While some economic indicators point towards a potential slowdown, a diversified company with steady income distributions and earnings growth, such as Stanley Black & Decker, Inc. (NYSE:SWK), can be a good alternative investment to weather a potential downturn.

Despite a recent pullback, the Stanley Black & Decker stock still delivered strong long-term growth and has risen more than five-fold since the 2008 financial crisis. In addition to the relatively steady asset appreciation, Stanley Black & Decker also rewarded its shareholders with dividend distributions since 1877 and has delivered more than 50 consecutive years of annual dividend hikes.

While the current share price pullback affected negatively the existing shareholders, the discounted pricing could be an opportunity for interested new investors to take a long position at reduced prices. While the share price dropped below both moving averages in late August due to pressures from market volatility, the 50-day moving average has been trading above its 200-day counterpart since it broke above the 200-day average in early-April 2019. The share price might not surge immediately, but analysts currently covering the stock appear confident in the stock’s recovery over the next year.

Nearly half of the analysts — 11 out of 23 — currently have a “Buy” recommendation, with another four analysts recommending a “Strong Buy.” The remaining eight analysts remain neutral with a “Hold” recommendation. In addition to analysts’ recommendations, the current share price has nearly 24% room on the upside before it reaches the analysts current average target price of $162.50. Moreover, while the share price might have dropped recently under overall market pressure, Stanley Black & Decker has beaten earnings expectations every quarter during the trailing 12-month period.

Financial Results

On July 23, 2019, Stanley Black & Decker reported second-quarter revenues of $3.8 billion, which was 3% higher than the same period last year. The company achieved the revenue growth evenly from organic growth and acquisitions.

Net income rose 22% year over year from $293 million in the second quarter last year to $357 million. The second-quarter earnings per share (EPS) of $2.37 were nearly 23% higher in the same period last year. The adjusted EPS advanced 3.5% from $2.57 last year to the current $2.66 adjusted earnings per diluted share, which beat analysts’ expectations of $2.54 by nearly 5%.

On the strengths of its first-half 2019 results Stanley Black & Decker reiterated its 2019 EPS outlook of $7.50 to $7.70, or $8.50 to $8.70 on an adjusted basis. The company also expects organic revenue growth of approximately 4%, with EPS expansion between 4% and 7% versus prior year.

Dividends

Stanley Black & Decker is one of only 13 companies designated Dividend Kings. Dividend Kings are S&P 500 companies that have boosted their annual dividends for at least 50 consecutive years. Just over the past two decades, Stanley Black & Decker enhanced its annual dividend payout more than three-fold. This advancement corresponds to an average annual growth rate of nearly 6%.

The most recent dividend hike boosted the quarterly payout 4.5% from $0.66 to the upcoming $0.69 distribution on the Sept. 17 pay date. This new quarterly payout amount corresponds to a $2.76 annualized distribution and a 2.1% forward dividend yield, which is 12% higher than the company’s own 1.88% average yield over the last five years.

Furthermore, the current yield is also nearly 70% above the 1.25% simple average yield of the overall Industrial Goods sector. Even compared to the 1.92% average yield of the company’s peers in the Machine Tools & Accessories industry segment, the Stanley Black & Decker yield is nearly 10% higher.

Share Price

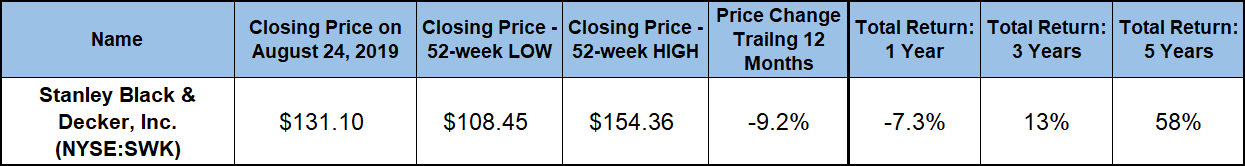

The share price began the trailing 12-month period with a 7% uptick towards its 52-week low of $154.36 on September 21, 2018. However, while most other equities declined throughout the fourth quarter under the downward pressure from the overall market correction, the Stanley Black & Decker stock dropped nearly 30% in just slightly more than a month. However, after bottoming out at $108.45 on October 29, 2018, the Stanley Black & Decker share price reversed direction and began rising, albeit with significantly more volatility.

Since its 52-week low in late October, the share price has recovered half of its losses to close on August 26, 2019, at $131.10. While still 9% short of its level from one year earlier, the August 26 closing price was 21% above the 52-week low from late-October 2018, as well as 43% higher than it was five years ago.

While unable to overcome the 9.3% share price deficit for the year, dividend income managed to reduce the total loss to 7.2% over the trailing 12 months. However, over the extended period of the last three and five years, the shareholders enjoyed total returns of 13% and 58% respectively.

Stanley Black & Decker, Inc. (NYSE:SWK)

Headquartered in New Britain, Connecticut, and founded in 1843, Stanley Black & Decker, Inc. engages in tools and storage, industrial, and security businesses worldwide. The company’s Tools & Storage segment offers power tools and equipment. The product offering includes professional grade corded and cordless electric power tools and equipment, as well as pneumatic tools and fasteners. Additionally, this segment also offers consumer products, which include corded and cordless electric power tools primarily under the BLACK+DECKER brand, as well as lawn, garden and home products and related accessories.

The Industrial segment provides engineered fastening products and systems to customers in the automotive, manufacturing, electronics, construction and aerospace industries. This segment also sells and rents custom pipe handling, joint welding and coating equipment for use in pipelines construction, as well as provides pipeline inspection services. The Security segment designs, supplies and installs commercial electronic security systems and provides security services. Formerly known as The Stanley Works, the company changed its name to Stanley Black & Decker, Inc. in March 2010.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.