After losing more than one third of its value in 2018, the Northrop Grumman Corporation (NYSE:NOC) stock price has been trending upward since the beginning of 2019. Indicators suggest that the uptrend could continue.

Prior to the 2018 pullback, the last significant correction occurred in the aftermath of the 2008 financial crisis when the Northrop Grumman share price dropped more than 50% and hit its lowest level since 2000. However, after dropping to nearly $31 in March 2009, the share price embarked on a long uptrend and rose more than 11-fold before the 2018 correction. During this trend, the share price experienced one 20%-plus pullback in 2011. Otherwise, the share rose with minimal volatility for nearly a decade.

While the overall market correction did not start until the fourth quarter, the Northrop Grumman share price began declining in April 2018. However, after a Christmas Eve low, the share price reversed its trend and has recovered nearly 90% all of its 2018 losses. Furthermore, after dropping below its 200-day counterpart in July 2018, the 50-day moving average has been rising since late January. After spending 10 months below the 200-day average, the 50-day moving average returned above the 200-day average in a bullish manner on May 22, 2019.

The short-term average being above the long-term moving average for merely one day is not a definitive indicator of a potential uptrend extension. However, the share price also has been trading consistently above both moving averages since late April. In addition to these technical indicators, Northrop Grumman surpassed analysts’ earnings expectations in every quarter of 2018 and recently announced another dividend boost.

Financial Results

Northrop Grumman followed a strong financial result for full-year 2018 in January with another better-than expected earnings report for the first quarter of 2019 on April 24, 2019. First quarter revenues increased 22% year-over-year from $6.7 billion to $8.2 billion. Net earnings increased 3% from $840 million to $863 million assisted by a strong performance from the Innovation Systems business segment. Diluted earnings per share (EPS) of $5.06 were 6% higher than the $4.79 EPS from the same period last year. Also, Northrop Grumman returned $1 billion to shareholders by repurchasing approximately 3% of its common shares. Based on these strong first quarter results, the company raised its earnings guidance for full-year 2019 from its original $18.50 to $19.00 range to a new range between $18.90 and $19.30.

“These results are a good start to the year and provide the building blocks for our future growth. With a continued emphasis on performance, we are sharpening our focus on operational efficiency and agility to bring the power of our portfolio to solve our customers’ rapidly evolving needs,” said Chief Executive Officer and President Kathy Warden

Northrop Grumman Corporation (NYSE:NOC)

Based in Falls Church, Virginia and founded in 1939, the Northrop Grumman Corporation is a global security company that provides aerospace and defense systems, products and solutions to customers worldwide. The Aerospace Systems segment designs, develops, integrates and produces manned aircrafts as well as autonomous, spacecraft, high-energy laser and microelectronics systems. Additionally, the Innovation Systems segment designs, develops, integrates and produces flights, armaments and space systems. Furthermore, the Mission Systems segment offers products and services that include Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR) systems, radar technology, cyber solutions and acoustic sensors. Other offerings from this business segment include electronic warfare, intelligence processing, air and missile defense integration, navigation, shipboard missiles and encapsulated payload launch systems. Lastly, the Technology Services segment provides logistic solutions that support the full life cycle of platforms and systems. This segment’s products and services include software and system sustainment, modernization of platform and associated subsystems, advanced training solutions and integrated logistics support.

Dividends

Northrop Grumman boosted its quarterly dividend distribution 10% year-over-year from $1.20 in the first quarter last year to the current $1.32 payout. This new quarterly distribution is equivalent to an annualized dividend distribution of $5.28 per share. The current payout corresponds to a 1.7% forward dividend yield, which is 12% higher than the company’s own 1.5% five-year yield average.

While only slightly higher than the company’s own average, Northrop Grumman’s current yield outperformed the 1.16% average yield of the entire Industrial Goods sector by 44%. Additionally, the current 1.7% yield is also more than double the 0.79% simple average yield of Northrop Grumman’s peers in the Aerospace–Defense Products & Services industry segment. Even compared to the 1.24% average yield of the segment’s only dividend-paying companies, Northrop Grumman’s yield was still 34% higher.

Since missing an annual dividend hike in 2003, Northrop Grumman has boosted its annual dividend over the past 16 consecutive years. Over that period, the annual dividend payout rose by 560%. This pace of advancement corresponds to an annual growth rate of 12.5% per year.

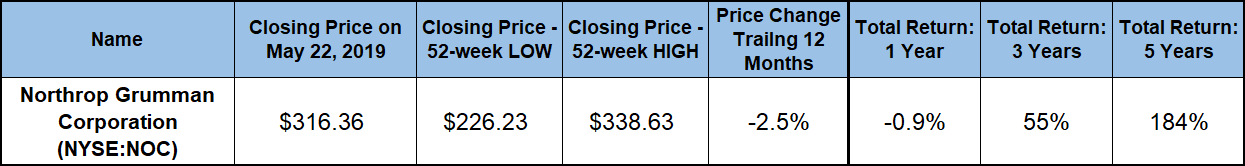

Share Price

Already on a downtrend since April 2018, the share price reached its 52-week high of $338.63 on June 6, 2018. The share price declined 33.2% on its way down to the 52-week low of $226.23 on December 24, 2018. However, since bottoming out on Christmas Eve, the share price has regained 87% of its losses since June and closed at $316.36 on May 22, 2019. While still 2.5% lower than it was one year earlier and 6.6% below the June peak, the May 22 closing price was nearly 40% higher than the 52-week low from late December, as well as 160% higher than it was five years ago.

While unable to overcome the 2.5% share price deficit completely, the dividend income reduced the total loss over the past 12 months to less than 1% with a trend towards turning positive as early as next week. Even with the 2018 correction, Northrop Grumman has rewarded its long-term shareholders with a total return of 55% over just the past three years. Furthermore, the shareholders nearly tripled their investment over the past five years with a total return of 184%.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.