Investors are bidding the U.S. stock market averages to new all-time highs amid ongoing sentiment that a trade deal with China is imminent. However, the precise time when a pact will be reached is anyone’s guess.

The news media keeps reporting that the “final touches” are being worked on and that it’s all but a signed, sealed and done deal. China wants the United States to roll back all current tariffs and the United States wants China to curtail and be accountable for intellectual property (IP) theft.

The market saw this rodeo before when China walked away at the last moment earlier this year, sending the stock market into a stiff selloff. Might this happen again when there is so much happy tweeting going on from both sides? Well, even though Wall Street isn’t waiting around, no one should presume to know the outcome of an event that is still in progress.

In the words of sports broadcaster Dan Cook, who used the phrase after the first basketball game between the San Antonio Spurs and the Washington Bullets (now the Washington Wizards) during the 1978 NBA Playoffs — “It ‘ain’t over ’till the fat lady sings.” And I think there is a pearl of wisdom in this celebrated colloquialism.

Depending on which media outlets you use, the level of unrest around the world seems to be widening in some key countries that investors are monitoring closely. Namely, the fact that protests and elections in Hong Kong are occurring right in the midst of the trade negotiations could result in an invasion of the area by the Chinese military.

The human rights bill has been passed by Congress and awaits President Trump’s signature. If he does sign it, the bill may well put the “phase one” deal on ice and put the next round of tariffs into motion. These are additional tariffs on $155 billion in goods that are scheduled to be subject to the same 15% levy on Dec. 15.

President Trump said that he had told China’s president, Xi Jinping, that crushing the Hong Kong protesters would have “a tremendous negative impact” on efforts to reach an accord to end the 16-month trade war. At the New Economy Forum, which was held this past week in Beijing, the tone was that of uncertainty about the outcome of the trade war, with high-profile attendees not willing to take sides.

When asked by CNN Business as to whether the United States should fight for the rights of people in Hong Kong, American hedge fund billionaire Ray Dalio demurred and called it a “touchy issue.” Really? I guess when you’re a billionaire, morals are up for sale.

A more outspoken individual at the conference was former Clinton-era trade negotiator Charlene Barshefsky, who had helped work out China’s entry to the World Trade Organization (WTO) nearly two decades ago, as she accused Beijing of a shift “from decades of market-opening and reform to mercantilism.”

Today, the China model fuses the party, resurgent state planning, massive subsidies, protectionism and IP theft — all turbo-charged by scale.” Barshefsky later stated that the relationship between the world’s top two economies will remain fraught regardless of whether a trade deal comes to fruition.

The other geopolitical hotspot is Iran, where the government raised gas prices by 50% and shut down the country’s internet service after reports of more than 100 deaths, according to Amnesty International, from a government crackdown on massive protests over the fuel price increases. Fresh warnings of missile attacks by Iran on U.S. military bases are making headlines, but the concern and impact on the market is on oil prices.

Unlike China, where tens of thousands of U.S. companies do business and are caught in the middle of two sides that are hunkered down in negotiations, Iran offers little economic benefit to the United States and thus doesn’t have Wall Street’s attention.

China is the short-term priority for market participants. Even if a “phase one” deal is made possible and the S&P 500 sprints to new highs, it’s my view that it won’t change the long-term calculus of curbing China’s behavior. We are seeing a clash of cultures and both sides are formidable.

Against a backdrop of negative reporting on how the trade war with China is going to drive the U.S. economy into a recession, what is actually occurring is that the economic data are pointing towards a resumption of growth in 2020.

It seems that the U.S. consumer is doing quite well in light of the doom-and-gloom predictions. Housing data are one of the most important leading indicators of consumer confidence and are why the market pays such close attention to these numbers when they are released. Household formation and solid home purchasing trends reflect rising confidence by consumers in their employment outlook and financial security.

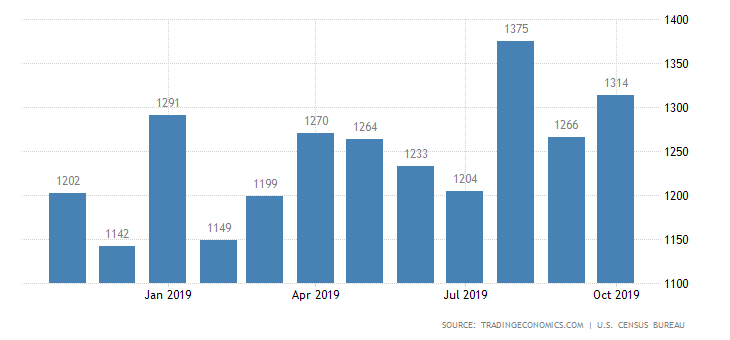

The Commerce Department reported last week that new housing starts rose 3.8% in October to a 1.31 million annual pace, which is the second strongest month this year. Also notable is that building permits rose 5% in October to a 1.46 annual pace, which was substantially above economists’ consensus estimate of a 1.39 million annual pace. This is the fastest pace for building permits in 12 years since 2007 and clearly bodes well for home builders and the mortgage industry.

How will the market likely trade if there is no trade deal and further tariffs are imposed? Well, the S&P 500 is doing a nice job of consolidating its recent gains, with the rising 20-day moving average sitting just under 3,100 and would, if violated, test the 50-day moving average at 3,020. A break of that level would invite a retest of the 200-day moving average at 2,910, or 6.4% lower, where there is strong support.

On the upside, 3,200 looks very doable if the right headlines cross the tape. What seems clearer heading into the year’s end is that not cutting a deal with China will not derail the U.S. economy as it will spur more businesses to relocate operations out of China to neighboring Asian countries or elsewhere. This is where the trade war could be won by America over the long term — with U.S. business investment and Chinese private and commercial capital leaving China.

Bloomberg reported on October 11, 2019, that China’s hidden capital flight surged to a record high in the first half of this year, suggesting that residents who want to move money abroad are using unrecorded transactions to evade tight capital controls.

China’s balance of payments, widely seen as an indicator of concealed capital flight, rose to a record high of $131 billion in the first six months of this year according to the Washington-based Institute of International Finance. That amount is roughly 40% higher than the average for the past four years.

I think that the sucking sound of oxygen (capital) leaving the country will be about the only thing China’s ruling party will respect from all that will come their way. We’re at a centennial moment where one of the most powerful communist nations in history, with very clear and very evil directives, is vulnerable to financial calamity. President Trump, Congress and America should support the undoing of such a global threat while it is still possible.

Join Me for the Orlando MoneyShow, February 6-8, 2020, at the Omni Orlando Resort at ChampionsGate. I will be speaking Thursday, Feb. 6, 10:30 a.m. about Double-Digit Income Investing. On Saturday, Feb. 8, I will talk at 8:00 a.m. about Extreme Profits Made Easy. Other investment experts who will be speaking include retirement and estate planning specialist Bob Carlson, Wall Street investment powerhouse Hilary Kramer and world-traveling, free-market economist Mark Skousen, who leads the Forecasts & Strategies newsletter. Register by clicking here or call 1-800-970-4355 and mention my priority code of 049265.