While losing more than one-fifth of its value in late 2018, Allstate Corporation (NYSE:ALL) saw its share price rebound and gained 25% since the beginning of 2019.

Wall Street analysts’ current recommendations cover the entire spectrum from “Sell” to “Strong Buy”. However, on average the “Buys” have it. Therefore, some investors might consider taking a long position in anticipation of the company’s second-quarter earnings release next week.

While still facing some headwinds, the company has continued to distribute cash to its shareholders through rising dividend income payouts over the past few years. Additionally, after a correction in the last quarter of 2018, the share price has fully recovered and might be on its way to challenge its own all-time highs from December 2017.

Financial Results

After missing analysts’ earnings expectations in the third quarter last year, Allstate beat earnings estimates over the subsequent two periods. In its first-quarter 2019 financial report on May 2, Allstate announced 12.5% total revenue growth to nearly $11 billion, up from $9.8 billion in the same period last year. Several positive developments drove this revenue expansion.

The net written premium increased 6.2% in the first quarter. Allstate also managed to accelerate policy growth from its wholly-owned subsidiary Esurance to nearly 11%. Additionally, Allstate increased the issuance of its own brand insurance policies by 2.3% in the period. Compared to issuing policies by other insurance providers and underwriters, Allstate’s own policies generate higher profit margins. Net income advanced 29% year-over-year from $977 million to $1.26 billion. The adjusted earnings of $2.30 per diluted common share beat Wall Street analysts’ estimates of $2.28 by almost 1%.

While Allstate anticipates a year-over-year revenue decline, those figures are already reflected in the $1.53 earnings per share (EPS) estimates expected by Wall Street analysts. However, while the expected revenue decline is nearly 12%, the expected EPS is nearly 20% lower than the $1.90 actual EPS delivered by Allstate in the second quarter last year. Therefore, even with the revenue decline, if Allstate can beat those lowered expectations, the share price might receive the necessary boost to continue its current uptrend.

Allstate will release its second quarter earnings result before markets open on July 31, 2019.

Dividends

Allstate began dividend distributions in 1993 and initially delivered a steady streak of rising annual payouts. However, like most financial organizations, Allstate was forced to cut its dividend in the aftermath of the 2008 financial crisis. The company cut its quarterly payout amount by more than 50% for the second-quarter 2009 distribution. However, after paying the same $0.20 quarterly amount for the eight subsequent periods, Allstate began hiking its dividend distributions again in the second-quarter 2011.

Since resuming dividend hikes in 2011, the company has enhanced its annual dividend payout amount 150% over the past nine years. That advancement corresponds to an average annual growth rate of 10.7%.

The company’s current $0.50 quarterly amount is 8.7% higher than the $0.46 distribution from the same period last year. This current amount is equivalent to a $2.00 annualized distribution and a 2% forward dividend yield, which is 12.6% higher than the company’s own 1.74% average dividend yield over the last five years. Allstate’s current yield lags below the 3.04% average yield of the overall Financial sector — as most insurance companies’ yields do. However, Allstate’s 2% yield is 32% higher than the 1.48% average yield of Allstate’s peers in the Property & Casualty Insurance industry segment.

Share Price

Before the most recent correction in the fourth-quarter 2018, the share price had quadrupled since late 2011. After trading relatively flat in the first half of 2018, the share price gained nearly 9% at the beginning of the trailing 12-month period before plunging nearly 25% by the end of the year.

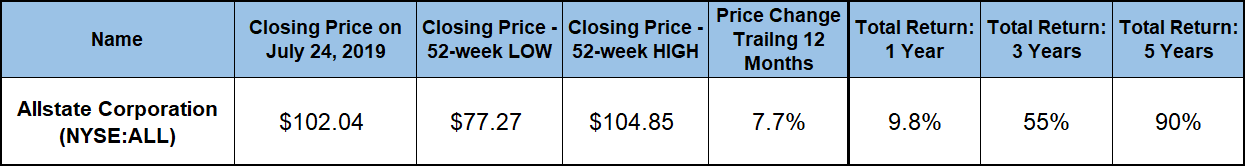

Assisted by the downward pressure from the overall market correction, the share price dropped to its 52-week low of $77.27 by December 24, 2018. However, as the downward market pressure subsided, Allstate’s share price reversed direction and embarked on a recovery uptrend at the turn of the year.

With only minor fluctuations, the share price recovered all its losses by early April 2019 and continued to rise towards its new 52-week high of $104.85 on July 16, 2019. After gaining nearly 36% above its 52-week low from late-December 2018, the share price pulled back 2.7% from the peak to close on July 25, 2019, at $102.04.

While slightly below its recent peak, the July 25 closing price was 7.7% higher than it was one year earlier and 32% above the 52-week low from the end of 2018. Furthermore, the share price gained 76% over the past five years.

The asset appreciation and the dividend income distributions over the past 12 months combined to deliver a total return on shareholders’ investment of nearly 10%. Over the past three years, investors enjoyed total returns of 55%. Moreover, shareholders nearly doubled their investment over the past five years with a combined total return of 90%.

Allstate Corporation (NYSE:ALL)

Headquartered in Northbrook, Illinois, and founded in 1931, the Allstate Corporation provides property, casualty and other insurance products in the United States and Canada. The company operates through four business segments — Allstate Protection, Service Businesses, Allstate Life and Allstate Benefits. The Allstate Protection segment offers private auto and homeowners’ insurance, as well as specialty auto products, including motorcycle, trailer, motor home and off-road vehicle insurance. This segment also offers other personal lines products, such as renter, condominium, landlord, boat, umbrella and manufactured home insurance. The Service Businesses segment provides consumer electronics and appliance protection plans, analytics and customer risk assessment solutions, as well as roadside assistance services. The Allstate Life Segment offers term, whole, and variable life insurance products, as well as non-proprietary retirement product solutions offered by third-party providers. Lastly, the Allstate Benefits segment provides life, accident, critical illness, short-term disability and other health insurance products.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.