company authorized an additional $1.5 billion for the buyback program. Based on its first-quarter performance, the company reiterated its full-year 2019 guidance for revenues between $8.31 billion and $8.46 billion. Expected earnings of $555 million to $575 million correspond to an EPS between $4.60 and $4.75.

Tractor Supply Company (NASDAQ: TSCO)

Headquartered in Brentwood, Tennessee, and founded in 1938 as a mail order catalog business offering tractor parts to America’s farmer families, the Tractor Supply Company operates many rural lifestyle retail stores today. The company offers a selection of merchandise for livestock, pet and small animal care products. Additionally, the company sells hardware, truck accessories, towing products, tools and power equipment, as well as an assortment of work and recreational clothing as well as footwear. As of May 2019, the company operated 1,775 retail stores in 49 states under the Tractor Supply Company and the Del’s Feed & Farm Supply brand names. Additionally, Tractor Supply Company also owns and operates Petsense, a small-box pet specialty supply retailer primarily located in small and mid-size communities that focuses on meeting the needs of pet owners and offers a variety of pet products and services. At the end of March 2019, the company operated 176 Petsense stores in 26 states. Furthermore, the company offers its products through two e-commerce websites — TractorSupply.com and Petsense.com.

Dividends

The Tractor Supply Company paid its first dividend distribution in 2010 after operating for more than seven decades. However, since initiating dividend income payouts, the Tractor Supply Company has boosted its annual payout amount every year. The company has advanced the annual distribution amount 10-fold over the past nine years. This pace of advancement corresponds to an average growth rate of 29.2% per year.

The company’s most recent dividend hike increased the quarterly payout nearly 13% from $0.31 per share in the previous period to the current $0.35 distribution. This new quarterly payout corresponds to a $1.40 annualized amount and a 1.4% forward dividend yield, which is 13.6% higher than the company’s own 1.22% average yield over the past five years.

Just one year ago, Tractor Supply Company’s yield was competitive with the yields of its Services segment and Specialty Retail industry segment’s peers, such as Barnes & Noble (NYSE: BKS) and Office Depot (NASDAQ:ODP). However, while TSCO’s rising share price suppressed its yield, Office Depot’s and Barnes and Noble’s yields increased despite their declining share prices over the past year.

Additionally, the Tractor Supply Company’s current dividend payout ratio of 28% indicates that the company’s current earnings are more than sufficient to cover the dividend distributions. Therefore, the company should be able to easily maintain and support future dividend hikes.

The Tractor Supply Company will distribute the next round of dividend payouts on the June 11, 2019, pay date to all shareholders of record before the May 24, 2019, ex-dividend date.

Share Price

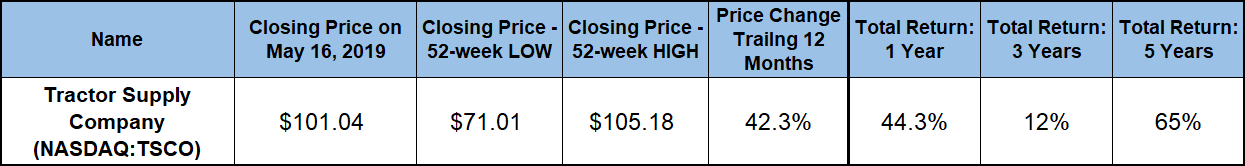

The share price — which has been rising since mid-2017 — hit its 52-week low of $71.01 on the first day of the trailing 12-month period. With just a minor pullback in the aftermath of the overall market correction in December 2019, the share price gained more than 18% before reaching its new all-time high of $105.18 on April 16, 2019.

Since peaking in mid-April, the share price pulled back a few points and closed at $101.04 on May 16, 2019. While this is almost 4% below the all-time high, the current closing price had managed to rise 42.3% above the 52-week low from the beginning of the current 12-month period. Also, the current closing price is nearly 60% higher than it was five years ago.

Assisted by the rising dividend income, the robust asset appreciation delivered a total return on investment of 44.3% to the company’s shareholders just over the past 12 months. The 20%-plus share price decline in 2016 and 2017, reduced asset appreciation and suppressed total returns to merely 16% over the past three years. However, since the share price has recovered fully from that pullback and advanced higher, the return on shareholders’ investment has been 65% for the last five years.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.