Stock market crash safety sought by concerned investors is coming in the form of shiny precious metals that include gleaming gold and silver coins.

Even though stock market drops usually coincide with a price hike in gold and silver, both equities and precious metals soared on March 24 when the Dow Jones Industrial Average jumped 11.37%, or 2,112.98 points, to reach 20,685.04 for its biggest percentage gain since March 1933 and its largest point rise ever. The Federal Reserve Board’s repeated intervention in recent weeks to enhance liquidity for financial institutions and corporations may have helped to mitigate a credit crisis and show that the U.S. central bank is willing to adopt inflationary policies that should boost the value of gold and silver.

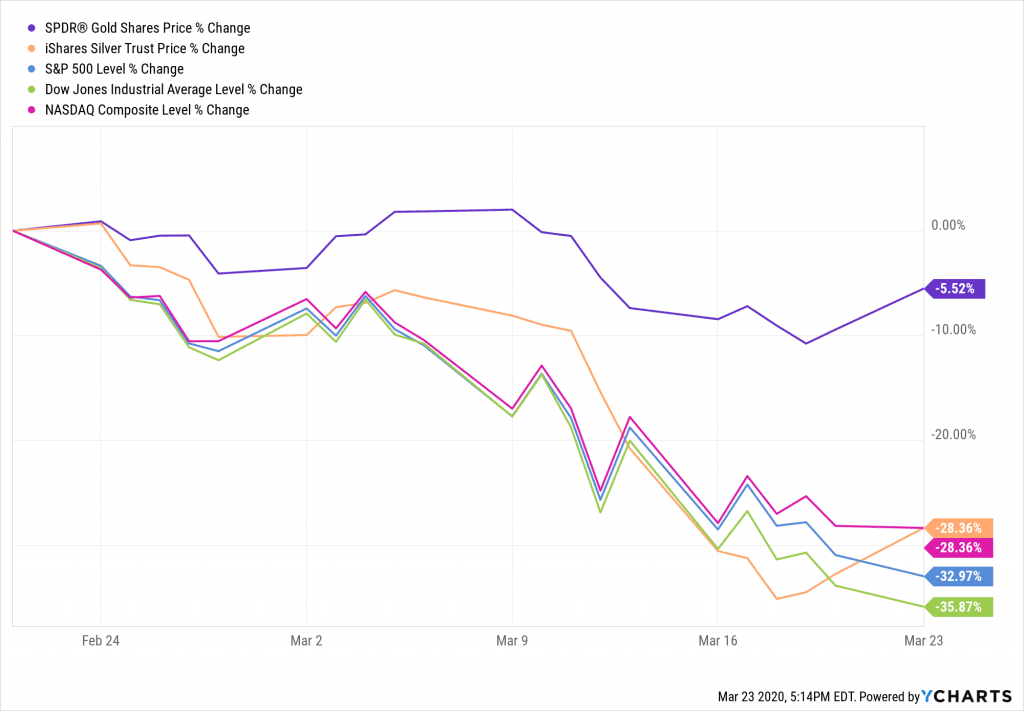

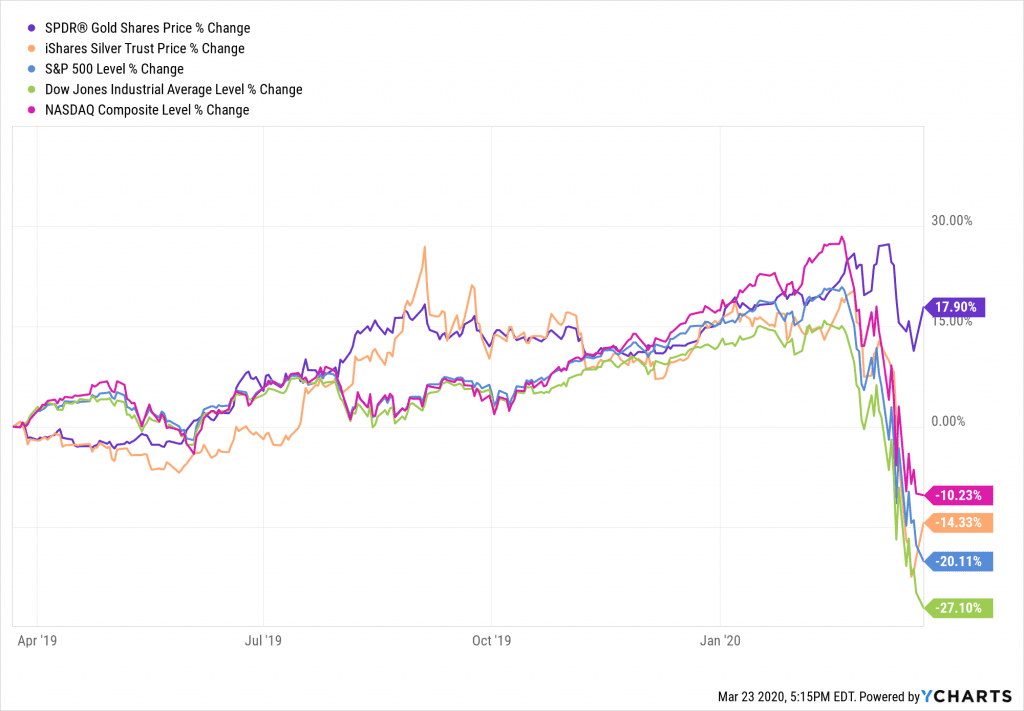

Chart of the prices of gold (purple line) and silver (orange line) as compared to market indices, one month

The longest and biggest bull market in history ended abruptly as the S&P 500 plunged more than 30% in just 22 trading days to drop from its all-time high on Feb. 19. That rapid descent more than met the 20% plummet required to qualify as a bear market and caused many market observers to describe it as a stock market crash precipitated by the spread of the deadly coronavirus, also known as COVID-19.

The Fed panicked by cutting short-term federal fund rates to zero and restarting its quantitative-easing (QE) policies, said Mark Skousen, PhD., an economist who is a Presidential Fellow at Chapman University and leader of the Forecasts & Strategies advisory service. Skousen opined that he has never seen so much “unwarranted hysteria” amid growing fear from the coronavirus and cautioned that big economic trouble will ensue if the ongoing global shutdown lasts much longer.

Coronavirus Complicates Search for Stock Market Crash Safety

“It seems that the treatment — quarantine, hoarding and closing of businesses — is worse than the disease,” Skousen said. “It is like using a sledgehammer to crack a nut.”

The coronavirus-related stock market plunge, aside from hurting investors, has caused 18,892 deaths and 422,614 infections worldwide as of March 24. The United States now ranks third, behind China and Italy, among the countries with the most confirmed cases, totaling 54,808, with 775 deaths as of March 24. Public health officials have cautioned that the current scourge is many times more deadly than common influenza.

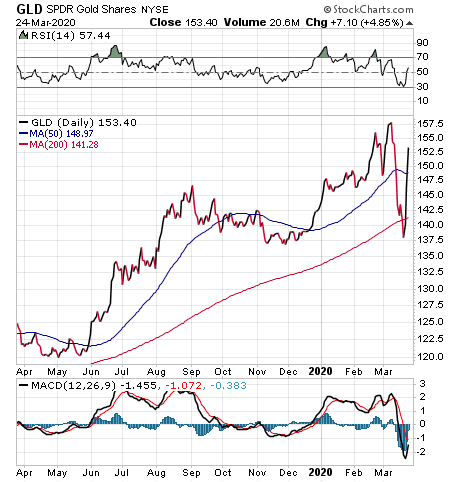

Skousen began to recommend gold as an investment last December as a hedge and his choice of Franco-Nevada Corp. (NYSE:FNV) produced a 24.35% gain, including dividends, before stopping out as the market fell in February. His newest gold recommendation, SPDR Gold Shares (GLD, $140), an exchange-traded fund (ETF) that invests in bullion, is up since he featured it on March 2. It zoomed 4.85% on March 24.

Chart courtesy of www.StockCharts.com

“Central banks everywhere are engaged in a new round of easy money, which is good news for gold and the mining business,” Skousen advised in his trading services that include Five Star Trader, TNT Trader, Fast Money Alert and Home Run Trader.

Mark Skousen piles silver dollars on copies of his “Maxims of Wall Street” book.

The “cash is king” argument just doesn’t add up in an economic environment where the value of fiat currency such as the U.S. dollar is reset day by day through monetary policy easing and fiscal policy stimulus, said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the GameChangers advisory service. As a result, Kramer said she favors preserving purchasing power by using U.S. dollars to buy some bullion, consisting of gold and silver coins produced by government mints, bars or rounds made by private mints that charge significantly less for the same precious metal content as the U.S. mint or other sovereign mints, she added.

Precious Metals Offer Safety from Stock Market Crash Fallout

Precious metals do not appreciate about 95% of the time, but when Treasury debt doesn’t even pay 1% or much above zero, investors are not sacrificing huge returns by keeping money in a bank, said Kramer, who also leads the Value Authority advisory service. Right now, the “real crown” of any portfolio consists of gold, she added.

“What I suspect is really happening is that some institutional investors are selling across their holdings to raise cash and make margin calls at a moment when traditional big bullion buyers in Asia are distracted,” Kramer said. “Motivated sellers plus an absence of buyers drives prices down.”

However, gold jumped 3.5% on Monday, March 23, in an apparent sign that the pressure has eased on investors who borrowed heavily and needed to sell gold and other assets to raise cash fast to meet margin calls on their brokerage accounts. Such selling of gold and silver when the stock market has fallen in the past couple of months deviates from the normal inverse relationship between precious metals and equities, but understanding the situation helps investors avoid drawing false conclusions.

Buy Gold and Silver on Dips to Gain Stock Market Crash Safety

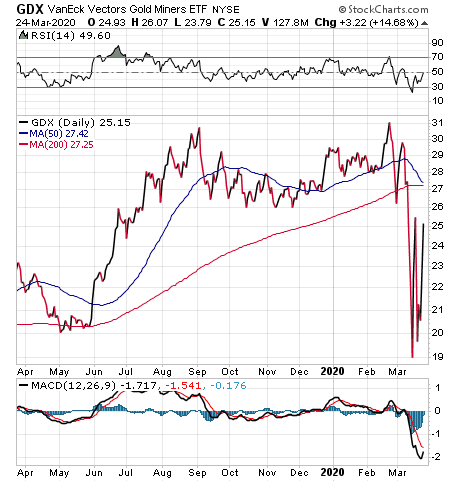

“Maybe 5% of your portfolio in gold is all it takes to cushion economic shocks,” Kramer said. “With SPDR Gold Trust (GLD) down from its recent peak, now is the time. From there, you can move toward the miners, most of which have been battered in this downturn, or buy a little silver as well. Start with VanEck Vectors Gold Miners ETF (GDX) if you want the companies that dig the ore or iShares Silver Trust (SLV) if you want white metal. Silver has been challenging in the absence of inflation or strong industrial demand, but this could finally be the year it comes into its own.”

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

A $2 trillion federal stimulus bill to help counter the economic blow from the coronavirus is designed to help laid-off workers, small businesses, airlines and others that are struggling due to the economic hit. The spending bill and the Fed’s monetary policy measures, combined with 0 percent interest rates, should be positive for gold.

“Even though this figures to be a very severe recession, bordering on a depression, it will be quick with a fast recovery,” Kramer said. “However, I doubt this will stop the Fed from taking the foot off the pedal, adding to the threat of inflation. Being patient with gold now could pay off “

Paul Dykewicz interviews Hilary Kramer, whose advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Precious Metals Coin Dealers Can Provide Stock Market Crash Safety

The premiums for gold and silver bullion purchases have been in the 10% range lately but one seller who had 100, 100-ounce silver bars asked for a 25% premium, or $4 above the spot price, on March 24, said Van Simmons, who heads David Hall Rare Coins in Santa Ana, California. The offering price was too inflated to accept, Simmons told me, but two minutes later the prospective seller emailed back to report another dealer bought them.

“I have trouble being gouged on pricing and then expected to pass it on to clients,” said Simmons, who told me he laughed when he heard the seller ask for a 25% premium above the spot price for silver.

However, the U.S. Mint recently ran out of silver eagles due to strong demand, Simmons said. Gold eagles are still available, he added.

“The spreads on gold eagles are usually around 1%,” Simmons said. “The spreads on pre-1933 $20 gold coins are around $30 to $50.”

Simmons told me about a wholesaler who called him late on March 24 and inquired about selling gold for $60 over the spot price on the world market, even though the usual spread is $10.

“Unbelievable,” Simmons told me.

Van Simmons, of David Hall Rare Coins, said investors are buying gold as an “island of safety.”

“We have been selling quite a bit of gold in the last couple of days,” Simmons said. “Many investors are just looking for an island of safety.”

‘Wealth Insurance’ with Gold and Silver Supports Stock Market Crash Safety

Well-diversified investors should consider putting 10% of their assets in “wealth insurance” using gold and silver, said Rich Checkan, president and chief operating officer of Asset Strategies International, a full-service tangible asset dealer in Rockville, Maryland.

“If I have a crisis, I sell it immediately to meet my financial obligations, then replenish it as soon as possible for the next crisis,” Checkan said. “In looking to profit in a crisis, I like a mixture of gold, silver, platinum and palladium. I really like silver here for-profit oriented purchases.”

For emergencies, Checkan said he favors 1-ounce gold coins and 1-ounce silver coins or pre-1965 90% U.S. silver coins. The latter coins commonly are called junk silver because the material is so rubbed off it is not suitable for collectors, but the silver content largely remains and still can be measured reliably. In addition, silver prices have lagged gold and offer further capital appreciation potential at this point than the yellow metal, Checkan added.

Despite rising demand, there is no shortage of gold and silver, Checkan told me. However, there is a “big shortage” of fabricated, retail bullion bars and coins from all sources, he continued.

With airlines canceling flights and many countries advising people to stay home due to the threat of the deadly coronavirus, delivery times for gold and silver purchases can be “very long,” the premiums charged are high and prices are climbing, Checkan said.

Volatility Has Complicated Search for Stock Market Crash Safety

The volatility of precious metals prices lately has been massive, Checkan told me. On the morning of March 24, gold fell 5% in one minute after rising 7% overnight, then rallied to finish the day up 5%, he explained.

Stocks also have ridden the roller-coaster ride of volatility, with the Dow dropping 1,000-plus points on March 23, before surging more than 2,100 points the following day to achieve a record rise.

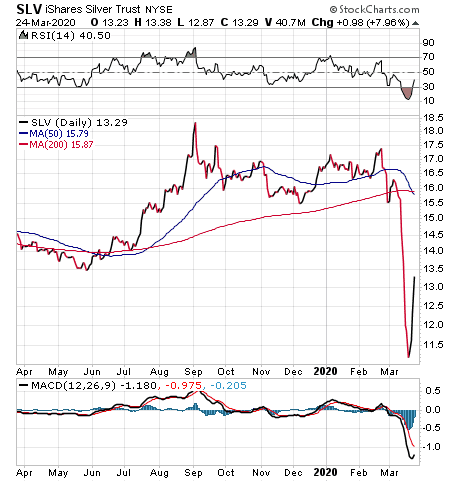

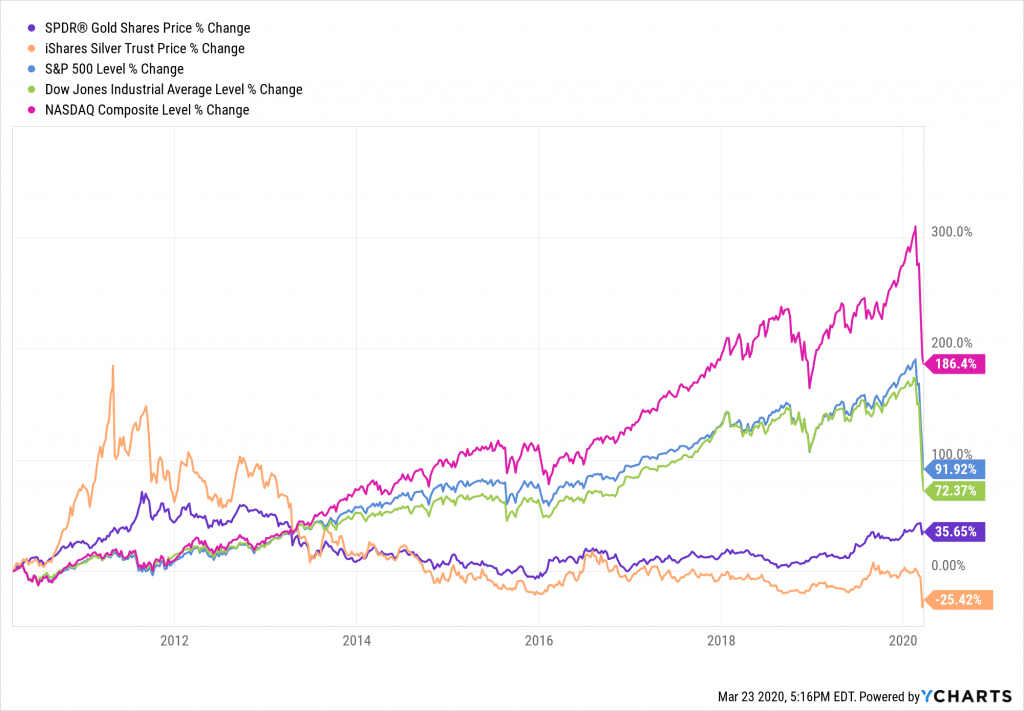

The markets for both precious metals and stocks are reacting to news as it unfolds each day, Checkan said. But the trend thus far in 2020 is clear with the Dow down 28%, the S&P 500 plummeting 25%, the NASDAQ nosediving 18%, while gold has gained 7.5%.

Chart of the prices of gold (purple line) and silver (orange line) as compared to market indices, one year

“With all the stimulus, in varying forms, that is expected to be injected into this market, expect gold to make new all-time highs before the bear returns to the precious metals market,” Checkan said. “You cannot expand the money supply on this order without driving the gold price to the moon.”

Rich Checkan, of Assets Strategies International, analyzes precious metals pricing.

Patrick Heller, communications officer of Liberty Coin Service in Lansing, Michigan, said he observed a jump in demand among buyers of precious metals coins and other bullion before Michigan Gov. Gretchen Whitmer’s “stay-at-home” executive order on March 23 forced non-essential businesses to close to curb the spread of coronavirus.

Activity at the store on March 23 before the executive order to close took effect at midnight slowed “significantly” from recent days, Heller said. Even so, the coin dealer in the capital of Michigan sold an above-normal amount of bullion-priced gold and silver on March 23 compared to days of the past two to three years, he added.

“Typical orders are much larger than average,” Heller told me. “Very little is being liquidated by the public.”

U.S. Government Intervention Helps Provide Stock Market Crash Safety

The price of gold and silver stayed strong on March 23 after the announcement by the U.S. government that it will flood the money supply to whatever degree of financial help is needed, Heller said. Such an announcement pretty much guarantees that precious metals prices will keep rising and the value of the U.S. dollar will depreciate, he added.

The $83 increase in the gold price from the close on Friday, March 20, to the close on Monday, March 23, was the largest one-day jump Heller said he could ever remember.

“In gold products, I really like the lower premium forms such as U.S. American Arts Medallions, issued from 1980-1984; Austria 100 coronas; and Mexico 50 pesos, Heller said. “But we have seen that most people really prefer to own exact 1-ounce gold content coins and ingots. For them, the Canada 1-ounce Gold Maple Leaf and the 1-ounce Ingots have competitive premiums.”

Chart of the prices of gold (purple line) and silver (orange line) as compared to market indices, ten years

Liquidity Squeeze Could Ease and Enhance Stock Market Crash Safety

Bob Carlson, who is chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, told me the current liquidity crisis and panic will continue until the right combination of monetary and fiscal policies convince investors that businesses will be able to gain the cash they need to prevent insolvency. The inability of Congress to pass a federal stimulus package quickly has hurt the markets, as well as those who urgently need help amid layoffs and business closures.

In recent weeks, there have been days when gold and silver fell as investors sold anything they could to raise cash, said Carlson, who also leads the Retirement Watch advisory service. With gold jumping March 23 and 24, it signals that enough of the panicked investors previously sold gold, he continued.

“Investors who are seeking traditional safe havens now are pushing up the price,” Carlson said. “I expect whenever the liquidity crunch ends that gold will rise, as it did in 2008 and 2009. A lot of money is going to flood into the economy and markets following actions by the Federal Reserve and the government, plus similar actions from authorities around the globe. People will want an investment that provides protection against both inflation and crisis. Gold meets that description.”

Bob Carlson answers Paul Dykewicz’s queries during an interview.

Investors seeking stock market safety can find it in gold and silver bullion, but particularly through the strategic purchase of precious metals coins. However, it is important for investors to work with reputable coin dealers who are transparent about the pricing and premiums to avoid overpaying when many others also are seeing the merit of searching for safety in shiny precious metals.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.

![[gold pill]](https://www.stockinvestor.com/wp-content/uploads/3022618543_9ab124cc98_b.jpg)