(Note: Fourth in a series of ETF Talks on the Millennial generation).

The iShares MSCI KLD 400 Social ETF (DSI), the fourth exchange-traded fund (ETF) in our series on Millennial-themed ETFs, has “social” in its name, but it does not track social media stocks.

Rather, DSI seeks out stocks with “positive environmental, social and governance characteristics,” as determined by iShares. Many Millennials prioritize these factors when considering which companies to patronize for the purchase of goods and services.

This fund offers exposure to “socially responsible” U.S. companies that have been screened for the above-mentioned characteristics. The fund markets itself as a way to “invest based on your personal values” to entice investors who possess this characteristic. For those who invest based on such principles, then the stocks that make up DSI may gain added appeal.

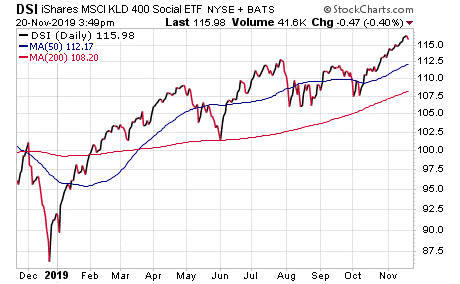

Despite the fact that this fund does not seem to strongly consider economic or technical factors in its stock selection, it has been performing well. It is up 26.62% year to date. Since its inception in 2006, its share price has more than doubled. However, over both time periods, DSI’s performance has closely tracked that of the S&P 500, performing just a little better both year to date and since 2006. The fund is currently near an all-time high. Its expense ratio is 0.25%.

Chart courtesy of www.StockCharts.com

The fund offers a current dividend yield of 1.48%, so investors who like income might be inclined to give it a try.

The five largest sector holdings in this fund are Information Technology, 27.4%; Communication, 14.4%; Health Care, 11.1%; Industrials, 9.49%; and Financials, 9.16%.

As far as individual holdings, its five biggest ones are Microsoft Corp. (MSFT), 7.86%; Alphabet Inc. Class C (GOOG) and Class A (GOOGL) shares, totaling 5.78%; Facebook Inc. (FB), 3.44%; Visa Inc. (V), 2.28%; and Procter & Gamble (PG), 2.19%.

If you feel that Millennial trends are likely to make their way into the investing world in the future, you may decide that iShares MSCI KLD 400 Social ETF (DSI) is worth putting into your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.