After beating Wall Street analysts’ earnings expectations for the third consecutive time this year, Discover Financial Services’ (NYSE:DFS) share price is continuing its uptrend and has gained more than 20% year to date.

Its share price rose more than 13-fold with minimal volatility between hitting its all-time low in 2009 and late 2014. Since 2015, the share price has experienced significantly higher volatility. However, the share price was still able to maintain a steady overall uptrend and reached a new all-time high in mid-2019.

Financial Results

After delivering strong results for the full year 2018 and beating analysts’ earnings expectations in the first two quarters of the year, Discover Financial Services exceeded expectations again for the third quarter of 2019. On October 22, 2019, the company reported $2.9 billion in total revenues net of interest expenses. This result marked a 6% increase over the $2.72 figure from the third quarter last year.

Other operating expenses increased by 9% from $1.02 billion last year to $1.11 billion for the most recent quarter. The resulting quarterly net income of $770 million was 7% higher than the $726 million figure from the same period last year. A share repurchase program reduced the number of shares since last year, which drove the current earnings per share (EPS) 15% higher year-over-year from $2.05 last year to $2.36 in the third-quarter 2019. Additionally, the current $2.36 EPS beat Wall Street analysts’ expectations of $2.28 by 3.5%.

“We had a strong third quarter, achieving key objectives for loan growth, margin expansion and credit performance, against the backdrop of continued stability in the consumer sector of the U.S. economy. We continued to invest in our operating model with the objective of driving sustained profitable growth and solid returns,” said Roger Hochschild, CEO and President of Discover Financial Services. “Once again this quarter we generated an outstanding return on equity of 26%, reflecting the strength of our business model. Looking ahead to the fourth quarter, we expect to finish the year on a very solid footing, achieving all elements of our 2019 financial and operational guidance.” added Mr. Hochschild.

Dividends

Just six quarters after initiating dividend distributions in late 2007, Discover Financial Services had to cut its quarterly payout from $0.06 to $0.02 in the aftermath of the 2008 financial crisis. After distributing a $0.02 payout for eight consecutive quarters, the company hiked its payout back to the $0.06 level in the second quarter of 2011. Since resuming dividend boosts in early 2011, the company has increased its annual payout every year for the past nine consecutive years.

The company’s current $0.44 quarterly distribution is 10% higher than the $0.40 dividend payout from the same period last year. Since beginning the current streak of consecutive annual dividend hikes in 2011, the company has enhanced its total annual payout amount 22-fold. This level of dividend advancement is equivalent to an average dividend growth rate of 41% per year.

Even disregarding the initial hike to the previous $0.06 quarterly payout level, the annual payout has risen nearly nine-fold over the last eight years. This average annual growth rate is still more than 30%. The current quarterly payout amount converts to a $1.76 annualized distribution and a 2.1% forward dividend yield, which is 7% higher than the company’s own 1.94% average yield over the last five years.

Investors interested in taking a long position in the Discover Financial Services stock should consider acting before the upcoming ex-dividend date on November 20, 2019. All investors that can claim stock ownership before that ex-dividend date will be eligible to receive the next round of dividend distributions on the December 5, 2019, pay date.

Share Price

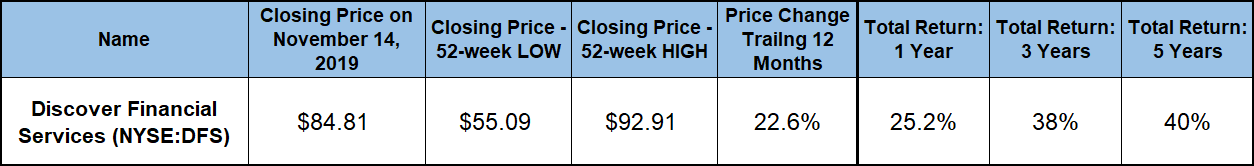

The company’s share price traded relatively flat in the first nine months of 2018. Unfortunately, the overall market correction in the last quarter of the year pushed the share price more than 20% below the price level from the beginning of the trailing 12-month period. However, after bottoming out at $55.09 on December 24, 2018, the share price reversed direction and headed higher. After recovering all its fourth-quarter 2018 losses by February 2019, the share price reached its new all-time high of $92.91 on July 6, 2018 for a total gain of nearly 70% above the 52-week low from Christmas Eve 2018.

Since spiking to its new all-time high in early July, the share price pulled back 8.7% to close on November 14, 2019 at $84.81. While slightly lower than the July peak, the Nov. 14, closing price was more than 20% higher than it had been one year earlier, 32% higher than it was five years ago and nearly 54% above the 52-week low from late December 2018.

Dividend income distributions provided additional gains that combined with asset appreciation for a total return in excess of 25%. While a share price pullback in 2015 limited the five-year total return to less than 40%, the total return has been nearly 38% just over the last three years.

Discover Financial Services (NYSE:DFS)

Based in Riverwoods, Illinois, and founded in 1960, Discover Financial Services operates as a direct banking and payment services company in the United States. The company’s Direct Banking segment offers Discover-branded credit cards to individuals, as well as other consumer products and services, including private student loans, personal loans, home equity loans and so on. Additionally, this segment also offers deposit products, such as certificates of deposit, money market accounts, savings accounts, checking accounts and individual retirement arrangement certificates of deposit. The Payment Services segment operates the Discover Network, which processes transactions for Discover-branded credit cards and provides payment transaction processing and settlement services. Additionally, this segment also operates the PULSE network, which is an electronic funds transfer network which provides financial institutions that issue debit cards on a network with access to automated teller machines and point-of-sale terminals. Furthermore, this segment also operates Diners Club International — a payments network that issues Diners Club branded charge cards and provides card acceptance services.

Ned Piplovic is the assistant editor of website content at Eagle Financial Publications. He graduated from Columbia University with a Bachelor’s degree in Economics and Philosophy. Prior to joining Eagle, Ned spent 15 years in corporate operations and financial management. Ned writes for www.DividendInvestor.com and www.StockInvestor.com.