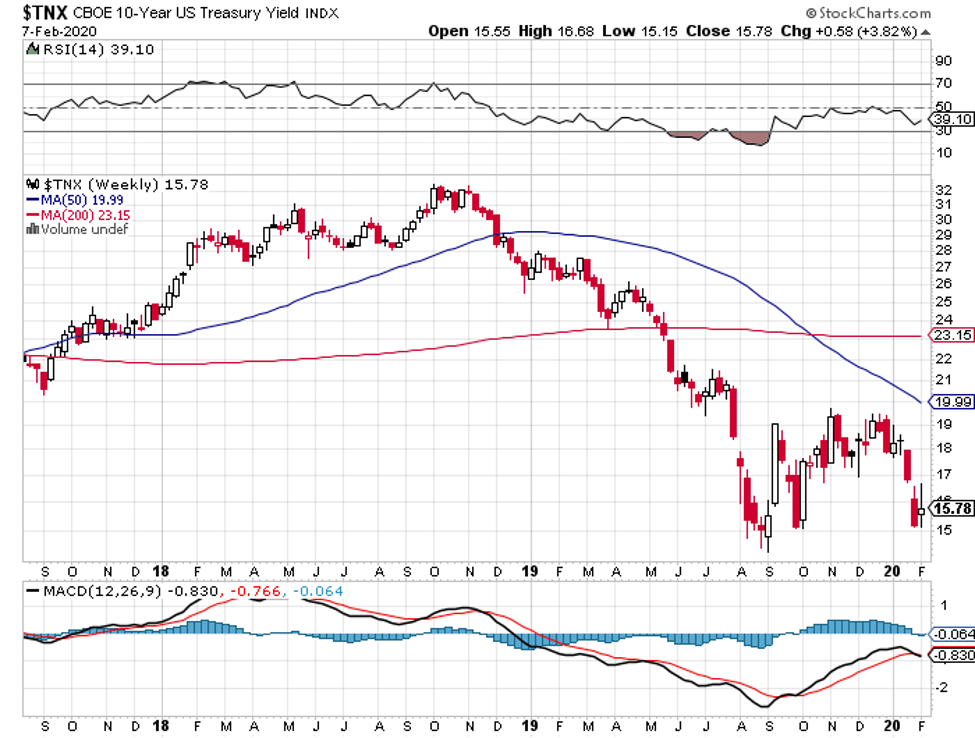

After a period of relative calm following the finalizing of the Phase One trade deal, volatility has re-entered the market. This has sent stock valuations lower and bond prices sharply higher.

Yields across the curve are plunging with the 2/10 year spread briefly inverting as of Jan. 31. The two-year T-Note yield is 1.58% and the 10-year T-Note yield stands at 1.59%, in contrast to Jan. 2, when the spread stood at a comfortable 33 basis points.

Bond traders aren’t necessarily raising a red flag for the economy, but instead the spread of coronavirus is fueling risk-off bets in the stock market as authorities struggle to contain it. To put the bond rally into perspective, the yield on the benchmark 10-year Treasury is testing the lows of the past 20 years, matched only in early 2012, the first quarter of 2016 and again in the third quarter of 2019 amid the peak of the trade war.

One real-time development that deserves every investor’s attention is how the bond market’s fear gauge is trading just off its lows, which means we may well have not seen the worst of the yield curve’s volatility. The 10-year U.S. Treasury Note Volatility Index (TYVIX) — the bond market’s equivalent to the CBOE VIX — closed at 4.49 on Friday. This figure was way off the highs that we have seen in prior spikes in bond prices during periods of elevated short-term fear and uncertainty. Could this disconnect foretell of a further plunge in Treasury yields? The answer is, quite possibly, yes.

The most recent Fed statement changed little from its Dec. 11 Federal Open Market Committee (FOMC) meeting. The Fed statement indicated, “Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee decided to maintain the target range for the federal funds rate at 1‑1/2 to 1-3/4 percent.

“The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2 percent objective. The Committee will continue to monitor the implications of incoming information for the economic outlook, including global developments and muted inflation pressures, as it assesses the appropriate path of the target range for the federal funds rate.”

So, what seems best in class for income investors who are looking for an attractive yield that is becoming scarcer by the day? Given the robust nature of Q4 sales and earnings results from big-cap tech companies and how solid the outlook is for the continued build-out and expansion of 5G infrastructure, cloud computing and logistics for e-commerce distribution, investors should look to three high-tech real estate investment trust (REIT) sub-sectors for dividend growth and capital appreciation.

Data Center REITs — There are five listed stocks in this space. Among them, CoreSite Realty Corp. (COR) sports the highest dividend yield of 4.33%.

Cell Tower REITs — There are three listed stocks in this space, with Crown Castle International (CCI) boasting the highest dividend yield of 3.20%.

Industrial Logistics REITs — Among the 15 stocks in this space, Industrial Logistics Properties Trust (ILPT) is the purest play, and Amazon.com is the largest tenant. ILPT also pays a very attractive dividend yield of 5.66%.

The REITs mentioned above, and the balance of those that weren’t, barely budged within the current market correction. They all can be researched at www.reit.com. This is what I like to describe as a “ballast income” when market seas are rough — offering a good way to consider having some assets in sectors that are enjoying strong compounded annual growth rates (CAGR) and a history of rising dividends with yields of two, three or even four times that of the 10-year Treasury note. It is an attractive investment proposition for sure.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)