Following a record-breaking Black Friday through Cyber Monday shopping spree by U.S. consumers, it will take a major chain of negative events to undue the strong undercurrent of the year-end bullish sentiment.

After all, the consumer has been the driver for the domestic economy in 2019 because interest rates are low, the unemployment rate is low, gas prices are low, food prices are stable, home prices are rising, wages are rising and individual retirement account (IRA) and 401(K) plans are appreciating. One good piece of news is that consumers are doing a better job of managing debt, since the latest data show that households are paying out less of their disposable personal income to service their borrowing than they were in the fourth quarter of 2018.

There is also a prevailing belief that the U.S. economy is not going to enter a recession anytime soon. Instead, the notion of a pickup in gross domestic product (GDP) during the first quarter of 2020 is rising among the collective mindset on Wall Street. If the stock market does take a dive in December, it won’t be for fundamental reasons.

Just to be sure about why the S&P 500 is up 24.3% year to date and sitting at a record high along with the Dow and the NASDAQ — they have gotten there in part on the back of the hope that a trade deal of some kind will get done. If there was real worry about the trade deal imploding because of the signing of the Hong Kong Human Rights and Democracy Act, the market would have shed more ground than what occurred when it was announced, voted on and signed by President Trump.

There remains a hopeful attitude about the United States and China reaching a trade agreement that will curtail the threat of a 15% tariff rate being placed on $156 billion of imported consumer goods from China starting on Dec. 15. That would be a negative if it were to happen but the reports on the issue this week might spur consumers to spend more in front of that possible tariff deadline and increase the retail numbers that much more.

With the elusive trade deal in the balance, investors have had plenty to focus on this past week when a parade of economic data points crossed the tape. Construction, ISM Manufacturing Index, MBA Mortgage Applications Index, ADP Employment Change, ISM Non-Manufacturing Index, Initial Claims, Continuing Claims, Trade Balance, Factory Orders, Nonfarm Payrolls, Unemployment Rate, the University of Michigan Consumer Sentiment Survey, Wholesale Inventories and Consumer Credit all showed an economy that was on good footing. The Federal Open Market Committee (FOMC) meeting this week will provide more insight.

During the past 15 months of the trade war, U.S. economic data has not caved in as many bearish forecasters had warned. While there have been a couple soft patches, the Fed responded by lowering short-term rates three times this year and the economy’s pace has picked up heading into 2020. Will another round of tariffs on $156 billion of Chinese imports derail a $20 trillion U.S. economy? I don’t believe so.

We’ll know more come Dec. 15 if the mighty American economy can continue to thrive, despite the possibility that the current trade war could ratchet higher. Even if a “phase one” deal with China comes to pass without rollbacks, most of the tariffs on Chinese goods will remain in place. This raises the specter that long-term tariffs will become the “new normal” because there is little evidence that China will curb the state-dominated economic model that gave rise to the trade war in the first place.

It is core to any lasting deal that China stops coercing the transfer of foreign technology as the price of doing business there while also unfairly subsidizing state-owned enterprises that fuel excess capacity and swamp global markets. At this juncture, there are almost no details on China being flexible on these issues. And this doesn’t even get into intellectual property (IP) theft, cyber hacking, currency manipulation and the importation of illegal fentanyl.

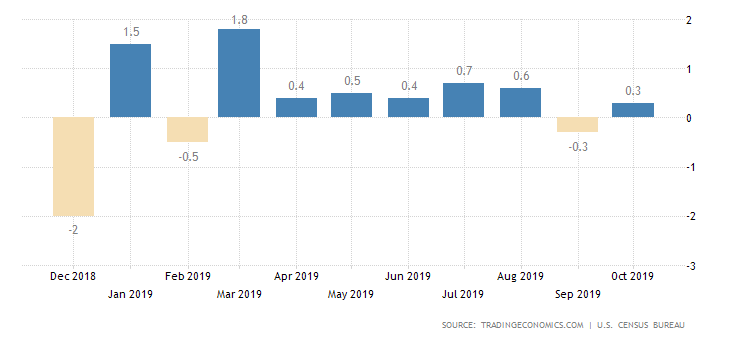

U.S. Retail Sales for 2019

There is little evidence to support the notion that China is willing to change its behavior, leaving me to believe that the hefty tariffs on both Chinese and U.S. imports will last indefinitely. Under this scenario, the rally likely will pause and wait on more data to see if there is any material impact on the consumer. Previous tariff enforcement actions on $375 billion of Chinese imports have had little effect on consumer spending patterns in 2019.

An additional round of 15% U.S. tariffs on $156 billion of Chinese imports is a very real possibility — but the size and strength of the U.S. consumer-driven economy supports the assumption that Americans will absorb it, adjust to it, handle it and move forward.

Join Me for the Orlando MoneyShow, February 6-8, 2020, at the Omni Orlando Resort at ChampionsGate. I will be speaking Thursday, Feb. 6, 10:30 a.m. about Double-Digit Income Investing. On Saturday, Feb. 8, I will talk at 8:00 a.m. about Extreme Profits Made Easy. Other investment experts who will be speaking include retirement and estate planning specialist Bob Carlson, Wall Street investment powerhouse Hilary Kramer and world-traveling, free-market economist Mark Skousen, who leads the Forecasts & Strategies newsletter. Register by clicking here or call 1-800-970-4355 and mention my priority code of 049265.

![[renminbi bills]](https://www.stockinvestor.com/wp-content/uploads/chinese-currency-29612955145495D1.jpg)