A stock market crash could be caused by an unexpected calamitous event, known as a “black swan” in the investment world, spurring a huge sell-off to end the current bull run that began in March 2009 and ranks as the longest and biggest in history.

Traditionally, a stock market crash is a sudden plunge during a single trading day or several days that is much more severe than a correction, which occurs with a drop of more than 10 percent from a 52-week high in major U.S. indexes: the Dow Jones Industrial Average, the Standard & Poor’s 500 and the NASDAQ. While corrections may occur in days, weeks or months, a stock market crash comes abruptly, such as the four-day dive of 25 percent that began on October 24, 1929, and launched the Great Depression.

At the time, the Dow Jones Industrial Average lost $30 billion in market value, equaling close to $400 billion today. Two other big U.S. stock market crashes have occurred. The first one took place in 1987, with the largest one-day plunge in history of 23 percent on “Black Monday,” Oct. 19. The second took place in 2008 amid excess use of mortgage-backed securities and a real estate bubble that was ready to burst.

Dot-Com Stock Market Crash of 1999-2000 Shows Longer-Term Drop

A market collapse also can stem from a longer-term drop, such as the one that occurred in 1999-2000 during the dot-com boom. Normal valuations no longer served as a rational basis to explain soaring stock prices, particularly of internet companies that found eager buyers even as the companies were losing money.

Then, reality returned with a vengeance. By 2002, the dot-com frenzy had ended and roughly 100 million individual investors collectively lost $5 trillion in the value of their stock holdings.

What events currently taking place could cause a stock market crash now? There are several possibilities that bear watching.

Fed Tightening, Economic Woes and an Epidemic Can Spur a Market Crash

Potential causes of a stock market crash could include monetary policy tightening by the Fed, a pronounced economic downturn and a deadly epidemic that disrupts commerce, travel and other normal activities while killing previously healthy people. However, the U.S. central bank has moved to cut interest rates in the past year, so that monetary policy risk is unlikely to cause a stock market crash anytime soon.

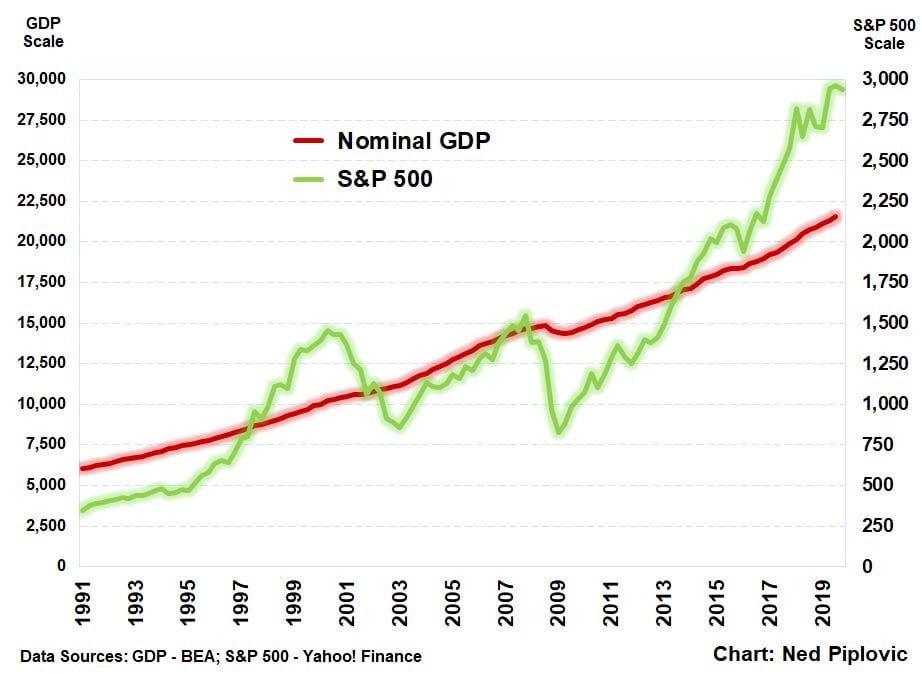

The Fed tried tightening U.S. monetary policy in 2017-2018 to keep inflation at bay, but it appeared to be an overreach, and the central bank later reversed itself by cutting rates to avoid an economic downturn. The S&P 500 responded by rallying amid sustained growth in nominal gross domestic product (GDP), which includes the rate of price changes in the economy, unlike GDP.

Economist Mark Skousen, PhD, who heads the Forecasts & Strategies investment newsletter, opined that a correction in the market would be healthy. Dr. Skousen, who also champions the gross output (GO) statistic that measures economic growth at all stages of production, contrary to GDP’s focus only on the production of final goods, indicated he remains fully invested but cautious about giving his subscribers any new recommendations right now.

Bob Carlson, who leads the Retirement Watch advisory service and serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said Fed tightening is unlikely to happen in the near future. Nine Fed rate hikes of .25 percent each from December 2015 to December 2018 “did not go well,” he added.

Central bankers now know that the U.S. and global economies won’t fare well under tight monetary policies, Carlson said. But other potential events could trigger a market decline or crash, he continued.

A Weakening Chinese Economy Could Cause a Stock Market Crash

“A major concern is China’s economy,” Carlson said. “Most Asian economies are heavily dependent on China to buy their exports, and a significant portion of Europe also is dependent on China.”

But China’s growth has been slowing steadily in the last few years. That reduced growth has been intentional, since China’s leaders want to slow the pace of taking on additional debt, Carlson said.

“They also want to shift from an export-driven economy to a domestic consumer-driven economy,” Carlson said. “It is not an easy transition to manage, and the leaders could make a mistake at any time. They’ve had a few close calls in recent years but so far have avoided a sustained decline.”

Political Risk in China Also Could Cause a Stock Market Crash

Political risk in China also bears watching, Carlson said. China’s leaders have been unified and strong for a while but protests in Hong Kong and the recent coronavirus outbreak and its ill effects could cause political instability, he added.

“An escalation of the trade conflicts leading to less global trade also is a concern,” Carlson said. “For now, these issues are on the back burner. They probably won’t arise again until after the 2020 elections in the United States, but that’s not a sure thing.”

Global politics in general also could trigger a market crash, Carlson cautioned. There are a wide range of potential causes, he added.

Iran’s Propensity for Conflict Poses Risk to the Stock Market

“At the top of the list is continuing conflicts with Iran,” Carlson said. “Close behind is the rise in populism around the world which could lead to political and policy changes in major countries.”

Such changes could cause reduced trade and international cooperation, Carlson cautioned.

“Europe is a continuing problem,” Carlson said. “There hasn’t been much progress in improving the fundamentals there since the financial crisis and the continent’s debt crisis,” Carlson said. “The continent remains in a deflationary depression with negative interest rates in many countries. Europe remains in danger of spiraling down and dragging the rest of the global economy with it.”

Bob Carlson answers questions from Paul Dykewicz during an interview.

Domestic Disruption Could Cause a Stock Market Crash

A stock market crash could be caused by domestic disruption that may occur if a Democrat is elected as the next U.S. president and boosts corporate tax rates, said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the GameChangers advisory service.

In 2018, S&P 500 per-earnings rose from $135 to $161, largely due to the Tax Cuts and Job Acts of 2017, recalled Kramer, whose new book GameChanger Investing launched this month.

“This year’s election looks like it could go either way, and should a Democrat win, there is a good chance this legislation, which reduced the top U.S. corporate tax rate, will be repealed,” Kramer said. “And I believe this is the case even if Republicans should hold the Senate, as I believe they will be under immense pressure to make a deal with the new president.”

Reduced Corporate Earnings Due to Tax Hikes Could Be ‘Devastating’

Given the current aggressive valuations in the market of nearly 20 times this year’s earnings per share (EPS) estimates, reduced earnings due to tax hikes would be “devastating,” Kramer cautioned. The next election also presents risks beyond taxes, she added.

Increased public debate about wealth inequality could lead to other tax hikes in the form of extra costs for companies to pay for the childcare of their employees, along with decreased profit margins for health care companies that may be pressured to price their services more transparently and affordably than they do now, Kramer said. While any legislation that would bring these changes about may be good for many people, they will be bad for corporate earnings at a time when there will be no room for error, she added.

Keep in mind that the federal budget remains “unsound” and excess U.S. national debt will have “lasting impact,” continued Kramer, who also leads the Value Authority advisory service.

The total U.S. government debt now tops $23 trillion. America will have a deficit of more than $1 trillion in the federal fiscal year ending Sept. 30.

Unsustainable Federal Debt Increases Could Cause a Stock Market Crash

“While we have had larger deficits, to have one this large when the economy is relatively strong and interest rates are so low is unprecedented,” Kramer warned. “These deficits are in large part what is driving Fed efforts to keep interest rates low, or else financing these debts would become more difficult. With much of the budget going to entitlements and interest payments, there is little room for budget cuts, and any tax increase to make a difference would be so large the economy would be hurt.”

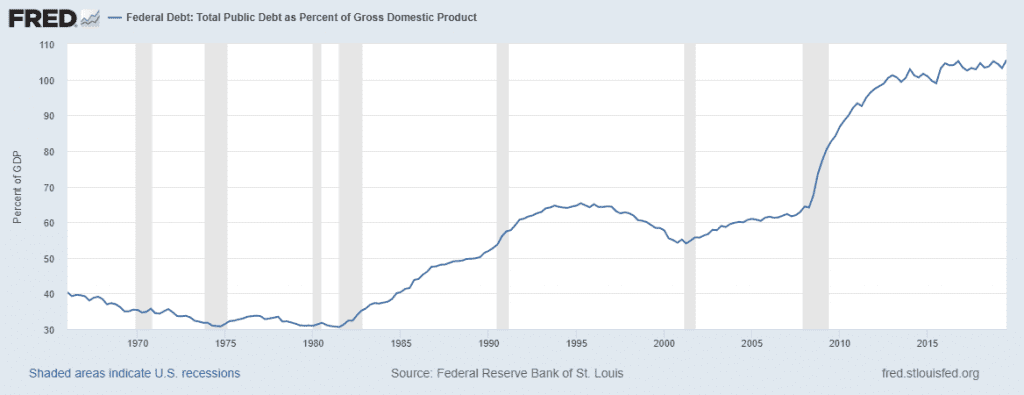

The “end game” may result in America following the path of Japan, with its national debt to GDP ratio of 236 percent — the highest in the world when compared to national income, Kramer said. Banks must hold large quantities of Japanese government bonds, which restricts lending, she added.

“This has caused Japanese economic growth to be limited since the 1990s,” Kramer cautioned. “With national debt at 106% of GDP, the United States is a way from being like Japan, but if we keep adding $1 trillion to the national debt each year, our ratio will start to accelerate. Our deficit situations will only get worse as the population ages and more will be spent on seniors.”

While Fed policies aimed at keeping rates low to trim the impact of rising debt levels have aided the market short-term, they also create risk by causing bubbles in certain sectors such as growth stocks, said Kramer, whose 2-Day Trader service has profited in 81 percent of its trades for a 9.65 percent average gain since launching in July.

Now, price-to-earnings (P/E) multiples above 50 are “very common,” Kramer said.

“At some point, these bubbles will burst, most likely when we see the inevitable slowdown in the growth of cloud computing,” Kramer said. “Also, the Fed policies have encouraged companies to take on debt to buy back stock, with Home Depot being perhaps a notable example of this. This works fine, until we have a recession and the extra interest cost companies have taken on leads to a sharper decline in earnings than would normally occur in a recession.”

A total of $80 trillion in debt has been added worldwide since the 2007-2008 global financial crisis. This debt will be a burden when the next recession hits, Kramer warned.

Passive Investment Funds Could Trigger a Stock Market Crash

Passive investing in index funds carries unseen risks, Kramer cautioned.

Such passive index funds now equal the amount in actively managed funds in the United States, with each holding around $4.25 trillion. However, most of the incremental dollars have been going into passive funds, Kramer continued.

This has been a boon to the average U.S. investor, who has profited by staying disciplined consistently through the bull market of the last decade, Kramer said. This has also provided a good flow of funds to stocks, since investors only need to be concerned about the “market” and worry little about individual stock risk, she added.

However, a sustained downturn, with little or no buying on the dips, could end the money flow into the market and, in fact, spur withdrawals, especially as the growing number of older workers begin to prepare for retirement and opt to lock in profits, Kramer said. The result could be deepened losses on the downside once selling starts, she added.

If investors have been lulled into complacency amid easy monetary policy, the consequences may include excessive risk taking, bloated stock valuations and profligate federal spending that keeps the deficits soaring. With central banks around the world pressured to keep rates low to let governments pay the interest on their mushrooming debt, a stock market crash seems inevitable. Only the timing remains unknown.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.