The recent fall in the market due to the global spread of the coronavirus has forcibly reminded us of the old adage, “what goes up, must come down.”

In fact, that maxim is truer now than it was when the market seemed to only go up. At a time of such global uncertainty, there are ways for investors to profit, even when the market is sliding as it did last week and one path is through the judicious use of inverse exchange-traded funds (ETFs).

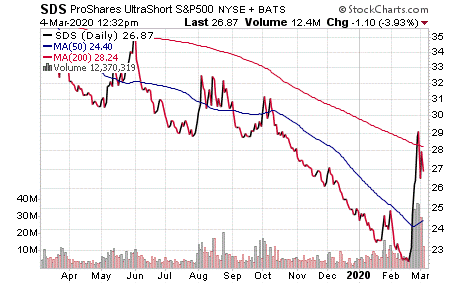

The ProShares UltraShort S&P500 (NYSEARCA: SDS) is an inverse ETF that seeks investment results which correspond to two times the inverse (-2x) of the performance of the S&P 500. The ETF provides exposure to a market-cap-weighted index of 500 large- and mid-cap U.S. firms that the S&P committee selects.

It is worth pointing out that this fund, like most leveraged and inverse ETFs, is designed to provide a positive return at a time when the S&P 500 is dropping. However, SDS, and inverse ETFs in general, do their best work when they are held for only a short time. Holding on to shares of SDS for longer periods is a tricky proposition, as it always is difficult to determine how long a market downturn will last. Thus, it is best to avoid undue risk of confusing a temporary aberration with the start of a bear market.

Furthermore, failing to rebalance SDS shares regularly, especially at a time of heavy market volatility, has the possibility of leaving investors vulnerable to performance drift from the S&P 500 index. This means that it is possible for the value of your shares to fall even as the market moves in a desirable direction.

Chart courtesy of StockCharts.com

The fund currently has more than $1.2 billion in assets under management and an average spread of 0.04%. It also has an expense ratio of 0.89%, meaning that it is more expensive to hold than some other ETFs.

According to Morningstar.com, this fund’s performance has been positive in both the short and long run. As of 3/3/2020, SDS has jumped 14.12% in the past month, 3.14% for the past three months and 12.51% year to date. This is not surprising, since the S&P 500 yielded negative returns during parts of each of those time periods.

In short, while SDS does provide an investor with the ability to profit at a time when the S&P 500 is yielding negative returns, inverse ETFs may not be appropriate for all portfolios. Thus, interested investors always should do their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)