(Note: The third in a series of ETF Talks on the Millennial generation).

The French gastronome Anthelme Brillat-Savarin once wrote, “Tell me what you eat and I will tell you what you are.” Since our bodies are fueled with what we eat, we should choose our foods wisely.

The adverse health benefits of eating processed, and packaged foods is a scientific fact and is leading more and more millennials to return to humanity’s roots by seeking out natural, sustainable and organic foods for their nourishment. Indeed, a 2016 survey conducted by the Organic Trade Association revealed that 40% of millennials believe that choosing organic is an integral part of living green. At the same time, only 32% of Generation Xers and 28% of Baby Boomers agree.

Similarly, the Organics ETF (NASDAQ: ORG) is an exchange-traded fund (ETF) that seeks investment results which correspond to the performance of the Solactive Organics Index. Thus, ORG provides investors with exposure to global companies that focus on naturally derived food and personal care items. These companies, most of which are food retailers, produce, distribute, market and sell organic food, beverages, supplements or packaging.

The top 10 countries that this ETF is invested in include the United States (34.29%), Denmark (20.91%), Australia (16.61%), Japan (11.82%), Hong Kong (6.51%), Canada (3.60%), the United Kingdom (2.38%), Thailand (1.82%), Sweden (1.18%) and Italy (0.63%).

Some of this fund’s top holdings include Chr Hansen Holding A\S (OTCMKTS:CHYHY), Sprout Farmers Market Inc. (NASDAQ: SFM), Hain Celestial Group Inc. (NASDAQ:HAIN), Ariake Japan Co Ltd. (TYO:2815), L’Occitane International SA (OTCMKTS:LCCTF), United Natural Foods Inc. (NYSE:UNFI), John B. Sanfilippo & Son Inc. (NASDAQ:JBSS) and Bellamy’s Australia Ltd. (ASX:BAL).

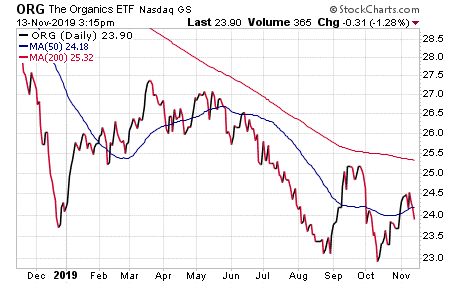

This fund’s performance has been solid in the short run. As of November 11, 2019, ORG is up more than 5.90% in the past month and 2.75% for the past three months. It is currently up 0.76% year to date.

Chart courtesy of www.stockcharts.com (accessed on November 13, 2019)

The fund has amassed $7.37 million assets under management and an expense ratio of 0.35%, meaning that it is cheaper to hold in comparison to many other exchange-traded funds.

In short, while ORG does provide an investor with a chance to profit from the world of organic food, the sector may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.