The Industrial Select Sector SPDR Fund (NYSEARCA: XLI) is an exchange-traded fund (ETF) that tracks stocks in the Industrial Select Sector Index.

XLI is considered to be a broad sector measure of industrial stocks. The index includes companies in aerospace and defense, industrial conglomerates, marine, transportation infrastructure, machinery, road and rail, air freight and the logistics and commercial services and supplies industries. The fund selects from the S&P 500, with limited exposure to small- and mid-cap stocks, which only account for a small fraction of its holdings.

The Industrial Select Sector SPDR Fund’s (NYSEARCA: XLI) top 10 holdings include Boeing Co. (NYSE: BA), 8.31%; Honeywell International Inc. (NYSE: HON), 5.54%; Union Pacific Corp. (NYSE: UNP), 5.22%; United Technologies Corp. (NYSE: UTX), 4.61%; 3M Co. (NYSE: MMM), 4.36%; General Electric Co. (NYSE: GE), 3.99%; Lockheed Martin Corp. (NYSE: LMT), 3.90% Caterpillar Inc. (NYSE: CAT), 3.40%; United Parcel Services Inc. Class B (NYSE: UPS), 3.14%; and CSX Corp. (NASDAQ: CSX), 2.59%.

Another crucial factor in the industrial sector resides on the trade front, especially with China. After a supposed trade truce was reached between the United States and China, U.S. officials are traveling to China next week at the start of a six-week congressional recess to continue their lengthy trade negotiations.

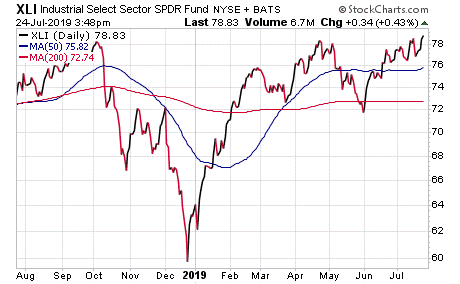

The truce may have had a somewhat positive effect on XLI’s share price, as it’s up 1.51% in the past month. A recent ETF Channel analysis claims XLI’s share price has about a 7% upside and could reach as high as $83.92 in the next 12 months. XLI currently is up more than 21% year to date, as you can see in the chart below.

Chart courtesy of StockCharts.com

The Industrial Select Sector SPDR Fund (NYSEARCA: XLI) currently has a 1.99% yield that pays out a quarterly dividend of $0.337. Its ex-dividend date is Sept. 20.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.