Potential acquisition targets to invest in now highlight three stocks with unique innovations and technologies that could enhance the capabilities of bigger companies.

Corporate combinations that make sense for both sides often occur sooner than later. The directors of companies have a fiduciary duty to maximize shareholder value, although the timing of potential acquisitions cannot be predicted due to many uncontrolled variables.

Low interest rates, the presence of prospective buyers that are flush with cash and the acquirers’ desire for increased growth combine to spur businesses to pursue mergers and acquisitions. Plus, established companies often prefer to expand more quickly and effectively by buying other businesses than trying to grow organically.

Potential acquisition targets to invest in now, such as those identified below, typically find a niche to form a successful business but still benefit from the financial strength, management expertise and complementary activities of a buyer. Acquisitions can improve the target company’s performance and help develop its business, trim excess industry capacity, create market access for products and gain skills or technologies faster or at lower cost than if developed in-house, according to the McKinsey & Co. business consulting firm.

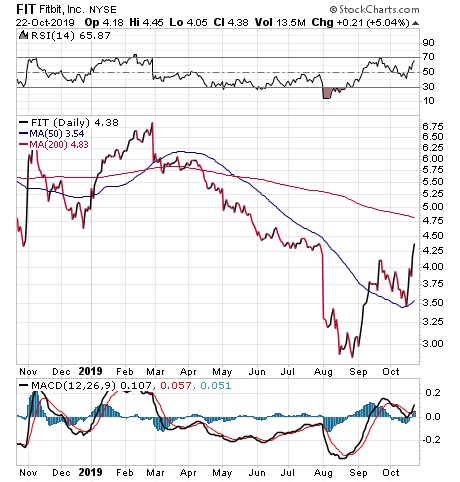

Fitbit Is a Potential Acquisition Target to Invest in Now

Fitbit, Inc. (NYSE:FIT) is seeking strategic alternatives to its current independent structure to support and expand its efforts to help people achieve their health and fitness goals by tracking activity, exercise, sleep, weight and even monitor atrial fibrillation (AFib), a medical term for irregular heartbeat. The latter application involves a new partnership formed between Fitbit and Bristol-Myers Squibb Pfizer to develop educational content and software to support people with AFib.

Since the AFib product appears to be in its early stages, it should not have a material near-term effect on the financial performance of Fitbit, said Tom Forte, a senior research analyst at D.A. Davidson & Co. investment firm.

“We see this partnership as continued evidence that the company is differentiating itself from other smartwatch players with a continued push into changing the way health care providers and patient-physician interactions occur in the future,” Forte wrote in an Oct. 17 research note. “Upon submission and clearance from the FDA on its AFib software for Fitbit devices, users would be able to provide information to relevant parties to discover early detection for AFib, which is also a risk factor for stroke.”

Partnership Aids Potential Acquisition Target to Invest in Now

The partnership exemplifies FitBit’s thrust into the health care ecosystem, which is a “huge differentiator” in the consumer technology sector where investors often view products as replaceable commodities, Forte opined. The push into health care services and software is aimed at creating a highly recurring revenue stream with enhanced profit margins that would reduce Fitbit’s current dependency on device sales, he added.

A “buy” rating and $5.75 price target on FitBit is based on a discounted cash flow analysis, including long-term adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin forecast of 15.0% versus negative 2.1% in 2018, according to a Sept. 23 research report by Forte. Reuters previously reported that Fitbit is in talks with an investment bank about strategic alternatives that could include the company’s sale.

Fitbit’s smartwatch sales contracted by nearly 27.0% year-over-year in second-quarter 2019, primarily due to an underperforming sales device, Forte said. However, overall device sales grew 30.4% to show the overall FitBit business is much healthier than reflected in its current share price, which may offer value that could attract a potential acquirer, he added.

Fitbit also has a “very healthy balance sheet,” Forte noted. As of second-quarter 2019, FitBit had $2.21 in cash per share, which equals more than half of the company’s market capitalization, Forte added.

Chart courtesy of www.StockInvestor.com

Fitbit Adds Intrigue with Health Applications

Fitbit is where Twitter (NYSE:TWTR) was three years ago: on the defensive and reviewing strategic options, said Hilary Kramer, whose 2-Day Trader service has notched 16 out of 19 profitable trades with an average return of 11.78 percent and a hold time of less than a day since its launch. It takes “outside-the-box” thinking to identify possible acquirers for Twitter, but Apple (NASDAQ:AAPL) has taken away some of the smartwatch market and could lead Amazon (NASDAQ:AMZN) to pay $1 billion purely to keep an Alexa-enabled device on 25 million wrists around the world, she added.

“From there, the Amazon ecosystem travels with people Apple isn’t reaching,” Kramer said. “Hand out discounted Fitbit to 100 million Prime subscribers and the gambit pays for itself very fast.”

In addition, Amazon CEO Jeff Bezos wants to get into medical applications and Fitbit would offer a way to do so, Kramer continued. It also could make sense for a “leading insurance company” to buy Fitbit and offer its smartwatches as a health care cost-reduction perquisite, she added.

“You’d have to be big and visionary, but it would ultimately generate a lot of value,” said Kramer, who leads the GameChangers advisory service, which has booked 21 profitable trades among its last 25 transactions. “Otherwise, there isn’t a lot here to interest a purely financially oriented buyer like someone in private equity. I don’t see FIT ever making money on its own. Someone will need to do a lot of work and fold in a lot of resources to make an acquisition pay off.”

Columnist Paul Dykewicz interviews New-York-based money manager Hilary Kramer.

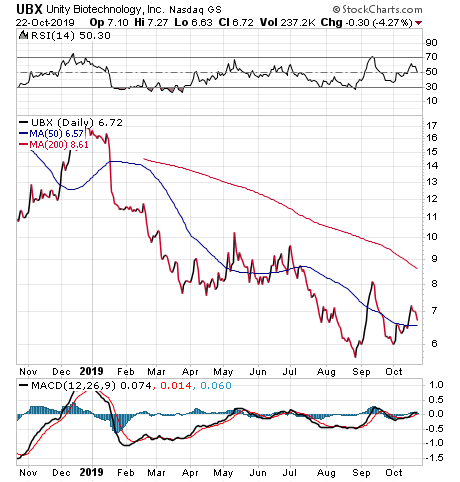

Kramer Eyes Unity Biotechnology as a Potential Takeover Target

Unity Biotechnology, Inc. (NASDAQ:UBX) hit a 52-week low of $5.61 on Aug. 28 before starting to recover from a precipitous fall in which it plunged from a 52-week high of $17.46, despite the company’s meritorious goal of developing therapeutics to extend the life span of people by slowing, stopping or reversing the aging process. A plus is that 39.13 percent is owned by institutions, which shows that so-called “smart money” sees promise in the stock.

The company’s top drug candidates include UBX0101, which is in a Phase 1 clinical study to treat musculoskeletal disease, and UBX1967, which is targeting ophthalmologic diseases. Unity Biotechnology also is developing programs in pulmonary disorders.

“There’s a long and glorious tradition of little biotech companies getting absorbed into Big Pharma once all the risk has been taken and the rewards are in sight,” said Kramer, who also is at the helm of the Turbo Trader, High Octane Trader and Inner Circle advisory services.

‘Fountain of Youth’ Is Goal of Biotech Buying Opportunity

From a conventional view, the company’s product pipeline is nowhere near that stage, Kramer said. It will take several years to grow revenue, let alone produce a profitable, Food and Drug Administration (FDA) approved franchise, Kramer said. However, Kramer said she loves the concept and she is not alone.

“As a wild card, I can see Facebook paying $500 million because Mark Zuckerberg feels jealous of having been left out of its early financing rounds and wants to keep up with Alphabet’s Calico, which has a similar approach to curing aging-related conditions,” Kramer said. “That’s three days of the profit Facebook throws off. If Zuckerberg wants a moon shot, he can definitely afford it.”

Goldman Sachs initiated coverage of Unity Biotechnology with a “Neutral” rating and a 12-month price target of $17 a share on May 28, 2018. Those projections proved too propitious but any positive research results in the months ahead could return interest to the stock.

Chart courtesy of www.StockCharts.com

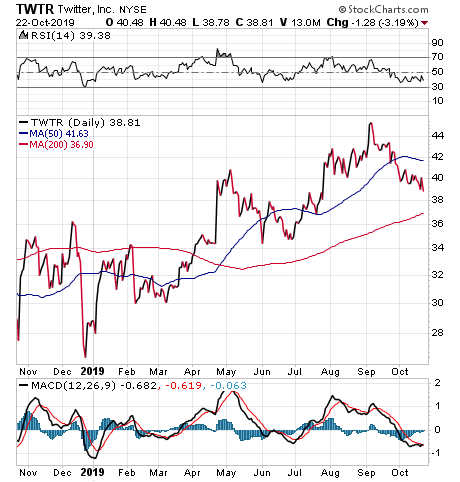

Twitter Tempts with Potential Share Price Gains and Ultimate Buyout

A social media stock that Kramer likes with the upcoming U.S. presidential election is Twitter, Inc. (NYSE:TWTR). Twitter, scheduled to report third-quarter 2019 results on Oct. 24, offered guidance for its third-quarter 2019 total revenues between $815 million and $875 million. The Zacks Consensus Estimate for revenues of $876.3 million would produce an increase of 15.6 percent from the year-ago quarter. In fact, Twitter’s earnings beat the Zacks Consensus Estimate in the past four quarters by an average of 34.1 percent, so outperformance would not be a surprise.

Chart courtesy of www.StockInvestor.com

I personally expect Twitter to show strong growth during the next year as the U.S. presidential election and international growth spur increased use of the short-messaging service. As long as Twitter can combat the use of manipulated videos that falsely portray the actions of certain politicians, the company could generate strong returns driven by increased ad sales.

The ultimate impetus for Twitter to seek a merger partner could be fierce competition with social media rivals such as Facebook (NASDAQ:FB), Google (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) for ad dollars.

“Twitter was seriously reviewing acquisition offers a few years ago but a sweet enough deal never materialized,” Kramer said. “Since then, CEO Jack Dorsey has gotten even more confident as the long fight to monetize the service finally bears fruit. He’s got traction now. The numbers are going in the right direction and there’s zero reason to surrender to any sense of urgency or desperation… the offer has got to be spectacular.”

Twitter Offers Potential Acquisition Target to Invest in Now

The question then becomes what possible buyer would want Twitter that badly, Kramer said. In 2016, TWTR made sense as a “tuck-in” acquisition for Disney (NYSE:DIS) and still does today, but probably not at any price Dorsey will accept, she added.

However, a news-gathering company may be interested in Twitter, especially as political controversy heats up with the approaching 2020 election and possibly beyond, Kramer continued. Serious Washington watchers spend time monitoring Twitter now, Kramer added.

“That’s only going to get more intense,” Kramer said. “Even if no buyer takes the stock off the table, the future looks bright.”

Europe’s negative interest rates, soaring U.S. government debt, China’s unfair trade practices, economic struggles, international conflicts and U.S. House hearings to build a case for impeachment against President Trump are buffeting investors. These three acquisition targets to invest in now could prove rewarding for investors willing to buy stocks that have further potential to rise and also may entice a bigger organization that could help a company that it purchases achieve heightened success.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.