Is BB&T Corporation’s (NYSE:BBT) record of delivering robust asset appreciation and steadily rising dividend income in jeopardy after merger approval, or do investors still have the opportunity to enjoy steady total returns?

On July 30, 2019, BB&T Corporation’s shareholders approved the company’s merger of equals with SunTrust Banks Inc. (NYSE:STI) with more than 98% of the votes cast in favor of the merger. Additionally, 96% of the shares voted to approve the name of the new entity — Truist Financial Corporation.

In addition to the shareholders’ endorsement, the bank also received merger approval from the North Carolina Office of the Commissioner of Banks on July 10. While these two events complete major steps towards creation of the new financial entity, the merger still requires additional regulatory approvals. Both companies expect to receive all necessary approvals and complete all necessary merger transactions in late third-quarter or fourth-quarter 2019.

“We’re very pleased BB&T shareholders have overwhelmingly supported both the merger of equals with SunTrust and the new Truist name,” said Chairman and Chief Executive Officer Kelly S. King. “This is an important milestone as we move toward our goal of creating a bold, transformative organization that benefits our shareholders, associates, clients and communities,” added Mr. King.

The merger of current shares will be executed at the exchange ratio of 1.295 BB&T shares for each SunTrust share. Based on this exchange ratio, the new business entity — Truist Financial Corporation — will be created with 57% ownership of former BB&T shares and 43% of former SunTrust shares.

Both companies are well positioned to execute the merger with their past integration experience. Collectively, the two banks have successfully executed acquisitions and integration of more than 100 banks over the past 35 years. Based on figures from the bank’s 2018 respective annual reports, the new financial institutions will be the sixth largest U.S. bank in terms of assets ($441 billion) and deposits ($324 billion).

Financial Results

In the most recent quarterly financials release on July 18, 2019, BB&T reported record second-quarter net income of $842 million, which was 8.6% higher than in the same period last year. Diluted earnings per share (EPS) of $1.09 were also a new second-quarter high and up 10.1% versus the second-quarter 2018. Adjusted diluted EPS increased 10.9% year over year to $1.12 and beat analysts’ expectations of $1.08 by 3.7%.

BB&T remains well positioned for revenue enhancement through continued loan growth and expects to enhance earnings by holding its own third-quarter and full-year 2019 expenses at 2018 levels. The company also plans to address its exposure to risky loans by selling approximately $4 billion residential mortgage loans in the third-quarter 2019 to improve its rate risk positioning. Additionally, BB&T affirmed its expectations in achieving approximately $1.6 billion in cost synergies — net of investments — from the upcoming merger with SunTrust.

Share Price

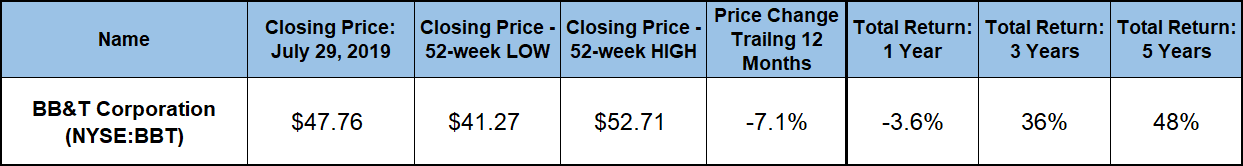

After increasing more than three-fold following the 2008 financial crisis decline, the share price tripled before reaching its all-time high of more than $56 in early-March 2018. However, after peaking in early 2018, the share price pulled back and delivered no gains over the past 12 months despite increased volatility. The share price passed through its 52-week high of $52.71 on October 3, 2018, and declined for the remainder of the year. Influenced by the overall market correction in the fourth-quarter 2018, the share price lost nearly 22% before hitting its 52-week low of $41.27 on December 24, 2018.

However, after bottoming out in late-December 2018, the share price reversed trend and regained all of its losses over the previous year by late-July 2019. However, uncertainties regarding the trade agreement with China and the Fed’s interest rate cut on perceived economic slowdown caused an overall market selloff in early August. Amid this selloff, BB&T’s share price dropped 7% to close on August 6, 2019, at $47.76. In addition to being 7% down for the year, the Aug. 6 closing price was also 9.4% below the 52-week high from early-October 2018. However, the current price is still nearly 16% above the 52-week low from late 2018, as well as 32% higher than it was five years ago.

Despite steadily rising payouts, BB&T’s dividend income was not enough to compensate for the recent share price drop. However, the dividend distributions were able to offset more than half of the share price pullback and limit the one-year total losses on shareholders’ investment to just 3.6%. Without the share price drop in August, the shareholders would have enjoyed a 3.8% total return over the past 12 months. Over the past three and five years, the shareholders received total returns of 36% and 48%, respectively.

BB&T Corporation (NYSE:BBT)

Based in Winston-Salem, North Carolina, and founded in 1872, the BB&T Corporation operates as a financial holding company for the BB&T Bank that provides various banking and trust services for small and mid-size businesses, public agencies, local governments and individuals. The bank operates through six business segments. — Community Banking Retail & Consumer Finance, Financial Services & Commercial Finance, Community Banking Commercial and Insurance Holdings. In addition to the customary retail banking services, such as savings accounts, checking accounts and certificates of deposit, the BB&T Corporation also offers other financial and wealth-management services. The bank offers individual retirement accounts, as well as asset management, lending and consumer finance, as well as home equity and mortgage lending. Furthermore, the Insurance Holdings segment offers a variety of products, such as property and casualty, life, health, employee benefits, commercial general liability, surety, title and other insurance products. Additionally, BB&T provides investment brokerage, mobile and online banking, payment, lease financing, small business lending, as well as wealth management and private banking services.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.