Top 10 favorite value stocks to invest in now offer the appeal of better dividend yields than growth stocks and reduced risk from economic slowdowns.

In times such as now when growth stocks are losing momentum and value stocks are gaining it, investors increasingly start to rotate their money into the most promising, less pricey equities. Value stocks trade at a lower price than expected based on fundamentals, such as dividend yield, earnings or sales, whereas growth stocks produce hefty and sustainable positive cash flows, rising revenues and increased earnings slated to climb faster than average companies in the same industry.

The top 10 favorite value stocks to invest in now stand out in their respective industries but their full potential is not reflected in current share prices, said New York-based money manager Hilary Kramer, who leads the Value Authority advisory service. She chose a diversified array of top 10 favorite value stocks to invest in now for people who may be seeking to buy bargain-priced equities that she forecasts will climb in the months ahead.

Top 10 Favorite Value Stocks to Invest in Now Pay Dividends

“These are the stocks that remain at the top of my income screen, year in and year out,” said Kramer, whose 2-Day Trader service has notched 14 out of 15 profitable trades with an average return of 15.9 percent and an average hold time of less than a day since its launch.

Kramer’s top 10 favorite value stocks to invest in now are consistent, recession-resistant and have made shareholders much money in the long term, she told me.

“When Wall Street has forgotten about them and the yields are as high as they ever get, I tell my Value Authority subscribers that it’s time to lock in the income stream,” Kramer said.

Paul Dykewicz interviews money manager Hilary Kramer.

Dividend Yield Enhances Top 10 Favorite Value Stocks to Buy Now

Dividend yield helps to turn a slow year for capital appreciation into a decent one, Kramer said. In a bad year, yield provides a “floor” to cushion losses and produce cash flow, she added. Just a 1-2 percent increase in yield can prevent 25 percent of all the negative years in the market, she added.

Dividend-paying stocks typically pay yields that average at least 3 percent, beating banks that pay less than 1 percent and the 1.64 percent yield recently offered by 10-year Treasury securities. With inflation hovering near 2 percent, dividend-paying value stocks provide an investment vehicle to more than keep pace with rising prices, before accounting for potential capital appreciation.

Top 10 Favorite Value Stocks to Invest in Now Trump Growth

Value Authority subscribers booked an average exit on closed positions in 2018 of 14 percent, beating the broad market by 10 percent, while also adding 3 percent in dividend yield, Kramer said. Between 1927 and 2015, value stocks outperformed growth stocks by an average of 4.3 percent annually.

A key tip for identifying value opportunities is to seek out stocks that should trade for higher prices but temporarily are below that level, Kramer said. Another screening tool is to find companies with enough cash flow to show the current price of the stock may be too low, she added.

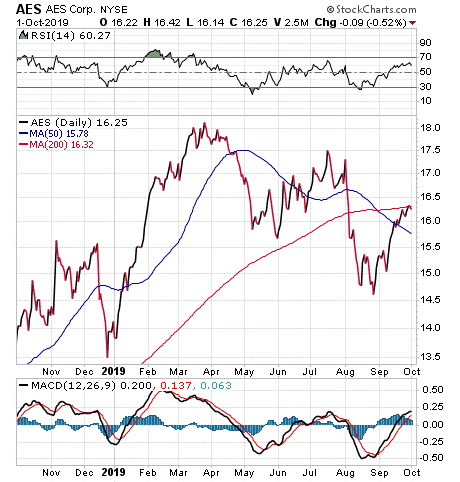

A utilities stock, AES Corp. (NYSE: AES), gained a place on the list of top 10 favorite value stocks to invest in now due to its modest valuation, dividend yield that rises to 3.7 percent on its dips and fast growth that has allowed it to boost its dividend 37 percent since 2015. At that pace, a 4 percent dividend yield today would become 5.4 percent in 2023, Kramer said.

Top 10 Favorite Value Stocks to Invest in Now Includes ‘Go-To’ Utility

“A lot of investors look to the utilities first when they’re building an income portfolio, so AES is my go-to name in that group,” said Kramer, who also leads the GameChangers, Turbo Trader, High Octane Trader and Inner Circle advisory services.

AES is as defensive as any other utility stock and it hasn’t risen much as investors seek safe havens, Kramer said. The stock still pays 3.3 percent, well above what’s now an unappealing 2.9 percent for its sector, she added.

Chart courtesy of www.stockinvestor.com

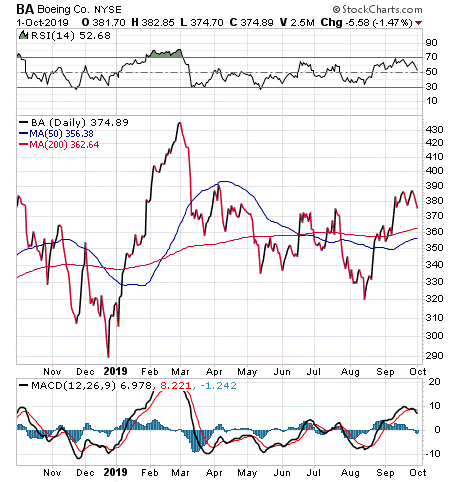

Boeing Climbs into Top 10 Favorite Value Stocks to Invest in Now

Despite the Federal Aviation Administration grounding the 737 MAX of Boeing Inc. (NYSE:BA) since March 13 after two fatal crashes, the aerospace and defense giant received a spot on the list of top 10 favorite stocks to invest in now. Part of the reason is that its net income should expand about 10-20 percent a year, Kramer said.

Boeing regularly boosts its dividend and most recently lifted it by 20 percent, Kramer said. During the past 20 years, Boeing’s dividend has soared 1,300 percent, she added.

“Boeing is almost unique because its management truly thinks 30 years ahead,” Kramer said. “The current questions around the 737 MAX will be resolved in a fraction of that time, probably in a matter of months. The dividend has been safe for decades and will only swell in the foreseeable future. That dividend growth is what you’re buying here. Based on management’s track record, they’ll be paying $3 per quarter 20 years from now, or a healthy 5.2 percent for everyone who buys in at $380.”

Chart courtesy of www.stockinvestor.com

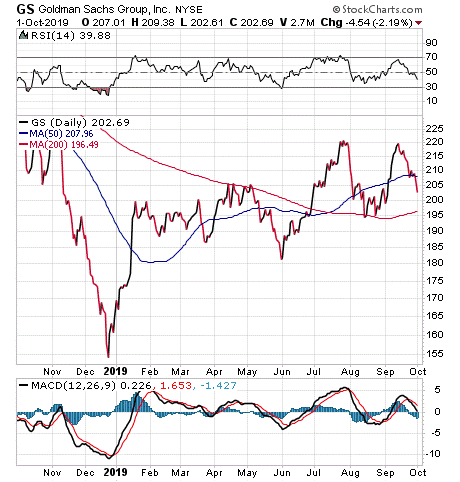

Another industry leader that attained a spot on the list of top 10 favorite value stocks to invest in now is Goldman Sachs (NYSE:GS). The investment bank is embroiled in a scandal involving a Malaysian sovereign fund that led to criminal charges against 17 current and former Goldman executives in August 2019.

The scandal could require the payment of up to $7.5 billion in reparations from Goldman Sachs for its activities involving 1MDB. The stock understandably has fallen and left investors wondering how low it may go.

However, Goldman Sachs should survive the fallout and rise again, Kramer said. Its current “insane” valuation of just 8 times earnings gives investors incentive to buy now and stay patient for a recovery.

A sweetener is that Goldman Sachs has hiked its dividend 55 percent in the past five years. The current dividend yield of 2.3 percent would jump to 3.6 percent by 2024 at that rate of growth, Kramer said.

Chart courtesy of www.stockinvestor.com

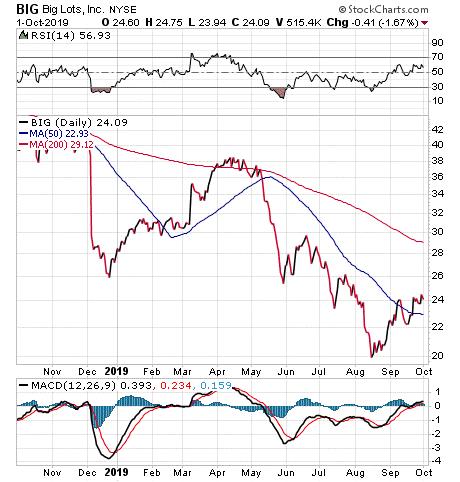

Retailer Ranks Among Top 10 Favorite Value Stocks to Invest in Now

Retailers usually fall out of favor with investors when the economy slows and sales become soft, but Kramer found one to love that still trades at barely nine times earnings. Big Lots (NYSE:BIG) has become bargain-priced in recent months and currently offers a divided yield of around 5 percent.

“Big Lots is a rare concept that works in the modern retail landscape,” Kramer said. “The secret is that these stores can be dropped into vacant big box spaces that mall operators can’t rent to anyone else anymore, so lease terms are extremely favorable.”

Plus, the valuation of Big Lots is “truly” tempting, since so many investors have written off everything in retail for dead, Kramer said. The stock dipped enough in August to lift its dividend yield to 6 percent when the share price traded for barely 6 times earnings, she added.

“Lock it in,” Kramer said.

Chart courtesy of www.stockinvestor.com

Top 10 Favorite Value Stocks to Invest in Now Include ‘Big Pharma’

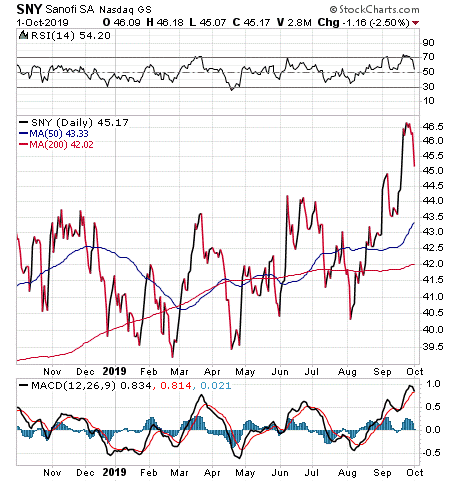

Two giant pharmaceutical stocks, Sanofi (NYSE:SNY) and GlaxoSmithKline (NYSE:GSK), also earned spots among the top 10 favorite value stocks to invest in now. Both are based in Europe and offer compelling reasons to like them, Kramer said.

“Big Pharma is often a game of waiting years for the right entry on a stock you’ve always loved,” Kramer said. “Sanofi and GSK are two of those stocks for me. I love the franchise driving both of these companies.”

Specifically, vaccines and diabetes are dynamic in terms of the amount of innovation that’s being done, but as drug franchises they’re extremely well positioned to fend off competition, Kramer said. Once a company gets the upper hand in either category, it is “set for decades, if not forever,” she told me.

Chart courtesy of www.stockinvestor.com

“If I were buying one today, it would be Sanofi,” Kramer said.

Sanofi features a higher yield now and offers further growth ahead, Kramer said. In contrast, GSK already has come a long way, she added.

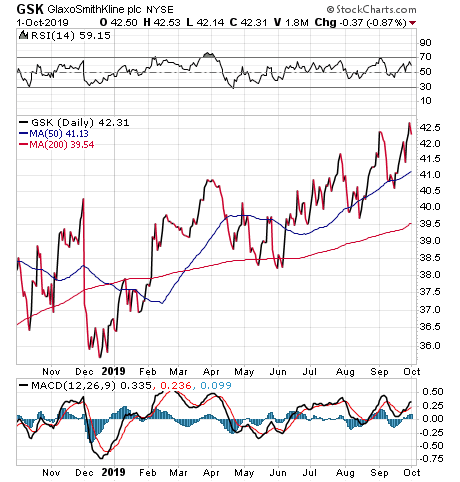

To buy GSK, Kramer would want to see a “big dip” in its share price.

Chart courtesy of www.stockinvestor.com

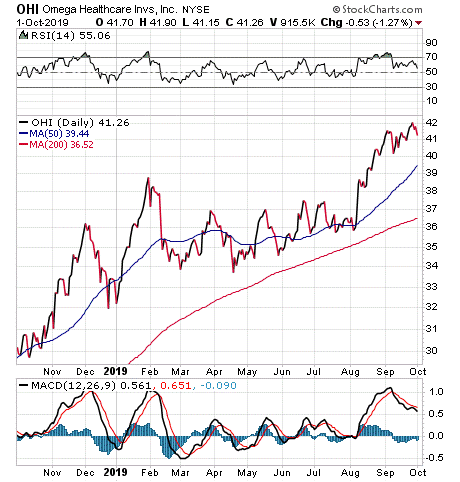

REIT Joins Top 10 Favorite Value Stocks to Invest in Now

A real estate investment trust (REIT), Omega Healthcare Investors Inc. (NYSE:OHI), of Hunt Valley, Maryland, offers an enticing dividend yield above 6 percent. As appealing as that yield may seem, it topped 10 percent early in 2018.

“People often think of the REITs when building an income portfolio, so OHI is my top long-term prospect there,” Kramer said. “While there’s $4.7 billion in debt on the balance sheet, it’s anchored by $8.3 billion in property.”

If the REIT’s management team felt a need, it would divert $800 million in annual earnings before interest, taxes, depreciation and amortization (EBITDA) to pay down its debt faster, Kramer said. Instead, the company is refinancing its debt at 3.6 percent and planning to use the cash for expansion.

REITs feature businesses that pay their shareholders at least 90 percent of taxable income, own properties that produce reliable rent payments and offer enhanced appeal because they have limited correlation to the stock market. Omega Healthcare is Kramer’s top choice in that sector.

For investors looking for opportunities in a yield-challenged market, REITs offer a “Holy Grail,” said Jim Woods, who heads Successful Investing, Intelligence Report and Bullseye Stock Trader.

Chart courtesy of www.stockinvestor.com

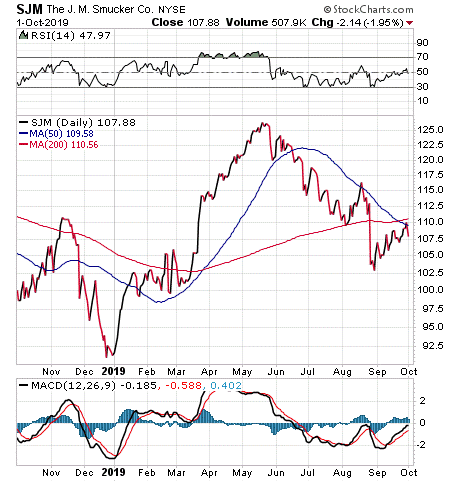

Top 10 Favorite Value Stocks to Invest in Now Feature Food Stocks

Two of the stocks on Kramer’s list of top 10 favorite value stocks to invest in now are J.M. Smucker (NYSE:SJM) and General Mills Inc. (NYSE:GIS). Smucker’s may be best known for its jams, jellies and preserves but it also has the Pillsbury brand of products, as well as peanut butter and coffee.

Smucker’s is not a sizzling growth business, but it is perking along well enough to keep its dividends increasing a little ahead of inflation. The stock’s dividend yield tops 3 percent.

“Buy the dips,” Kramer said.

Chart courtesy of www.stockinvestor.com

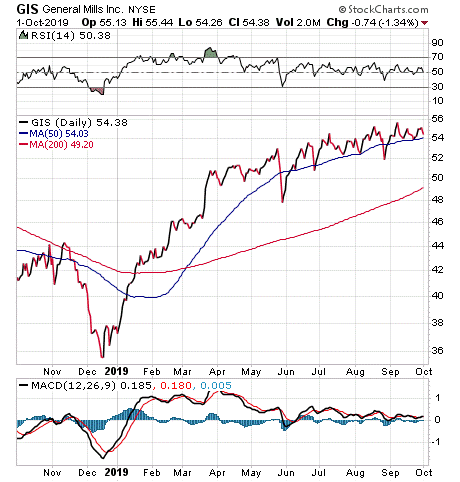

General Mills is not a fast-growing company, but it consistently boosts its profit about 2-4 percent a year, Kramer said. That growth allows the dividend to keep pace with inflation.

Even with its current dividend yield of 3.6 percent, General Mills pays a dividend that is twice as much as the yield of Treasury bonds, Kramer said.

Chart courtesy of www.stockinvestor.com

Domtar Ranks Among 10 Favorite Value Stocks to Invest in Now

The aging population has created a growing need for adult diapers that traditional paper company Domtar has turned into an important business. The stock’s price has fallen to the point its dividend yield now is 5.4 percent.

“I don’t say it often, but Domtar’s secret weapon is adult diapers,” Kramer said. “As the population ages, this is where the personal care business is headed.”

“After all, the U.S. population isn’t getting any younger, so senior housing will remain a hot spot for decades to come,” Kramer said.

With negative interest rates in Europe, soaring government debt, trade wars, economic weakening, global conflicts and U.S. House action to impeach President Trump, uncertainty abounds. For investors seeking a place to collect dividends and not overpay for the privilege, the top 10 favorite value stocks to invest in now offer an inviting opportunity.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.

![[happy investor up arrows]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_124509472.jpg)