The Technology Select Sector SPDR Fund (NYSEARCA: XLK) is an exchange-traded fund that can give a prospective investor access to the segment of the global economy that is involved with technology.

Specifically, XLK tracks the Technology Select Sector Index, which, in turn, attempts to provide an effective representation of the technology and telecom sector of the S&P 500 Index. It would, however, be a mistake to assume that this fund’s holdings are only confined to the big-name FAANG stocks of Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google’s parent Alphabet (NASDAQ:GOOG).

While this ETF’s selection universe is entirely centered around American companies and avoids the less stable small-caps and most mid-caps in order to produce lower volatility and a rise in value, XLK’s portfolio indicates that the world of technology is still much bigger than FAANG would make it seem.

For instance, XLK includes financial payment processors and telecom firms alongside the FAANG and other top technology companies. This choice, among others, has helped make XLK one of the cheapest, most liquid and largest funds in its segment.

This fund’s top holdings include Microsoft Corporation (NASDAQ: MSFT), Apple Inc. (NASDAQ: AAPL), Visa Inc. Class A (NYSE:V), Mastercard Inc. (NYSE: MA), Cisco Systems Inc. (NASDAQ: CSCO), Intel Corporation (NASDAQ: INTC), Adobe Inc. (NASDAQ: ADBE), Oracle Corporation (NYSE: ORCL) and PayPal Holdings (NASDAQ: PYPL).

The fund currently has more than $21.46 billion in assets under management and an average spread of 0.01%. It also has an expense ratio of 0.13%, meaning that it is less expensive to hold than some other ETFs.

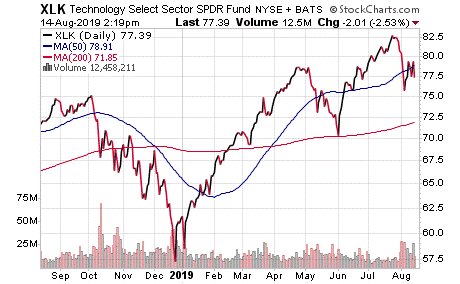

This fund’s performance has been mixed in the short term largely due to the U.S.-China trade war but has been more successful in the long term. As of August 12, 2019, XLK is down 1.42% over the past month, up 3.36% over the past three months and up 27.04% year to date.

Chart courtesy of StockCharts.com

In short, while XLK does provide an investor with a chance to profit from the world of technology, the sector may not be appropriate for all portfolios. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.