The Consumer Staples Select Sector SPDR® Fund (NYSEARCA: XLP) is an exchange-traded fund (ETF) that can give a prospective investor access to the part of the global economy that features consumer staples.

Specifically, XLP tracks the Consumer Staples Select Sector Index, which, in turn, attempts to provide an effective representation of the consumer staples sector of the S&P 500 Index. The companies that make up the XLP portfolio mainly come from food and staples retailing, beverage, food product, tobacco, household product and personal product industries in the United States.

The stocks included in XLP typically are well-known to even the most novice investors. As a result, the ETF creates an aura of familiarity and stability between investors and the fund’s holdings.

Furthermore, the added benefits that come from XLP include an expense ratio that is among the cheapest in the sector, with a stable asset base and strong liquidity to keep transaction costs low. Among the fund’s top holdings are Procter and Gamble Company (NYSE: PG), Coca-Cola Company (NYSE: KO), PepsiCo Inc. (NASDAQ: PEP) and Walmart Inc. (NYSE: WMT). Other top XLP holdings consist of Costco Wholesale Corporation (NASDAQ: COST), Phillip Morris International Inc. (NYSE: PM), Mondelez International Inc. Class A (NASDAQ: MDLZ), Altria Group Inc. (NYSE: MO) and Colgate-Palmolive Company (NYSE: CL).

While these companies mainly are in the personal & household sector (27.49%), this ETF has holdings in companies that are in the food & tobacco sector (26.98%), beverages (26.08%), food & drug retailing (14.80%) and diversified retail (4.48%). The fund currently has more than $12.1 billion in total net assets and an average spread of 0.02%. It also has an expense ratio of 0.13%, meaning that it is less expensive to hold than some other ETFs.

In terms of XLP’s MSCI ESG Fund Quality Score of 6.89, it ranks in the 86th percentile within its peer group and in the 54th percentile within the global universe of all funds in the MSCI ESG Fund Metrics coverage.

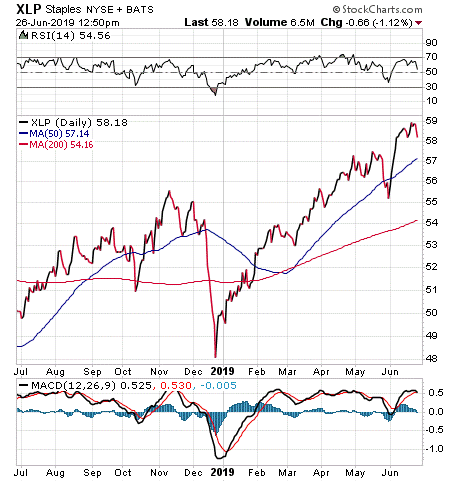

This fund’s performance has been mixed in the long term. While it has only been down 3.62% over the past month, it remains up 10.13% year to date.

Chart Courtesy of stockcharts.com

While XLP does provide a way to profit from the world of consumer staples, the sector may not be appropriate for all portfolios. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

In the name of the best within us,

Jim Woods

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)