- Issuing an Elizabeth Warren Stock Market Warning

- Philosophy, the Power of Fiction, and How to be An Ideal Man

- Ellen’s Beautiful Wisdom

***********************************************************

Issuing an Elizabeth Warren Stock Market Warning

Can you guess who just took the lead in the Democratic Party presidential nomination race?

If you guessed Massachusetts Senator Elizabeth Warren, then give yourself a gold star. According to the latest RealClearPolitics poll average, Warren is at 26.6%, just slightly ahead of former Vice President Joe Biden at 26.4%. Well behind both front runners is Vermont Senator Bernie Sanders, who just suffered a heart attack, at just 14.6%.

Perhaps more importantly, the momentum of late is clearly with Warren. Just 30 days ago, she was polling at 18%, while Biden was the runaway leader at 29.7% in the RealClearPolitics poll average.

The rise of Warren and the decline of Biden have many of my friends and colleagues asking me what an Elizabeth Warren presidency would mean for the stock market.

It is an interesting question, especially considering that Warren leads President Trump in every major head-to-head general election poll.

Unfortunately for America, the answer to the question of what a Warren presidency would mean for the markets is, in my opinion, nothing good.

Yes, I know I am biased here, because I am biased toward free markets, laissez-faire capitalism, less government intrusion in the economy, lower taxes and a near-complete separation between the economy and the state. Just based on philosophic grounds, I think a Warren presidency would be a disaster.

Given my philosophic orientation, I wanted to reach out to a colleague who I knew would be a bit more non-partisan on the issue, and someone who analyzes the economy and the markets for a living with a strict reading of the facts. That someone is my friend, colleague and Intelligence Report contributor Tom Essaye of Sevens Report Research.

Tom is not only one of the best macro analysts out there, he’s also a guy who (unlike me) is able to separate his political biases from his just-the-facts reading of conditions on the ground. So, I asked Tom for his insights on what a Warren presidency would mean for the economy and markets, and he wrote me a brilliant analysis that I had to share with The Deep Woods readers.

Here is what Tom told me:

I (Tom) went on to Politico.com and I reviewed Warren’s platform (here’s the link I visited).

To be crystal clear, I am only addressing the potential market implications of these policies. Many of these policies are designed specifically to reduce corporate profits and earnings and instead use those funds to benefit 1) Workers, 2) The environment, 3) Those with lower incomes and 4) Women and minorities.

It obviously is up to each of us to vote our own preference, but it is important to understand that Warren’s policy goal is to reduce the retained earnings of businesses across multiple sectors and to benefit other parties as mentioned above. As such, it is a very reasonable statement that if Warren were elected, and these policies were enacted, it would be negative for the stock market in the extreme because share prices are an expectation of future earnings.

If expected earnings go down, stock prices go down. These policies would hurt corporate earnings universally, although they likely would improve quality of life for many demographics at the expense of corporate profits. Whether that trade-off is positive, or negative, I’ll leave you to decide. I’m just focused on facts, and here are the facts on the 10 Warren proposals that I think will have the biggest impact on the stock market.

Ban Fracking. Warren wants to ban fracking for oil and gas based on environmental concerns. Negative for energy companies, positive for the price of oil/gasoline (supply would be reduced).

Eliminate Private Prisons. Warren wants to end federal contracts for private prisons and withhold funding to make state and local governments do the same. Materially negative for private prison stocks The GEO Group (GEO) and CoreCivic, Inc. (CXW).

Reinstate Glass-Steagall. Warren wants to reinstate the law that separated commercial banking and investment banking. Negative for the major investment banks such as JPMorgan Chase (JPM), Morgan Stanley (MS) and Goldman Sachs (GS), as they would likely have to spin off retail banking operations.

Increased taxes on the wealthy. Warren is advocating an “Ultra-Millionaire” Tax on the 75,000 richest families in the U.S. along with other tax increases aimed at high earners. This would reduce disposable income. Negative for consumer discretionary stocks, retail sectors and luxury stocks makers such as Tiffany & Co. (TIF).

Doubling National Minimum Wage to $15 from $7.25. Negative for the entire stock market and small business margins. This would significantly compress corporate margins across industries and would result in a reduction in expected earnings for the S&P 500, resulting in a broad decline in the markets. Additionally, it would also compress margins for small business. Those negative effects would be somewhat partially offset by more disposable income for minimum-wage earners.

Paid Maternity/Family Leave for 12 Weeks. Warren supports the FAMILY Act, which would create national paid family and medical leave for up to 12 weeks. Negative for small businesses. For large corporations, this likely won’t be that big of an impact. For small businesses, it would be a major blow to productivity, and I find it hard to believe this wouldn’t have a material impact on small business profits.

Break Up Agribusiness. Most of the country’s (and world’s) meat and agricultural production is concentrated in a few major companies. Warren wants to break up these vertically integrated agriculture and food companies. Negative for agricultural sector companies such as Tyson (TSN), Archer Daniels Midland (ADM), Bunge (BG) and other ag stocks as well as pesticide producers Bayer (BAYRY) and DuPont (DD).

Medicare for All. Warren is a staunch supporter of Medicare for all. Negative for health care stocks, health insurers, biotech and Big Pharma (Warren also wants to address high drug prices via various strategies, including allowing the U.S. government to produce generic drugs).

Reduce Defense Spending. Negative for defense stocks such as Lockheed Martin (LMT) and Boeing (BA).

Breakup Big Tech. Warren is in favor of heavily regulating or breaking up large tech. Negative for companies such as Facebook (FB), Amazon.com (AMZN), Google (GOOGL) and Apple (APPL). This policy would be especially negative for the markets broadly as those super-cap tech names are heavily weighted in many indices and ETFs, as well as client portfolios.

The bottom line is that from a market standpoint, all of these policies would be negative for stocks, with some being downright negative for the broad markets (by reducing corporate earnings broadly) while others would be material negatives for certain sectors (large-cap tech, prison stocks, defense stocks, etc.).

Not only would policies like these reduce the “E” in P/E ratios, but they’d also reduce the market multiple, as there is no way investors would pay anywhere close to a 16X multiple with this type of regulatory environment (for reference, stocks have been trading between 16X and 17X for most of President Trump’s term). — T.E.

So, there you have it — a fact-based analysis of the top Warren ideas and how they would likely affect the stock market from a top macro analyst.

And now you can better understand why I say that the answer to the question of what a Warren presidency would mean for the markets is “nothing good.”

**************************************************************

Philosophy, the Power of Fiction, and How to be An Ideal Man

If you’ve been reading The Deep Woods for a while, you probably know that one of my favorite novelists and philosophers is Ayn Rand. I highly recommend her challenging novels “The Fountainhead” and “Atlas Shrugged,” along with her non-fiction, to anyone within an earshot of my voice or within spying distance of my writing.

I first read “Atlas Shrugged” in 1984, and it changed the entire focus of my life. Yet it took me many years to fully appreciate the depth of the work and the importance of Rand’s ideas.

So, how does a man go from reading “Atlas Shrugged” just nine years ago to becoming the president and CEO of the Ayn Rand Institute?

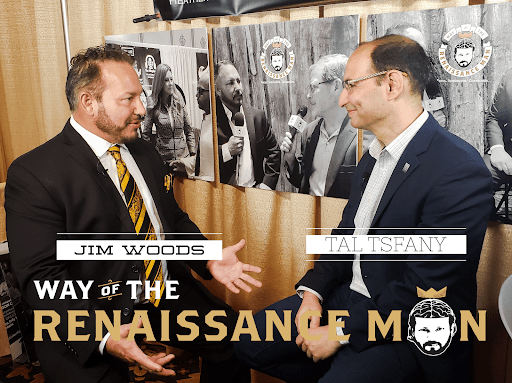

This fascinating story is the subject of the new episode of the Way of the Renaissance Man podcast, as I speak with Tal Tsfany: entrepreneur, leader, thinker and all-around Renaissance Man.

In this episode, you’ll learn how Tal was introduced to Ayn Rand, how her ideas quickly took over his thinking and how he used the inspiration and courage he drew from Rand’s work to leave a comfortable corporate job and create a Silicon Valley tech startup.

(Photo Credit: Unlock Your Wealth TV)

You’ll also learn about Tal’s simple, yet eminently beautiful, four-step system for achieving real happiness in life, which all begins with having a proper definition of what happiness truly is.

Plus, Tal shares his thoughts on how to remember the best days of your life, which ironically often come at one’s lowest point. You’ll also find out how to become really good at introspection, how to be a better valuer of life and how to integrate your values with actions.

I really loved this discussion with Tal, and as you’ll discover, our mutual love of ideas; the pursuit of happiness, music and even auto racing all contribute to the Renaissance Man chemistry of this discussion.

To listen to this episode of the podcast, simply click here right now.

For more about the Ayn Rand Institute, please visit AynRand.org.

*********************************************************************

Ellen’s Beautiful Wisdom

“Just because I don’t agree with someone on everything, doesn’t mean I’m not gonna be friends with them… When I say be kind to one another, I don’t mean only the people who think the same way that you do, I mean be kind to everyone.”

— Ellen DeGeneres

That is what comedienne and talk show host Ellen DeGeneres said this week in response to her detractors who were mad that she was sitting next to and joking around with former President George W. Bush at Sunday’s NFL game between the Dallas Cowboys and the Green Bay Packers.

The openly gay DeGeneres was castigated on social media by many on the left for sitting next to a former president they saw as diametrically opposed to her political beliefs. Yet DeGeneres wasn’t having that narrow-minded criticism. Instead, she struck back with a message that we all need to embrace, one that says just because someone disagrees with you on significant issues doesn’t mean you can’t enjoy their friendship.

In today’s world of extremely polarizing and toxic discourse, it’s nice to know that one celebrity is standing up against reactionary critiques with an inclusive lesson we should all embrace. So, Ellen, thank you for your beautiful wisdom.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods