The ProShares UltraShort S&P500 (NYSE: SDS) is an inverse exchange-traded fund (ETF) that seeks daily investment results that correspond to two times the inverse (-2x) of the daily performance of the S&P 500.

It is worth pointing out that this fund, like most leveraged and inverse ETFs, is designed to provide a positive return at a time when the S&P 500 is falling. However, SDS, and inverse ETFs in general, do their best work when they are held for a limited time.

Holding on to shares of SDS for more than a short time is not recommended as it is often difficult to determine how long a downturn will last. Thus, it is easy to expose oneself to unnecessary risk by confusing a temporary aberration and the beginning of a bear market.

Furthermore, failing to regularly rebalance SDS shares, especially at a time of heavy market volatility, has the possibility of exposing investors to performance drift from the S&P 500 index. This means that it is possible for the value of the shares to fall even as the market moves in a desirable direction.

The fund currently has more than $1.04 billion in assets under management and an average spread of 0.03%. It also has an expense ratio of 0.90%, meaning that it is more costly to hold than some other ETFs.

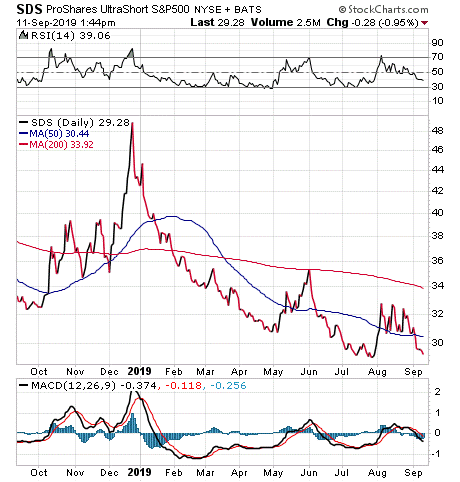

According to Morningstar.com, this fund’s performance has been negative in both the short and long run. As of September 10, 2019, SDS is down 4.83% over the past month, down 7.20% over the past three months and down 30.62% year to date. This is not a surprise given the S&P 500 yielded positive returns during each of those time periods.

Chart Courtesy of stockcharts.com

In short, while SDS does provide an investor with the ability to profit at a time when the S&P 500 is yielding negative returns, inverse ETFs may not be appropriate for all portfolios. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

Since SDS is double leveraged, investors need to be especially wary about owning its shares. An upturn in the S&P 500 would likely lead to double the losses incurred by this inverse fund. However, when the S&P 500 is tanking, this double inverse fund would be a way to seek twice the profits of the decline in the index.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.