This exchange-traded fund (ETF) uses a proprietary algorithm to identify companies with exposure to electronic vehicles, electric vehicle components and autonomous vehicle technology.

The Global X Autonomous & Electric Vehicles ETF (NASDAQ: DRIV) is a non-diversified, open-ended fund that was launched on April 13, 2018. The ETF has a average market cap of $70 million and currently has $13 million in assets.

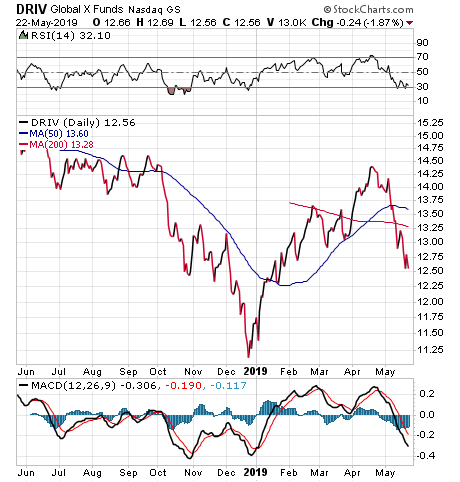

Shortly after the fund’s NASDAQ listing DRIV reached its all-time high of $15.78. Since then, its stock price fell 20%, although it has made solid gains in 2019 and is up 11.35% year to date.

With a 0.68% expense ratio, DRIV is considered a competitive fund in its industry according to ETF.com. The fund also holds a 2.32% dividend yield and recently paid out a $0.325 dividend on Dec. 28. Its next ex-dividend date is June 27.

DRIV is managed by Global X, a brand worth more than $9 billion, which manages a number of funds that I have featured in my ETF Talk series, including Global X Internet of Things ETF (NASDAQ: SNSR) and Global X FinTech ETF (NASDAQ: FINX).

The fund has 73 holdings with exposure to at least one of three segments: electronic vehicles, including motorcycles/scooters and electric rail; electric vehicle components, including drivetrains, lithium-ion batteries and fuel cells; and autonomous vehicle technology, including sensors, mapping and ride-share platforms.

People who live in or near a large city have, without a doubt, either used or seen a product or service of a company that DRIV includes among its holdings. Those companies not only feature those that engage with electric vehicles but also others that provide popular ride-sharing apps and electric scooters.

DRIV’s top 10 holdings are safe, blue-chip stocks. Their names and their weighting in the fund are Apple (NASDAQ:AAPL), 3.53%; Qualcomm Inc. (NASDAQ:QCOM), 3.40%; Microsoft Corporation (NASDAQ:MSFT), 3.38%; Texas Instruments Inc. (NASDAQ:TXN), 3.23%; NVIDIA Corporation (NASDAQ:NVDA) 3.13%; Alphabet Inc. (NASDAQ:GOOGL) 3.02%; Samsung Electronics Co. Ltd. (OTCMKTS:SSNLF), 2.92%; General Electric Company (NYSE:GE), 2.79%; Intel Corporation (NASDAQ:INTC), 2.79% and Toyota (NYSE:TM), 2.60%.

While DRIV offers a chance to invest directly in electric vehicles, since one of its holdings is Tesla, it also provides an even better opportunity to invest in the whole ecosystem of autonomous and electric vehicles, including component and material manufactures. An analogy for this strategy would be investing in the companies that provided the shovels, axes and other tools that were used during the Gold Rush.

Chart courtesy of StockCharts.com

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.