The WisdomTree Europe Hedged Equity Fund (NYSEARCA: HEDJ) is an exchange-traded fund (ETF) that provides investors with exposure to the European equity market while also hedging against possible fluctuations between the dollar and the euro.

This exchange-traded fund is based off the WisdomTree Europe Hedged Equity Index that is designed to track the share price moves of dividend-paying companies in the WisdomTree International Equity Index that derive at least 50% of their sales from exports outside of the euro zone. The presence of a currency hedge also matters because there is always the possibility of large movements in the exchange rate between the dollar and the euro.

At a time when the German economy is in recession, the imminent deadline for Brexit is fast approaching and populist politicians and parties are gaining sway across the continent. With that backdrop, prospective investors in the European economy need all the protection that they can get.

The top 10 countries that this ETF is invests in include France (28.30%), Germany (24.52%), the Netherlands (16.67%), Spain (11.61%), Belgium (7.79%), Finland (4.91%), Italy (3.35%), United Kingdom (1.14%), Portugal (0.84%) and Austria (0.54%).

Among the fund’s top holdings are Banco Santander SA (NYSE: SAN), Anheuser-Busch InBev SA/NV (NYSE: BUD), Sanofi S.A. (NASDAQ: SNY), Unilever NV (NYSE: UN), LVMH Moët Hennessy Louis Vuitton SE (OTCMKTS: LVMUY), Daimler AG (OTCMKTS: DDAIF), BASF SE (OTCMKTS: BASFY) and Bayer AG (OTCMKTS: BAYRY).

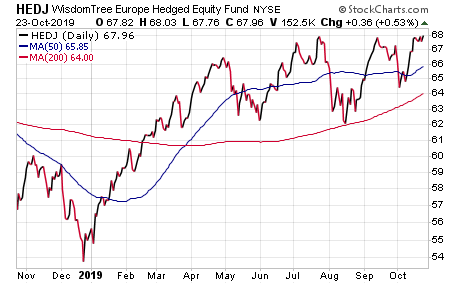

Chart courtesy of StockCharts.com

The sectors that attract this ETF’s highest investments are consumer non-cyclical (20.81%), consumer cyclicals (18.36%), industrials (14.85%), health care (13.55%), basic materials (11.58%) and financials (10.88%).

The fund currently has $3.36 billion assets under management and an expense ratio of 0.58%, meaning that it is slightly more expensive to hold in comparison to other exchange-traded funds. This fund’s performance has been quite good in the long and short runs. As of Oct. 22, HEDJ has jumped 0.65% over the past month and 1.74% in the past three months. It currently is up 21.87% year to date.

In short, while HEDJ does provide an investor with a chance to profit from the world of euro zone companies, the sector may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[dice with euro, pound, yen, and dollar symbols]](https://www.stockinvestor.com/wp-content/uploads/6001102681_643351de01_b.jpg)

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)