In a tough and competitive market segment, the United Technologies Corporation (NYSE:UTX) has managed to deliver 20 consecutive annual dividend hikes to its shareholders. It currently offers a 2.2% dividend yield.

In addition to its 20-year streak of consecutive annual dividend hikes, United Technologies has been distributing dividends for a very long time and has maintained a high-level of dividend growth. The company began dividend distributions in 1936 and its annual dividend hikes have advanced at a double-digit percentage average growth rate over the past two decades.

Additionally, United Technologies’ current 45% dividend payout ratio indicates that the company currently uses less than half of its earnings to cover the dividend distributions to its shareholders. This current payout ratio is slightly higher than the company’s own 39% payout ratio average over the past five years.

While slightly above its five-year average, the current dividend payout ratio is still within the 30% to 50% range that investors consider sustainable. Ratios lower than 30% are certainly sustainable as well. However, at those levels, the dividend distributions tend to be too low to garner the interest of income-seeking investors.

Alternatively, once the dividend payout ratio exceeds 50%, the company might encounter difficulties in providing sufficient funds to support company operations and dividend distributions at the same time. Therefore, in a conflict situation, securities will generally reduce their dividend distribution amounts as the payout ratio approaches or exceeds 100%. While close to the upper limit of the sustainable range, United Technologies’ current ratio indicates that the company still generates sufficient earnings to cover its current dividend distributions and that it can support continued annual dividend hikes.

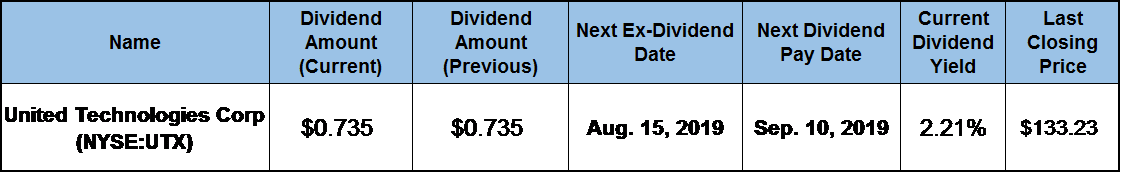

In addition to a dividend yield that exceeds the industry averages and a long streak of annual dividend hikes, the company has also delivered moderate asset appreciation and steady total returns on shareholders’ investments. Before taking a position in the United Technologies stock, interested investors must conduct their own analysis to confirm that this stock has positive outlook and fits within the investors’ overall portfolio strategy. To take advantage of the dividend distribution timing and collect the next round of dividend payouts on the September 10, 2019, pay date, investors must claim stock ownership before the August 15, 2019, ex-dividend date.

United Technologies Corporation (NYSE:UTX)

Founded in 1934 and headquartered in Farmington, Connecticut, the United Technologies Corporation provides technology products and services to commercial aerospace, defense and building industries worldwide. The company operates through four independent business units — UTC Climate, Controls & Security, Pratt & Whitney Otis and UTC Aerospace Systems.

The UTC Climate, Controls & Security segment provides heating, ventilating, air conditioning and refrigeration solutions for residential, commercial, industrial and transportation applications. This segment offers electronic security products, including intruder alarms, access control systems and video surveillance systems. Additionally, the segment provides fire safety systems and products, as well as design, installation, repair, maintenance, monitoring and inspection of such systems. UTX’s Pratt & Whitney segment supplies aircraft engines for commercial, military, business jet and general aviation markets. It also provides aftermarket maintenance, repair, overhaul and fleet management services.

The Otis segment designs, manufactures, sells and installs passenger and freight elevators, escalators and moving walkways. In addition to providing new systems, this segment offers modernization products to upgrade elevators and escalators, as well as maintenance and repair services. Lastly, the company’s UTC Aerospace Systems segment provides electric power generation and various control and monitoring systems for the aerospace and space exploration industries. The segment offers power management, air data and aircraft sensing, engine control, intelligence, surveillance and reconnaissance systems as well as other systems.

The company’s most recent annual dividend hike enhanced the quarterly dividend payout 5% from $0.70 in the third quarter last year to $0.735. This new quarterly distribution amount corresponds to a $2.94 annualized distribution for full-year 2019 and a 2.2% forward dividend yield. Because the share price advanced faster than the annual dividend payouts, the current yield is slightly lower than the company’s own 2.24% average yield over the last five years.

However, while trailing its own five-year average, United Technologies’ current yield outperformed the 1.17% simple average yields of the company’s peers in the Industrial Goods sector. Furthermore, compared to the 1.42% average yield of the Industrial Conglomerates market segment, the United Technologies’ 2.2% current yield is 55% higher.

Over the past two decades of consecutive annual dividend hikes, United Technologies has advancement its total annual dividend payout amount more than seven-fold. That advancement pace is equivalent to an average growth rate of 10.5% per year since 1999. While the growth rates generally tend to decrease as the payout amount rises, United Technologies managed still to maintain an average annual boost rate of nearly 5% over the last five years.

While experiencing a few pullbacks in the past year, the share price rose enough to deliver nearly 60% of the company’s 5.6% total returns over the trailing 12-month period. Another share price pullback of nearly 32% kept the total return over the last five years below 30%. However, over the past three years, shareholders have enjoyed a total return of 37% on their investment.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)