(Note: Second in a series of ETF Talks on the Millennial generation).

The Invesco Dynamic Leisure and Entertainment ETF (PEJ) tracks a multifactor, tiered equal-weighted index of U.S. entertainment and leisure industry stocks.

The exchanged-traded fund (ETF) is based on the Dynamic Leisure & Entertainment Intellidex Index. PEJ normally will invest at least 90% of its total assets in common stocks that comprise the Index.

The Intellidex Index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment criteria that include price momentum, earnings momentum, quality, management action and value. The underlying Index is comprised of common stocks of 30 U.S. leisure and entertainment companies.

These companies are principally engaged in the design, production or distribution of goods or services in the leisure and entertainment industries. The fund and the Index are rebalanced and reconstituted quarterly in February, May, August and November.

PEJ aims to pick winning stocks rather than deliver a market-cap-weighted basket that reflects the industry. Its stock selection process is a bit opaque beyond the broad descriptions of its screens: fundamental, timeliness, valuation and risk. Some might see value in this diversification, which mitigates single-stock risk, while others might see a lack of focus. In terms of firm size, the fund strays significantly away from large-caps.

The fund’s top sectors and their weighting in its portfolio include Restaurants & Bars, 41.26%; Airlines, 21.50%; Leisure and Recreation, 12.49%; Hotels, Motels & Cruises, 8.47%; and Food Retail & Distribution, 5.64%.

PEJ’s top holdings are United Airlines Holdings, Inc. (NASDAQ:UAL); Booking Holdings, Inc. (NASDAQ:BKNG); Delta Air Lines, Inc. (NYSE:DAL); Yum China Holdings, Inc. (NYSE:YUMC); and Chipotle Mexican Grill, Inc. (NYSE:CMG).

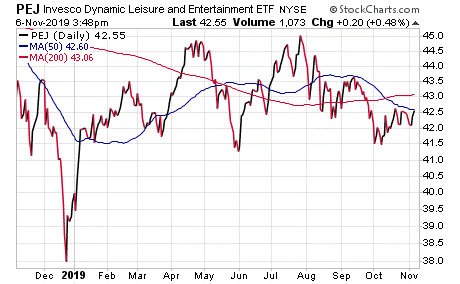

Chart courtesy of StockCharts.com

Up 5.85% year to date, PEJ has done well to weather the many market corrections in 2019. It has 31 holdings, an average spread of 0.13% and an expense ratio of 0.63%, meaning it is relatively expensive to hold compared to other exchange-traded funds.

PEJ provides investors with exposure to Leisure and Entertainment stocks but their performance can be cyclical and based on economic strength. As always, please conduct your own due diligence, as you would with any investment, before deciding whether this fund fits your own individual portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)