Three satellite stocks to consider buying consist of companies that operate their own spacecraft and provide services that rival telecommunications organizations cannot match.

Satellites offer unique point-to-point services to users on Earth from space, luring billionaires into the business, including Tesla (NASDAQ:TSLA) co-founder and Chief Executive Officer Elon Musk, Amazon.com (NASDAQ:AMZN) and Blue Origin founder Jeff Bezos and others. Musk, who also leads rocket launcher and satellite company Space Exploration Technologies (SpaceX), has raced ahead of his fellow corporate titan as he plans to take a huge part in expanding the number of satellites in orbit from nearly 2,000 now to more than 30,000 in the years ahead.

Satellite stocks are volatile, not well understood and require their financial backers to incur huge costs to build and launch spacecraft and ground stations, said Bryan Perry, who heads the Cash Machine and Hi-Tech Trader advisory services. Satellite operators have a track record of “notoriously burning cash” to put expensive spacecraft and sometimes entire constellations into use before they have a chance to turn a profit, added Perry, who also leads the Quick Income Trader and Instant Income Trader services that recommend both stock and option trades.

The three satellite stocks to consider buying have overcome immense obstacles to grow their revenues and customer bases, despite competition from rivals within the industry and from other technologies. One of the three satellite stocks to assess for purchasing is Iridium, which needed to restructure its finances along with GlobalStar and Orbcomm in the 1990s. All still operate and provide services from low-earth orbit but left early-stage investors to take losses for assuming the risk of backing startup space ventures.

Iridium and Viasat are Two of the Three Satellite Stocks to Consider Buying

“It is a bit like starting an airline — really expensive and sexy in launching the company and then it’s like affording a high-maintenance Hollywood star with bad habits,” Perry said about satellite stocks. “After decades of fits and starts, the satellite sector of the stock market is getting some stronger institutional holders and some profit daylight from the years of orbital installation efforts.

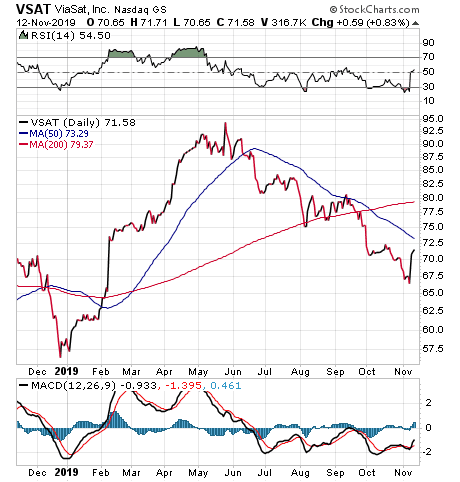

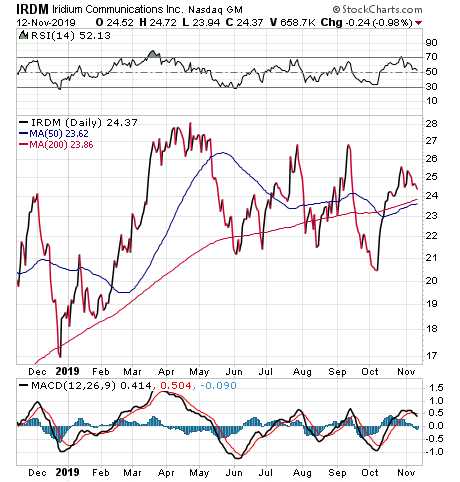

“My two favorites in the space — pun intended — are Iridium Communications (NASDAQ:IRDM) and Viasat, Inc. (NASDAQ:VSAT) for one very simple reason. Both companies are seeing a genuine ramp in top-line revenue and both companies have positive EBITDA (Earnings Before Interest Tax Depreciation and Amortization). For Q3 2019, Iridium reported a 10 percent increase in revenues to $115.9 million and an 11 percent increase in EBITDA to $88.5 million, as well as raised guidance.”

Viasat, led by entrepreneurial engineer Mark Dankberg, grew revenues by 14.5 percent to $592.3 million and increased its EBITDA 53 percent to $118.2 million during the just-ended quarter, Perry said. Both stocks jumped on the headlines before pulling back to follow their well-documented trading pattern, he added.

Bryan Perry

Although there are new entrants in the sector that will challenge Iridium and Viasat for celestial market share, these two companies have the advantage of beating the proposed mega-constellations to market that Musk and Bezos envision leading, Perry said.

“Additionally, Viasat is the Wi-Fi connection of choice for the Boeing 737 MAX, so when that plane gets cleared for reactivation, service fees have a fresh catalyst,” Perry said.

One example of the volatility satellite stocks can exhibit occurred on August 10, 2018, when shares of Viasat Inc. closed down 17.1 percent after the company reported earnings that fell well below expectations.

Chart courtesy of www.stockcharts.com

Iridium Stands out as One of Three Satellite Stocks to Consider Buying

Iridium Communications Inc. (NASDAQ:IRDM) delivers broadband services, tracks the internet of things (IOT), fulfills the communication needs of the Department of Defense (DoD) and hosts the payloads of others with its new-generation, $3 billion Iridium NEXT satellites. Final launch of the Iridium NEXT spacecrafts occurred on February 2, 2019, using a SpaceX rocket, to give the satellite operator freedom from capital expenditures for about the next 10 years, the company’s CEO Matthew Desch told me during an exclusive interview last May.

Image provided by Iridium

An important new aviation communications service offered by Iridium NEXT will assist with tracking airlines. For example, Malaysia Airlines Flight 370, which went missing in 2014 when it veered off course never to be seen or heard from again, should not recur in the future with the use of Aireon, a new service supported by Iridium NEXT. The completion of Iridium NEXT constellation last February has coincided with a rise in the company’s share price.

Chart courtesy of www.stockcharts.com

Ken Levy, Iridium’s vice president of investor relations, shared the following insights:

- In recent years, there’s been growing investor interest and media coverage of low-earth orbit (LEO). This orbital plane has emerged as the Holy Grail of space entrepreneurs and a centerpiece of new satellite business plans. Many analysts forget that Iridium has been uniquely associated with the term LEO constellation for more than 20 years. Though Iridium has established a successful and growing L-band business in LEO, some conflate LEO with a competitive position or business model, rather than a geographic neighborhood in space.

- I know there’s some confusion about the competitive threat posed by new mega-constellations being launched into LEO. We do not view them as competitors, and believe they are more likely to be partners in the same way that our L-band terminal is paired with VSAT in maritime today. The new mega-constellations use Ku- and Ka-band spectrum and are seeking to compete with existing Ku- and Ka-band operators on price and speeds.

- Having recently signed a Memorandum of Understanding (MoU) with OneWeb in advance of its impending launch of K-band service from LEO, this MoU should serve as a clear message to investors that Iridium’s L-band and the new Ku- or Ka-band LEO networks now being developed are not direct competitors. We look forward to welcoming other companies to the LEO neighborhood and expect other announcements that will leverage our global L-band capabilities with new mega-constellation owners to provide new unique solutions from low-earth orbit.

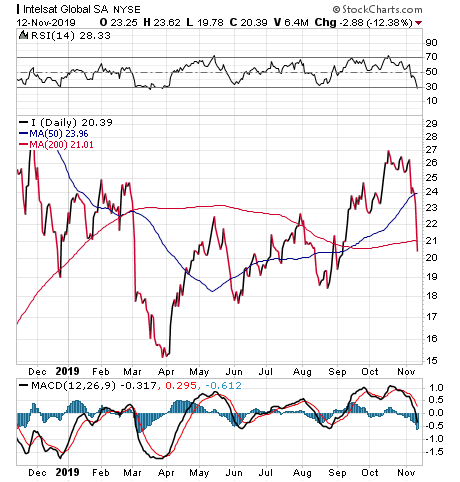

Intelsat Shows Volatility with One-Day Price Drop

Traditional fixed satellite services operator Intelsat (NYSE:I) fell 12.38 percent, or $2.88 a share to $20.39, on Nov. 12, following a downgrade of its shares from “overweight” to “neutral” by JPMorgan. The rating reduction also included a cut to the company’s Dec. 20 target price to $20 from $34.

Chart courtesy of www.stockcharts.com

JPMorgan had boosted its price target for Intelsat to $32 from $27 on Sept. 19, after concluding the Federal Communications Commission was progressing toward allowing the auction of 280 Mhz of C-band spectrum in 2020 for roughly $26 billion. A JPMorgan research note at the time estimated that Intelsat could receiving net proceeds of around $8 billion, or about $45 per share, for its C-band spectrum holdings. Such a windfall would be more than double the company’s current share price.

In addition, reports surfaced on Nov. 6 that Intelsat was seeking to raise capital with a 10 million share offering through Morgan Stanley. Intelsat’s three-quarter adjusted EBITA of $356.1 million fell short of meeting analysts’ consensus estimates of $359.1 million. The company’s Q3 earnings per share of $1.05 measured less than half the $2.74 EPS it notched in the same quarter a year ago. Intelsat, originally an intergovernmental satellite organization before it privatized, is one of the traditional fixed satellite service operators that include Europe’s SES and Eutelsat.

Mega Constellations Are on Their Way

SpaceX, OneWeb, Telesat and Amazon are among the 11 organizations that have filed plans with the Federal Communications Commission (FCC) to launch new low-earth-orbit satellite constellations. A key advantage of satellite companies, compared to fiber-optic, wireless and wireline rivals, is the capability to deliver secure point-to-point services through a single, homogenous network to service government, military or commercial customers.

Low-earth-orbit spacecraft under development would offer increased bandwidth to help the satellite and space companies compete for customers with long-range fiber-optic providers, said Chris Quilty, the founder and a partner of Quilty Analytics, a provider of satellite and spaced industry subscription research, strategic advice and investment banking services. Constellations that operate in low-earth orbit incur reduced latency to cut the time required to downlink communication services from the satellite to users on the ground.

Quilty, prior to establishing Quilty Analytics in 2016, served as a sell side research analyst with Raymond James for 20 years covering the industrial, defense, space, wireless and communications industries. In the past five years, he has been involved in more than 30 capital markets transactions that collectively topped $2.5 billion.

Qualty spoke optimistically about SpaceX’s fledgling Starlink constellation as a satellite operator, citing a recent U.S. Air Force test of the company’s satellites that found the company successfully demonstrated a data link to the cockpit of a military aircraft with a bandwidth of 610 megabits per second (Mbps). Most aircraft and drones today use dated, low bandwidth solutions, he added.

Aircraft that provide intelligence, surveillance and reconnaissance (ISR) download the video content to users on Earth to coordinate air operations, Quilty said.

Reaper Drones, also known and hunter drones that seek out targets, currently can take video images but don’t have the capability to download what they shoot. The use of high bandwidth connections could provide the ability to downlink high-resolution video in real time, Quilty added.

Aircraft Applications Lift Iridium’s Prospects

Quilty said he likes Iridium as a story and as a stock.

“It offers narrow-band solutions and is built for global voice and IoT (internet of things) connections,” Quilty said.

A $100 tracking device can be placed on an asset that then can be monitored anywhere it goes in the world, Quilty told me. Garmin Ltd. (NASDAQ:GRMN) is using Iridium capabilities in its handheld global positioning system (GPS) units, he added.

“If you get in trouble, it tells you where you are,” Quilty said.

With Garmin now using the Iridium technology, the GPS device can track the position of whoever or whatever needs to be tracked.

Revenues from that Garmin Application recently rose by one third, Quilty said.

Iridium’s Aireon Service Tracks Commercial Aircraft

A new aviation communications service called Aireon, offered by Iridium NEXT, uses a transceiver which comprises both a transmitter and a receiver, to track aircraft in real time in flight. The transmitted signal that goes from the transceiver to satellite is called the uplink, while signal transmitted back to Earth from the satellite to a different transceiver is called the downlink.

Aireon already has signed agreements with 14 air navigation service providers (ANSP) to provide the service, Quilty said. The U.S. Federal Aviation Administration could be one of the next ones.

The service could help to prevent incidents such as the Malaysia Airlines Flight 370, which went missing in 2014 when it veered off course never to be seen or heard from again.

Quilty also spoke of the potential of the ViaSat 3 – featuring three new satellites that would provide more bandwidth than the combined capacity of all the other satellites on orbit today. Those satellites will not launch for another year and ViaSat is building the spacecraft itself rather than use a traditional manufacturer as it has done in the past.

“If everything goes accordingly to plan, it could world beating,” Quilty said. However, first-time technology also carries risk.

SpaceX President Expresses Confidence in Avoiding Congestion Problems

Gwynne Shotwell, president and chief operating officer of SpaceX, spoke at the Baron Investment Conference at New York’s Lincoln Center on Oct. 25 and expressed confidence the company could avoid congestion problems in orbit. The Baron Funds Investment Conference typically features public companies but included Shotwell’s presentation since the mutual fund company owns a minority stake in the privately held space company that launches commercial and government satellites. SpaceX plans to launch its own constellation of at least 4,425 satellites initially to provide services in the Ku- and Ka-bands.

Baron seeks to identify and invest in stocks that have strong long-term potential and superior management. Shotwell and Tesla Chairman Robyn Denholm, who both work for billionaire entrepreneur Elon Musk, addressed an audience of more than 5,000 Baron Funds’ shareholders at the conference.

OneWeb Satellites is a joint venture between Airbus, the global leader in the aerospace industry, and OneWeb, a company founded in 2012 that will deploy and operate a constellation of up to 900 low-earth orbit satellites providing global high-speed internet access. Airbus and OneWeb formed OneWeb Satellites to design and manufacture the spacecraft for their planned constellation.

To achieve the volume, cost and time requirements of the OneWeb project, a plan was adopted to achieve mass production of the satellites the way Ford (NYSE:F) and Airbus build cars and airplanes, respectively.

Telesat, of Canada, plans to launch 117 satellites to offer services through a Ka-band system. A recent study by researchers at the Massachusetts Institute of Technology praised Telesat’s high-capacity satellite design, use of inter-satellite links (ISLs) and digital processors. The Telesat system’s average Gbps per satellite, the study found, provides four times more capacity than the SpaceX constellation and 10 times more than OneWeb.

As a global satellite operator, Telesat provides secure satellite-delivered communications solutions worldwide to broadcast, telecom, corporate and government customers.

Project Kuiperis a new initiative that Amazon announced on April 4 to launch a constellation of low-earth-orbit satellites that will provide low–latency, high–speed broadband connectivity to unserved and underserved communities around the world. Amazon currently is seeking employees to hire at Project Kuiper to fill key roles to pursue the venture’s objective.

Intelsat Rating Reduction Shows Risk of Investing in Satellite Stocks

The plunge in Intelsat’s share price stems from JPMorgan cutting its rating on the stock to neutral because the existing satellite business is essentially irrelevant to the coming C-Band transmission environment, said Hilary Kramer, whose 2-Day Trader service has notched 18 out of 23 profitable trades with an average return of 11.29 percent and a hold time of less than a day since its launch.

Despite its history as a pioneering satellite operator, Intelsat needs to keep innovating just like the newcomers, said Kramer, whose GameChangers advisory service has booked 21 profitable trades among its last 25 transactions.

“The past is only prologue, even if you’ve been in the satellite communications business for decades,” said Kramer, who also leads the Turbo Trader, High Octane Trader and Inner Circle advisory services.

Growing demand for satellite services requires amassing as much bandwidth as every proposed constellation can provide, so at this stage competition is welcome, Kramer said.

“The rule of thumb I’ve seen is that it takes about 100 satellites to support streaming video for 50,000 people, and that’s not including making sure millions if not billions of smart cars will have enough bandwidth to see the road and each other at all times, Kramer said. “The important thing is getting enough birds in the air to tie a planet of 7 billion people and all our devices together with plenty of redundant capacity for outages and emergencies. After that, strategy becomes the key factor in determining which operators will really make shareholders long-term money. That’s probably close to a decade out.”

Risks faced by investors now include economic concerns, international disputes, negative interest rates in Europe, soaring government debt in the United States and elsewhere, China balking at stopping its unfair trade practices and U.S. House Democrats seeking to impeach President Trump. The three satellite stocks to consider buying each have unique capabilities that could reward investors who can afford to stay patient as those companies pursue growth plans before prospective new entrants put their constellations in orbit.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz.