The Ark Innovation ETF (NYSE Arca: ARKK) is an actively managed exchange-traded fund (ETF) that targets companies poised to benefit from disruptive innovation in one of three areas: industrial innovations, genomics or Web x.0.

ARKK, named ETF.com’s 2017 ETF of Year, launched in 2014 and currently has $1.86 billion in assets. In fact, the ETF is up 32 percent in the past 12 months.

The fund follows an active, all-of-the-above approach. Investing over 99 percent of its assets in stocks (more than 75 percent of which are based in the United States), ARKK is full of cutting-edge firms, such as Tesla (NASDAQ:TSLA), Twitter (NYSE:TWTR) and Alibaba (NYSE:BABA). That said, ARKK’s mandate is so broad that it includes almost any company that might benefit from new technologies, such as Disney (NYSE:DIS) and Charles Schwab (NYSE:SCHW).

The ETF’s top 10 holdings include Tesla Inc. (NASDAQ: TSLA), 9.39%; Square Inc. A (NYSE: SQ), 7.20%; Illumina Inc. (NASDAQ: ILMN), 6.79%; CRISPR Therapeutics AG (NASDAQ: CRSP), 6.12%; Invitae Corp. (NYSE: NVTA), 5.72%; Stratasys Ltd. (NASDAQ: SSYS), 5.29%; Intellia Therapeutics Inc. (NASDAQ: NTLA), 4.61%; 2U Inc. (NASDAQ: TWOU), 4.11%; Editas Medicine Inc. (NASDAQ: EDIT), 3.92%; and NanoString Technologies Inc. (NASDAQ: NSTG), 3.23%.

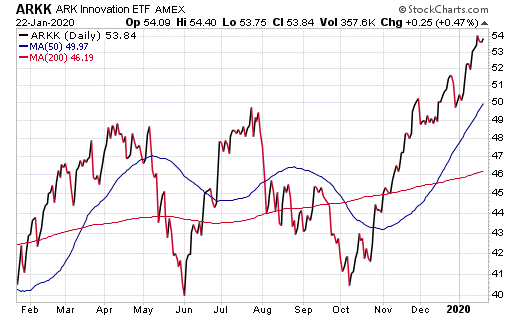

Chart courtesy of StockCharts.com

ARKK’s top holding, Tesla Motors, is poised to potentially become a $4,000 stock, according to the “bull” case presented by Catherine Wood, ARK Invest’s investment firm’s chief executive officer and chief investment officer, in an interview on CNBC. Tesla’s stock price is currently about $589.

“This is a five-year time horizon,” Wood said on CNBC’s “ETF Edge” last March 4. “Four-thousand dollars is the bull case, $700 is the bear case. It’s rare for us to a have a stock that meets our minimum hurdle rate of return in the bear case, so it’s north of 15 percent compound annual rate of return to get to our bear case target.”

The Ark Innovation ETF (ARKK) previously has been a recommendation in my Successful Investing growth portfolio, which you can subscribe to by clicking here. As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)