Featured Image Source: Honeywell Corporate Website

Despite minor share price fluctuations and missed dividend hikes, Honeywell International Inc. (NYSE:HON) has managed to deliver consistently total returns of approximately 20% over the past decade.

Since suffering is last major correction in the aftermath of the 2008 financial crisis, the Honeywell International stock price advanced nearly 650% from just slightly above 22% to nearly $170. In addition to extraordinary asset appreciation, Honeywell avoided dividend cuts in the past two decades and enhanced its annual dividend payout amount every year since 2011.

The current dividend payout ratio of 35% indicates that the company uses approximately one third of its earnings to cover its dividend distributions. Additionally, the current payout ratio is also substantially lower than the company’s own 57% ratio average over the past five years. Both of these indicators suggest that Honeywell should be able to support its current streak of annual dividend hikes for an extended period.

Additionally, the share price has more than 7% room to grow before reaching Wall Street analysts’ target price of $180.52. Furthermore, 16 out of 20, or 80%, of analysts currently covering the stock, recommend a “Buy” (9) or a “Strong Buy” (7) and only four analysts have a “Hold” recommendation.

Driven by the overall market correction in the last quarter of 2018, the Honeywell share price experienced a considerable pullback as well, which dropped the 50-day moving average below the 200-day average in mid-December 2018. However, the strong share price recovery in 2019, pushed the 50-day moving average back above its 200-day counterpart. Since crossing above the 200-day average in bullish manner in mid-March 2019, the 50-day moving average has risen to more than 8% above the 200-day average. Additionally, the share price has remained above both moving averages since the beginning of February 2019.

While signaling a potential continuation of share price uptrend and dividend income growth, all these indicators merely reflect the string of company’s positive financial results.

Financial Results

After outperforming earnings expectations every quarter in 2018, Honeywell International, reported another strong earnings report on April 18, 2018. Total sales dropped 15% because of business spin-offs. However, on comparable basis, organic sales were 8% higher than the same period last year.

The company also delivered adjusted earnings per share (EPS) of $1.92, which was 2% higher than previous year. Excluding the spin-offs, the current EPS was 13% higher than same period last year, as well as $0.07 higher than the company’s own high end guidance. Also, the first quarter EPS beat analysts’ earnings expectations by nearly 5%.

Operating income margin increased 190 basis points to 18.5%.

Honeywell International Inc. (NYSE:HON)

Currently based in Morris Plains, New Jersey, and tracing its roots to the Butz Thermo-Electric Regulator Company founded in 1886, Honeywell International, Inc. operates as a diversified technology and manufacturing company. The company’s Aerospace segment supplies products, software and services for aircrafts and other vehicles. This segment offers auxiliary power units, propulsion engines, integrated avionics and other electronic systems. Additionally, this segment provides aircraft lighting, advanced systems and instruments, satellite and space components, aircraft wheels and brakes, as well as spare parts, repair, overhaul and maintenance services. Furthermore, the Building Technologies segment offers sensors, switches, control systems and instruments for energy management, access control, video surveillance, fire products, remote monitoring systems and other building technology. The Performance Materials and Technologies segment develops and manufactures process technology products, including catalysts and adsorbents, equipment and consulting services. Lastly, the company’s Safety and Productivity Solutions segment provides personal protection equipment, apparel, gear and footwear, as well as gas detection technology and cloud-based notification and emergency messaging. After a long presence in the state, the company announced the relocation of its global headquarters from New Jersey to Charlotte, North Carolina, by September 2019.

Dividend

The company’s current $0.82 quarterly dividend is 10% higher than the $0.745 payout from the same period last year. This new quarterly amount corresponds to a $3.28 annualized distribution and a 1.9% forward dividend yield. The current yield is slightly below the company’s own 2% yield average over the past five years because the share price advanced faster than Honeywell’s annual dividend hikes.

While trailing its own five-year yield average, Honeywell’s current yield is nearly 68% higher than the 1.16% average yield of the overall Industrial Goods sector. Additionally, the current 1.9% yield is also 140% higher than the 0.81% simple average yield of the Aerospace-Defense Products & Services industry subsegment, as well as 55% above the 1.5% average yield of the segment’s only dividend-paying companies.

The company failed to boost its annual dividend in 2009. However, a flat dividend distribution is still better than cutting the payout like many other equities were forced to do in the aftermath of the financial crisis.

Since missing the hike in 2009, Honeywell, boosted its annual dividend for nine consecutive years and enhanced its annual payout more than 170%. This advancement corresponds to an average growth rate of nearly 12% per year. Furthermore, Honeywell boosted its annual dividend payout amount 14 times in the past 15 years. Over that period, the company increased the annual distribution 337%, which is still equivalent to an average annual growth rate of 10.3%.

Share Price

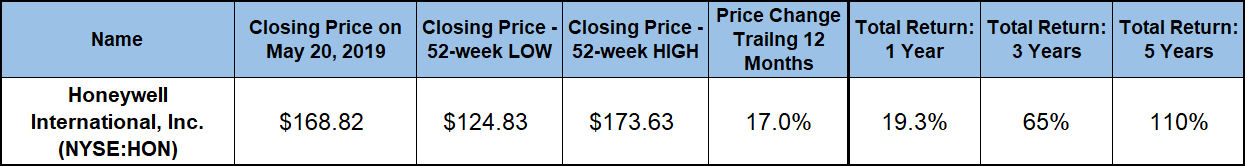

The share price continued its five year uptrend well into the first half of the trailing 12-month period. However, the overall market pullback in late 2018 interrupted that uptrend and pushed the share price lower to wards the 52-week low of $124.83 on December 24, 2018.

After reversing direction on Christmas Eve, the share price resumed its uptrend and recovered all its losses from late 2018, by the beginning of April 2019. Since April, the share price went on to set a series of new highs and closed at its new all-time high of $173.63 on April 30, 2019.

Since peaking at the end of April, the share price pulled back 2.8% and closed on May 20, 2019 at $168.82. This closing price was 17% higher than it was one year earlier, 35% above the 52-week low from late-December 2018, as well as 90% higher than it was five years ago.

While the company’s dividend yield is merely average, the dividend income distributions contributed to the total return of 19.2% over the trailing 12 months. The combined total returns over the past three years were nearly 65%. Also, Honeywell shareholders more than doubled their investment over the past five years with a total return of 110%.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.