Despite an overall share price decline over the past five years, the CVS Health Corporation’s (NYSE:CVS) share price has exhibited a steady upward trend over the past six months and might offer a potential for continued upward movement.

Unfortunately for long-term shareholders, CVS’s share price decline has lasted for a while. Just over the past five years, the stock has shed 23% of its value. While the generally increasing annual dividend distributions have offset some of the decline, the shares still have still delivered a total loss of approximately 6% over that time frame.

While long-term shareholders who have retained their CVS stock position might have to wait a little while longer to return to profitable levels, new investors might have an opportunity to jump on the current uptrend and at least take advantage of short-term asset appreciation. Furthermore, in addition to capital gains, shareholders can collect hefty dividend distributions that deliver above-average dividend yields.

A declining share price in the first half of the trailing one-year period pushed the 50-day moving average below the 200-day average in late January 2019. The 50-day average declined further and dropped to nearly 20% below its 200-day counterpart in early June 2019. However, as the share price reversed direction and headed higher in early April, the 50-day moving average followed suit two months later.

Since embarking on its current uptrend, the 50-day moving average has crossed back above the 200-day average in a bullish manner in mid-September and has continued to advance above its 200-day equivalent to its current level of 6.4%. Additionally, since early August, the share price has dipped below the 50-day average at the end of only one trading session. These technical indicators suggest the share price might have more fuel to continue its current uptrend, at least in the short term.

In addition to the positive indications from the moving averages, nearly two-thirds (15) out of the 24 analysts that are covering the stock have a “Buy” (10) or “Strong Buy” (5) recommendation, with the remaining nine analysts still standing at “Hold.” The current share price level is at least 7% below the analysts’ $70.79 target price. Furthermore, last week, analyst Lisa Gill wrote that J.P. Morgan considers CVS as “one of the best positioned companies across our coverage universe over the longer term” and placed a target price of $88 to go with their “Overweight” rating.

Dividends

The CVS Health Corporation has been rewarding its shareholders with dividend distributions for more than a century. While skipping a few annual dividend hikes over the past couple of decades, CVS also managed to avoid any dividend cuts despite the company’s extensive expansion and several recent major acquisitions.

Over the past two decades, CVS has failed to boost its annual dividend payout only five times. From 2001 through 2003, the company paid the same $0.115 annual dividend amount that it distributed in 2000. Additionally, after enhancing its annual dividend payout 15-fold over a 14-year period, CVS has paid the same $2.00 annual distribution amount since 2017.

However, even with flat annual dividend distributions over the last three years, CVS Healthcare Corporation’s annual dividend average growth rate is substantial. The 14-fold annual dividend payout amount enhancement since 2003 corresponds to an average growth rate of 18.5% per year over the last 16 years.

The company’s current $0.50 quarterly dividend distribution corresponds to an annual distribution of $2.00 and currently yields 3%. The dividend yield is a simple ratio of the total annual distributions of regular dividends and the stock’s share price. Therefore, the recent share price pullback has pushed the current dividend yield 32% above the company’s own 2.3% average yield over the last five years.

In addition to outperforming its own five-year yield average, the CVS Health Corporation’s current yield has also outperformed the 2.02% average yield of the overall Services sector by nearly 50%. A comparison to the 0.48% simple average yield of the companies in the Health Care sector is even more skewed, as the CVS Health Corporation’s current yield is more than six times greater. Furthermore, CVS Health Corporation’s current yield is twice the 1.47% yield average of the company’s peers in the Drug Stores industry segment.

Share Price

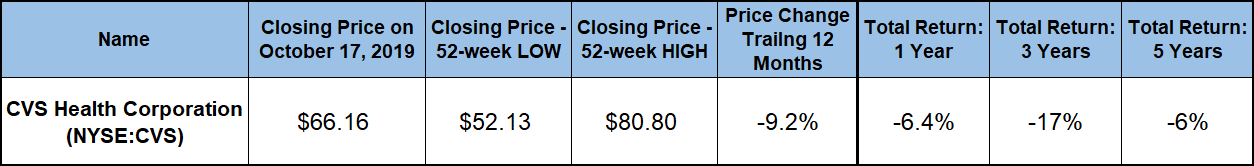

Despite brief uptrend bursts, the company’s share price has been trending down for the past several years. The first half of the trailing 12-month period was no different. The share price surged from nearly $73 at the beginning of the trailing 12 months to its 52-week high of $80.80 on November 13, 2019.

Nevertheless, bowing to the downward pressure of an overall market correction in late 2018, the share price continued its long-term downward trajectory and deteriorated more than 35% to its 52-week low of $52.13 by the beginning of April 2019. However, since reversing direction in early April, the share price has risen by nearly 27% to close on October 18, 2019 at $66.16. Despite the gains since the 52-week low, the Oct. 18 closing price was still 9% below its level from the beginning of the trailing 12-month period. While unable to offset the entire share price deficit over the last year, the dividend distributions managed to cut the shares’ total losses to just 6.4% over the last 12 months. A 7.1% share price gain – enough to reach analysts’ current average target price — would deliver a break-even point to shareholders. Any additional gains towards J.P Morgan’s $88 target price level would offer positive total gains.

CVS Health Corporation (NYSE:CVS)

Founded in 1892 and headquartered in Woonsocket, Rhode Island, the CVS Health Corporation provides integrated pharmacy health care services. The company operates through Pharmacy Services and Retail/LTC business segments. The Pharmacy Services segment offers pharmacy benefit management solutions, formulary management, Medicare Part D services, mail order, prescription management systems and other medical pharmacy management services under the Caremark, Accordant, SilverScript, NovoLogix, Coram, Navarro Health Services and several CVS brand names. The company currently operates approximately 10,000 stores in 49 U.S. states, the District of Columbia, Puerto Rico and Brazil. Additionally, the company operates online retail pharmacy websites, 38 on-site pharmacy stores, long-term care pharmacy operations and retail health care clinics. The company changed its name from the CVS Caremark Corporation to the CVS Health Corporation in September 2014.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.