“I have always believed in giving investors choices, and with those choices the freedom and power to make their own decisions.” — Charles Schwab, “Invested: Changing Forever the Way Americans Invest”

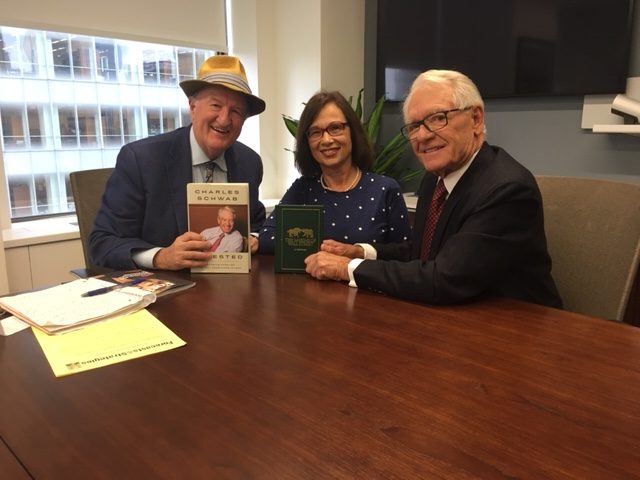

My wife Jo Ann and I had the pleasure this week of sitting down with one of the great innovators on Wall Street — Charles Schwab, the founder of the famous discount brokerage firm.

He no longer calls his brokerage firm a “discounter” — it’s a financial services company that not only offers “commission free” trades in stocks, mutual funds and exchange-traded funds (ETFs), but individual retirement accounts (IRAs), financial planning, credit cards and banking services.

Mr. Schwab has a new book out that tells his incredible story, “Invested: Changing Forever the Way Americans Invest.” I read the book cover to cover and highly recommend it. Click here to buy it on Amazon.

In his book, he describes how he focused on growth stocks and the new technologies in the financial services business. In the short run, stocks could tumble by 30% or more, but in the long run, they were huge winners.

His own stock, Charles Schwab Corporation (NASDAQ: SCHW), has fallen 50% or more during various crises (1987, 2001 and 2008), but since inception has gone up 21,000%!

We both have a lot in common — we began our careers during the financial revolution of the 1970s as editors of a financial newsletter when the stock and bond markets were in a decade-long bear market. It was the age of alternative investing in “gold, silver and Swiss francs,” collectibles, real estate and money market funds… the energy crisis and fear of runaway inflation.

Then Schwab went into the discount brokerage business, and I stayed in the newsletter and teaching world. Today, I’m worth several million. Meanwhile, Schwab is worth several billion! However, I have my freedom; there are always trade-offs in life. (Here’s my largest personal IRA holding, if you’re curious)

Revolution #1: Discount Broker Commissions

The ‘70s also were the time of a financial revolution for the common man. Americans could earn interest on their checking accounts. The Reserve Fund, the first money market fund, was created in 1971.

The year 1975 was special. Americans finally could own gold again. And on May Day, 1975, the Securities and Exchange Commission (SEC) deregulated brokerage commissions. Before that, commissions were fixed, and investors often paid 3% to buy stocks and 8% or more to buy mutual funds.

Merrill Lynch raised its commissions on May Day, and Charles Schwab, the discount brokerage firm, was in business. He eventually grew it into the largest independent brokerage in the world.

He would see the day when his fledging discount brokerage firm out of San Francisco would surpass the power and prestige of Merrill Lynch, the original firm that brought Wall Street to Main Street.

“The stone the builders rejected has become the cornerstone,” as the Bible says.

In fact, the only reason Merrill Lynch is around today is because Bank of America bailed it out during the financial crisis of 2008.

Revolution #2: Give Investors Independence

Charles Schwab also did something different in the brokerage business — he let investors decide for themselves what to buy and sell. “I have always believed in giving choices, and with those choices the freedom and power to make their own decisions.”

Even today, Merrill doesn’t get it, Schwab said.

“They never modernized,” Schwab told me. “They never let go of the old, broken model — selling stocks to make commissions. They never worked to reduce their costs. They never considered modern portfolio theory (recommending buying index funds). They didn’t let customers choose for themselves.”

‘What Will Cause the Next Crisis?’

I asked Mr. Schwab (I can’t get used to calling him “Chuck”) if a bear market is around the corner, given that we’ve enjoyed a 10-year bull market. In his book, he confesses, “If I had learned anything after years in the business, it was how little I could ever know about what the markets would do tomorrow.”

But he did give me a hint to the question, “When will we suffer the next crisis?” He said, “We’re fat and happy right now in the brokerage business. There’s so much money out there, that’s why interest rates are so low. Only a liquidity crisis and higher interest rates can cause stocks to collapse again. I don’t see it right now.”

Democratic Capitalism: Much Better than Socialism

Charles Schwab is one of the greatest examples of democratic capitalism. He’s an entrepreneur at heart. His employees get stock options and participate in the profits — and losses — of the company. His customers get the best service at the lowest cost. He has brought Wall Street to Main Street and improved the lives of millions of people.

I asked him, “Are you worried about the popularity of democratic socialism in politics and academia?” His response was emphatic: “Voters and students don’t understand capitalism in raising our standard of living. It’s a sad state. Socialism was a disaster. In the 1980s, I visited Moscow, Poland and the Iron Curtain countries, and life was worse for everyone.”

He is hopeful that if someone like Senator Elizabeth Warren gets elected, she will moderate her anti-capitalist stance.

He talked about “great economists like you at Chapman and Michael Boskin at Stanford” who are teaching the benefits of financial capitalism on college campuses.

‘What’s the Most Important Lesson in Life?’

At the end of the interview, I asked Mr. Schwab, “You’ve lived a long life, what’s the most important lesson you have learned?”

He didn’t hesitate. “Never give up on your own education. Watch less television and READ more! Be responsible for yourself.”

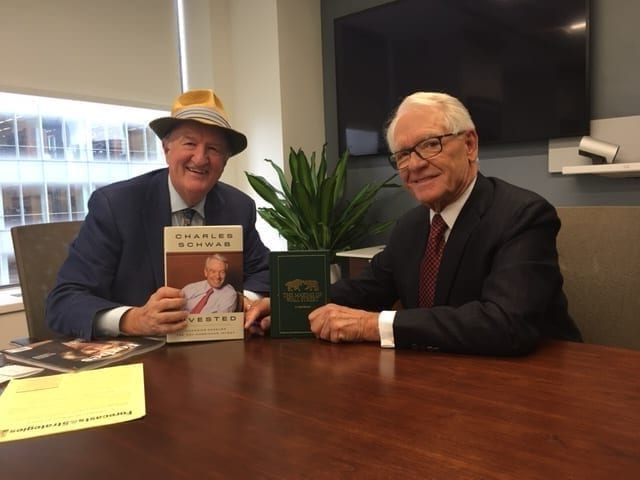

We exchanged copies of our books — he signed a copy of “Invested,” and I gave him a 6th edition of “Maxims of Wall Street.” (See photo.)

His eyes lit up. “Great idea. I’ll learn some new sayings!”

I’ve quoted a few sayings from Charles Schwab above. Here are some more:

“Luck is almost never only luck, especially in anything having to do with the stock market or in building a business.”

“There is a central truth about investing: time is on your side when there’s plenty of it; it can be your worst enemy when it’s scarce.”

Get Your Autographed Copy of ‘Maxims’ at a Discount!

If there’s one thing I have learned from Charles Schwab, it’s to give my customers a discount. My bestselling book, “The Maxims of Wall Street,” retails for $24.95, even on Amazon. But you can get an autographed copy for only $20 — and all additional copies are only $10 each. If you order an entire box of 32 books, you pay only $300. Plus, I pay postage and autograph each copy that is mailed within the United States.

As we approach the holidays, “Maxims” is the perfect gift for friends, investors, clients, students, money managers and stockbrokers.

It’s fun and educational to read on every page. The book is divided by topics, such as growth vs. income, contrary investing, bargain hunting, the pros and cons of gold, etc. Plus, it includes lots of stories about J. P. Morgan, Joe Kennedy, Bernard Baruch and Jesse Livermore.

Maxims is the one and only compendium of financial adages, ancient proverbs and worldly wisdom — it has sold over 28,000 copies. Alex Green calls it a “classic.” It has been endorsed by Warren Buffett, Jack Bogle and Dennis Gartman, who said, “It’s amazing the depth of wisdom one can find in just one or two lines from your book.”

To order, call Harold at Ensign Publishing at 1-866-254-2057, or go to www.skousenbooks.com.

Upcoming Conferences

Gold is back! Join Me for the New Orleans Investment Conference, Nov. 1-4, 2019, Hilton Riverside Hotel. With gold and silver moving up sharply, I urge you to attend the New Orleans Investment Conference, the annual gathering of gold bugs. I will be there, as I have spoken at every New Orleans conference since 1976! Speakers include Dennis Gartman, Kevin Williamson, Steve Moore, Rick Rule, Mary Anne and Pamela Aden, Doug Casey, Adrian Day and Peter Schiff. This is the granddaddy of gold bug conferences. All details can be found at http://neworleansconference.com/noic-promo/skousen/.

One Day Miami Investment and Latin American Conference, Nov. 8: Speakers include Rodolfo Milani, Louis Navellier, Art Hogan and myself, as well as a cohort of Latin American heroes: the blood poet of Cuba, Armando Valladares; Cuban freedom activist Rosa Maria Paya; former defense minister for Bolivia Carlos Sanchez Berzain; and exiled Cuban author Carlos Montaner. Price for this one-day event is $89 per person/$149 per couple. To register, contact Nathan at 1-855-850-3733, ext. 202. Attendance is strictly limited to 85 people. Don’t delay!