After suffering a 15% decline amid the overall market correction in late 2018, Medtronic PLC’s (NYSE:MDT) share price has fully recovered and has combined with the company’s dividend income distributions to deliver a double-digit percentage total return over the trailing 12-month period.

In addition to short-term asset appreciation, Medtronic has also rewarded its shareholders with long-term capital gains. The stock’s most significant drop occurred in the aftermath of the 2008 financial crisis. Between August 2008 and March 2009, the share price shed more than 55% of its pre-crisis value. However, after reversing direction in early 2009, the share price began its steady uptrend and recovered all those losses by the end of 2013. After reaching its pre-crisis level, the share price continued rising and has nearly doubled since the beginning of 2014. Including the loss recovery period, the share price has advanced four-fold between its 20-year low in March 2009 and its most recent all-time high in late September 2019.

Solid financial results have supported the share price advancement since the beginning of the year. After beating analysts’ earnings expectations in all four quarters of fiscal 2018, Medtronic also exceeded analysts’ earnings estimates for the first quarter of its fiscal-year 2020 that ended on July 26, 2019.

The company reported a 1.5% first-quarter revenue increase to $7.5 billion. First quarter net income of $864 million was equivalent to diluted earnings per share (EPS) of $0.64. The adjusted EPS of $1.28 was 7.7% higher than the $1.17 figure from one year earlier, as well as 6.7% above the $1.18 adjusted EPS that analysts expected.

Dividends

Medtronic has boosted its regular dividend distribution amount every year since paying its first quarterly dividend in July 1977. In addition to its long record of dividend hikes, Medtronic’s dividend also is quite resilient to market and share price fluctuations. During the 2008 financial crisis, most equities suspended or reduced their dividend distributions. However, Medtronic delivered its highest quarterly dividend hike thus far by boosting its payout amount by 50% for the July 2008 distribution.

Since instituting dividend distributions in 1977, Medtronic has delivered 42 consecutive annual dividend hikes. During that period, the annual dividend amount rose more than 330-fold. This is equivalent to an average annual growth rate of 14.8%. Even over the past two decades, Medtronic has enhanced its annual dividend amount more than 14-fold. This still converts to an average growth rate of more than 14.3% per year

The most recent quarterly dividend hike of 8% from $0.50 to the current $0.54 payout is not as high as the 2008 boost. However, the most recent increase rate is in line with the dividend’s 8.3% average annual growth rate over the last five years. This current $0.54 quarterly payout corresponds to a $2.08 annualized payout and a 1.915% yield, which is only 0.3% below the company’s own 1.92% average dividend yield over the past five years.

While in line with its own five-year yield average, Medtronic’s current 1.92% yield is nearly 270% above the traditionally low 0.52% simple average yield of the overall Health Care sector. Currently, Medtronic has the highest dividend yield among its peers in the Medical Appliances & Equipment industry segment. As such, its current 1.92% yield is nearly seven times higher than the 0.24% yield average of the companies in the Medical Appliances & Equipment industry segment, as well as nearly 63% higher than the 1.18% average yield of the segment’s only dividend-paying companies.

Share Price

The share price entered the trailing 12-month period riding a downtrend that began in late September 2018. The overall market correction in late 2018 suppressed the share price of most equities and the Medtronic stock was no exception. Between the onset of the trailing 12-month period and its 52-week low in early January, the Medtronic share price declined by more than 17%.

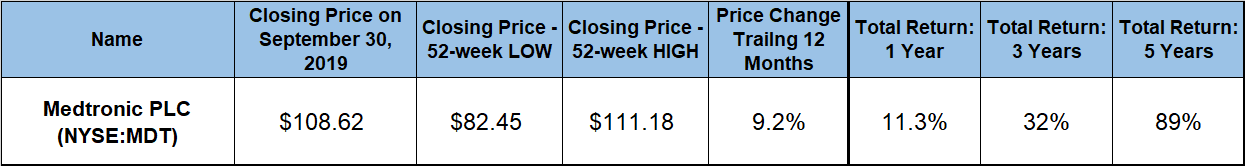

However, as soon as the downward pressure from the overall market correction subsided, the share price reverted to its steady uptrend. The share price needed until early July to recover all its losses from the fourth quarter of 2018. After reaching its previous all-time high of slightly below $99 that it had achieved before the late-2018 decline, the share price broke above the $100 resistance level by mid-July 2019 and continued advancing to set a series of new all-time highs. After hitting 16 new highs in 60 days, the share price reached its most recent high and peaked at $111.18 on September 20, 2019.

Since peaking in late September, the share price pulled back 2.3% to close on September 30, 2019 at $108.62. While slightly lower than the recent peak, the September 30 closing price was 9.2% higher than it was one year earlier and nearly 32% higher than the 52-week low from the beginning of January 2019. Additionally, the share price has gained nearly 70% over the last five years.

The asset appreciation managed to reach only high single digit percentage growth over the last year. However, the dividend income distribution that yields nearly 2% pushed the total return over the trailing 12-month period into double digits. In addition to an 11.3% total return over the trailing year, shareholders have also enjoyed a 32% total return over the last three years. Over the last five years, the long-term shareholders nearly doubled their investment with a total return of nearly 90%

Medtronic PLC (NYSE:MDT)

Founded in 1949 and headquartered in Dublin, Ireland, Medtronic manufactures and sells device-based medical therapies worldwide. The company operates through four distinctive segments — the Cardiac and Vascular Group, the Minimally Invasive Therapies Group, the Restorative Therapies Group and the Diabetes Group. Through these four segments, Medtronic develops, manufactures and distributes pacemakers, defibrillators, cardiac resynchronization therapy devices, diagnostics devices, surgical instruments, sutures, electro-surgery products, bone graft substitutes, drug delivery systems, insulin pumps and consumables. It also provides continuous glucose monitoring systems, web-based therapy management software solutions and many other health care products. The company has more than 370 locations globally in order to support its operations in more than 160 countries.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.