As the second quarter comes to a close and the market is at the midway point of the year, a view of what is working best for generating call option income shows a few sectors outpacing the rest of the market by a wide margin.

Roughly half the stocks in the S&P 500 are trading in technical bear market patterns, so stock selection is at a premium and it was reported last week that only five stocks are accountable for about 30% of the S&P 500’s year-to-date gains — namely Microsoft (NASDAQ:MSFT), Amazon.com (NASDAQ:AMZN), Facebook (NASDAQ:FB), Disney (NASDAQ:DIS) and Apple (NASDAQ:AAPL).

That’s quite a statement, but there is potential within these five heavyweights. Both Amazon and Facebook are in the crosshairs of antitrust advocates and Apple could be impacted by a widening trade war with China. Disney and Microsoft appear to be in worry-free zones but are trading at record high valuations for companies growing revenues by 10%-20%.

Stepping into the cloud computing and Software as a Service (SaaS) sector, where several younger companies are still ploughing income into the industry, more attention is paid to the 30-80% revenue growth that characterizes this white-hot tech subsector. The subscription-based software model embraced by most of these companies was first established by Adobe Systems (NASDAQ:ADBE), Intuit (NASDAQ:INTU) and Salesforce.com (NYSE:CRM), followed aggressively by other fledging companies.

Today, there is a lot of attention being paid to Autodesk (NASDAQ:ADSK), Alteryx (NYSE:AYX), Coupa Software (NASDAQ:COUP), CyberArk Software (NASDAQ:CYBR), ServiceNow Inc. (NYSE:NOW), Okta Inc. (NASDAQ:OKTA), Atlassian Corp. (NASDAQ:TEAM), Twilio Inc. (NYSE:TWLO), Veeva Systems (NYSE:VEEV), Workday Inc. (NASDAQ:WDAY), Zendesk Inc. (NYSE:ZEN) and Zscaler Inc. (NASDAQ:ZS), among others.

While these newcomers are considerably more volatile than the more established blue-chip tech leaders, they offer tremendous upside potential over the next year or two and command huge premiums for trading corresponding call options. Paying up for call options on these “hottie” software stocks can be an expensive and painful experience if the purchase of call options is ill-timed.

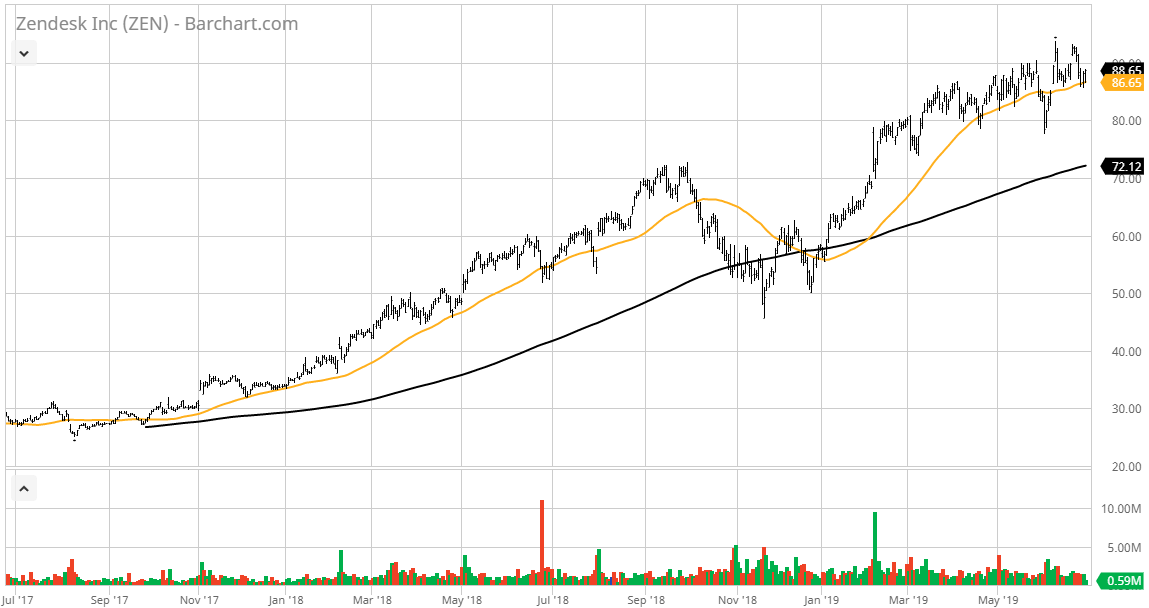

Conversely, selling richly priced out-of-the-money calls on cloud and SaaS stocks can be a highly lucrative income-generating proposition. For example, I’ve recommended trading Zendesk Inc. (NYSE:ZEN) five times in my Quick Income Trader advisory service that utilizes both covered-call and naked put strategies on select stocks that I find compelling short-term opportunities.

Just as a working example, the stock can be bought today at $88.50 and the ZEN August 16, 2019 $95 Calls can be sold for $4.00 per contract. This means if one commits $26,550 to buy 300 shares of ZEN, he or she can sell three calls at $400 each and bring in $1,200 immediately. That’s an instant 4.5% return on capital. If by chance the stock closes above $95 on Aug. 16, the 300 shares will be called away for a gain of $6.50 per share in addition to the $4.00 in call premium collected for a $10.50 gain per share. Multiply the $10.50 gain by 300 shares and that’s $3,150 in profit for only a six-week holding period on $26,550 invested, or roughly 12% on your money.

When one can fashion 12-15% net returns over a six-week period, that adds up fast over the course of a year. We’re talking potential annual returns of 80-120%, depending on the performance of the underlying stocks. But that’s my job — to keep working with and recommending the fastest tech stocks at the right entry points that can produce the quickest returns.

Take a tour of Quick Income Trader by clicking here and supercharge your portfolio’s second half 2019 performance with extreme covered-call income strategies that take all of 10 minutes and a hot cup of coffee per week to execute.