After beating analysts’ quarterly earnings expectations for two consecutive periods, Mattel, Inc. (NASAQ:MAT) reversed a declining trend of nearly three years and has advanced its share price almost 30% over the past seven weeks.

The toy market demand had been weakening for a while and was harmed even further with the Toys R Us Chapter 11 bankruptcy filing in late 2017 and liquidation in 2018. However, Mattel owns valuable intellectual property, such as its Barbie and Hot Wheels brands, which it can use to generate revenue even during weakened market demand.

Furthermore, Mattel is working on expanding its partnerships with other brands to strengthen its portfolio of products. The company announced in early June 2019 a new international licensing agreement with the Japanese Sanrio Company, Ltd (TYO:8136), maker of Hello Kitty products and owner of intellectual property right to dozens of additional characters from the “Kawaii” culture in Japan.

Additionally, Mattel also announced that a partnership with the Blumhouse Productions studio produce a movie based on the Magic 8 Ball. Finally, Mattel’s stock made additional gains over the last few weeks on the positive outlook on tariffs with China as trade negotiations continue. While the recovery might take time, Mattel has been restructuring and cutting cost to position itself for long-term growth.

Financial results

While struggling for the past couple of years, Mattel showed signs of potential recovery by beating Wall Street analysts’ quarterly earnings expectations for two consecutive periods — fourth-quarter 2019 and first-quarter 2019. After posting positive earnings in last-quarter 2018, Mattel reported a loss of $0.44 per share in first-quarter 2019. However, the reported adjusted loss beat the analysts’ expected loss of $0.56mper share by more than 20%.

While total revenues fell 3% to same period last year, revenues for Mattel’s two top brands — Barbie and Top Wheels – increased 7% and 4%, respectively. Furthermore, Mattel’s restructuring and cost cutting reduced its cash outflow to $214 million for the first-quarter 2019 from $552 million for the same period last year.

Dividends

While Mattel currently does not pay dividends, the company had delivered a relatively steady streak of rising dividends for more than two decades. The company began dividend distributions in 1992. Additionally, Mattel hiked its annual dividend distributions 13 times in the two decades between 1997 and 2017.

After reducing its annual dividend from $0.36 in 2000 to just $0.05 for 2001 and paying the same $0.05 dividend in 2002, Mattel boosted its annual dividend ten times in the subsequent 12 years. Over that 12-year period, the total annual dividend payout amount increased more-than 30-fold, which was equivalent to an average growth rate of 33% per year.

However, calculating dividend growth against the minimal $0.05 annual payout in 2002 exaggerates the growth rate. However, over the two decades prior to 2017, Mattel enhanced its total annual dividend payout amount more than 460%, which corresponds to a more representative average growth rate of 9% per year.

However, all this dividend growth information became irrelevant when Mattel was forced to cut its dividend payout from $0.38 to just $0.15 for the third-quarter 2017. With the share price struggling to even maintain flat trajectory and skimpy earnings, Mattel was using more than 100% of its quarterly earnings to cover dividend distributions, which is not sustainable.

Even after a significant payout amount cut, Mattel was unable to support its dividend distributions and suspended all dividends as of the last-quarter 2017. However, after steadily beating analysts’ earnings expectations for the last few quarters, Mattel might be in apposition to reintroduce dividend distributions as a way to return a portion of earnings to shareholders.

Share Price

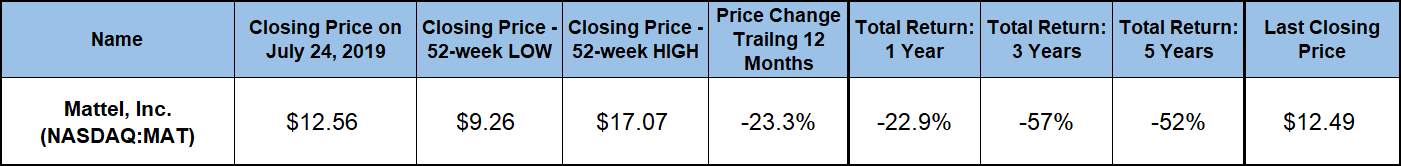

The share price has been mostly declining over the past five years amid toy market troubles and Mattel’s restructuring efforts. The share price entered the trailing 12-month period in late July 2018 riding a downtrend that began in August 2016. This downtrend continued for the remainder of the year, during the last five months of 2018, the share price declined more than 40% and reached its 52-week low of $9.26 on December 24, 2018.

After bottoming out in late-December 2018, the share price spiked nearly 85% to hit briefly its 52-week high of $17.07 on February 13, 2019. However, that share price increase was short-lived. Immediately after peaking in mid-February, the share price began declining and gave back 95% of its gains by the beginning of June 2019.

However, after closing on June 3, less than 5% above the 52-week low, the share price embarked on its current uptrend and has gained nearly 30% before closing on July 24, 2019, at $12.49. This closing price was still more than 20% lower than it was one year earlier. However, in addition to gaining nearly 30% since the beginning of June, the July 24 closing price was also 35.6% higher than the 52-week low from late-December 2018.

Mattel, Inc. (NASDAQ:MAT)

Headquartered in El Segundo, California, and founded in 1945, Mattel, Inc. is a children’s entertainment company that designs and produces toys and consumer products worldwide. Mattel operates through three business segments — North America, International and American Girl. The company offers dolls and accessories, content, gaming and lifestyle products, diecast cars, content, live events and books under several recognizable brand names. These brands include Barbie, Hot Wheels, Fisher-Price, Thomas & Friends, American Girl, MEGA, Polly Pocket, Uno and Matchbox. In addition to its own brands, Mattel also manufactures an distributes products under partner brands, which include Disney, WWE Wrestling, Nickelodeon, Warner Bros., Consumer Products, NBCUniversal and Mojang. Mattel, Inc. distributes its products through several wholesale and retail channels. The company sells directly to consumers through its catalog, Website and proprietary retail stores, as well as third-party distribution channels and retail, including discount and free-standing toy stores, chain stores, department stores and other retail outlets, as well as wholesalers and agents.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.