Stock market crash recovery stocks to buy include five dividend-paying dandies that not only offer income but strong potential for share-price appreciation.

Several of the stock market crash recovery investments that pay dividends are engaged in health care services that should be in strong demand during and after the current coronavirus crisis. The opportunity to invest in dividend-paying stocks that offer potent growth prospects includes the chance to buy them at reduced prices after the stock market crashed roughly 30 percent in six weeks from Feb. 24 to March 16 as coronavirus cases spread from China and Europe to the United States.

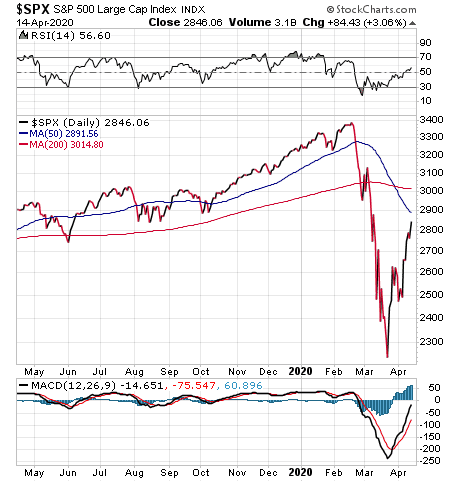

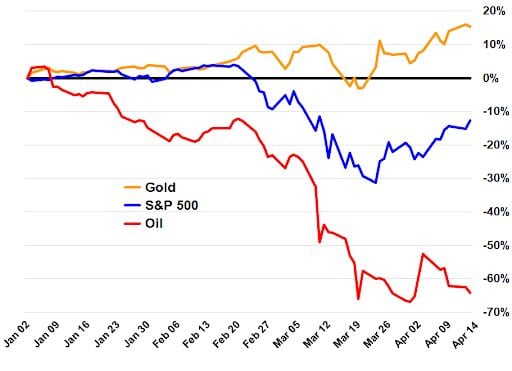

Between Feb. 24 and the close of trading on Monday, March 16, the Dow Jones Industrial Average (DJIA) tumbled 31%, the S&P 500 dove 29% and the Nasdaq tanked 30%. Those indexes have recovered substantially since then, including a 15% gain in the market during the past week.

Chart courtesy of www.StockCharts.com

Three dividend-paying investments earned the recommendation of Mark Skousen, PhD, a presidential fellow in economics at Chapman University, the longtime editor of Forecasts & Strategies and the author of more than 25 books on economics and finance. Two health care stocks ranked among the best dividend-paying choices of Skousen, who has been named one of the top 20 most influential living economists.

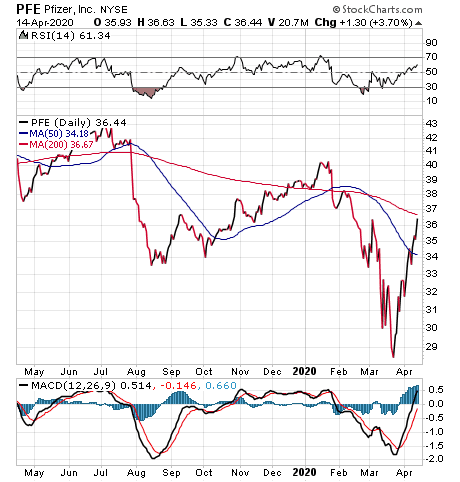

Pfizer Payouts Fuel Appeal as Stock Market Crash Recovery Choice

One of Skousen’s favored dividend stocks is New-York-based pharmaceutical company Pfizer (NYSE:PFE), offering a 4.17% current dividend yield and teaming up with Germany’s BioNTech to produce a vaccine for the coronavirus, also known as COVID-19. The companies plan to start human testing of the potential vaccine this month, they announced on April 9.

BioNTech will contribute multiple ribonucleic acid molecule (mRNA) vaccine candidates as part of its BNT262 COVID-19 response and collaborate with Pfizer to supply potentially millions of vaccine doses by the end of 2020, with plans to scale up capacity to hundreds of millions of doses in 2021. Pfizer would provide vaccine clinical research and development, regulatory, manufacturing and distribution infrastructure.

As part of the arrangement, BioNTech will receive an initial payment of $185 million, including an equity investment of approximately $113 million. BioNTech also will be eligible to receive future milestone payments up to $563 million for a potential infusion of $748 million.

Chart courtesy of www.StockCharts.com

The companies announced plans to partner on BNT162, the first treatment to emerge from BioNTech’s COVID-19-focused development program, called “Project Lightspeed.” BioNTech and Pfizer established a collaboration intended to tap BioNTech’s proprietary vaccine platforms.

The coronavirus crisis has caused government leaders around the world to order people to stay indoors with few exceptions as the number of cases and deaths zoomed to 1,998,111 and 126,600, respectively, as of April 14. Worldwide cases in the past week, as of April 14, jumped 363%, up from 66.7% the previous week, while deaths rose 54%, compared to 95% in the prior week. In the United States, the growth rate in cases climbed 53% to 613,886, compared to 112% the prior week, with deaths increasing 103% to 26,047, compared to a 230.5% surge the previous week and slightly more than one-fourth the 402% spike the week before that one.

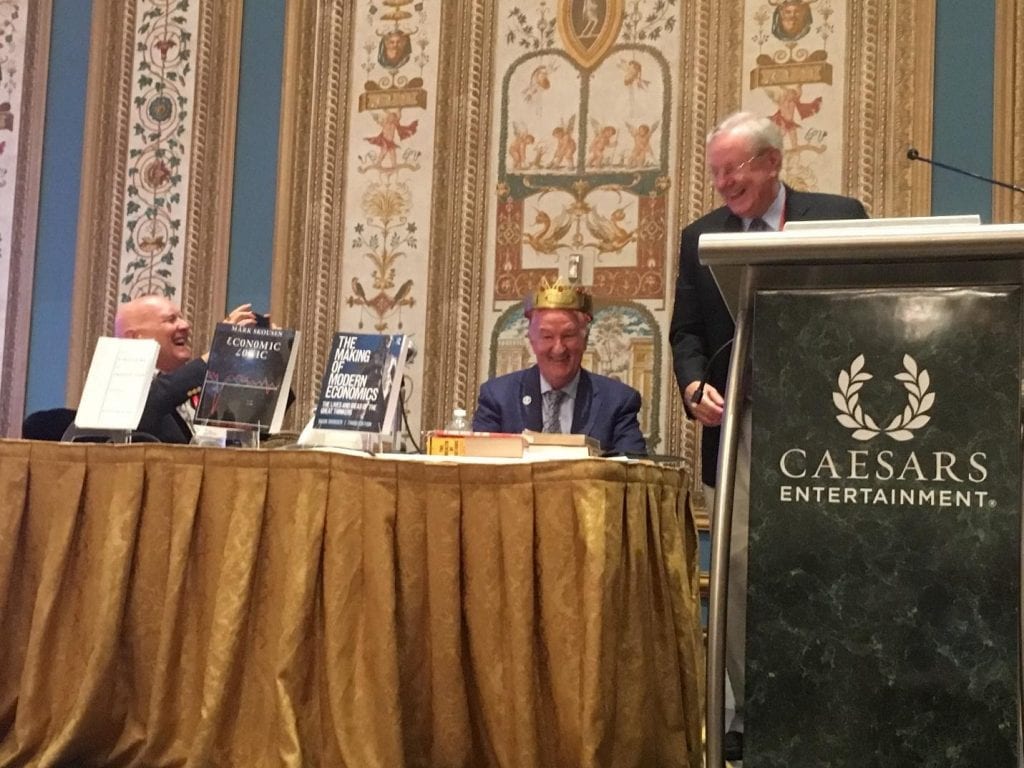

Mark Skousen, PhD, receives the “Triple Crown in Economics” from media mogul Steve Forbes, as economics professor Ken Schoolland takes a photo. Skousen leads advisory services that include Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert. Photo credit: Paul Dykewicz

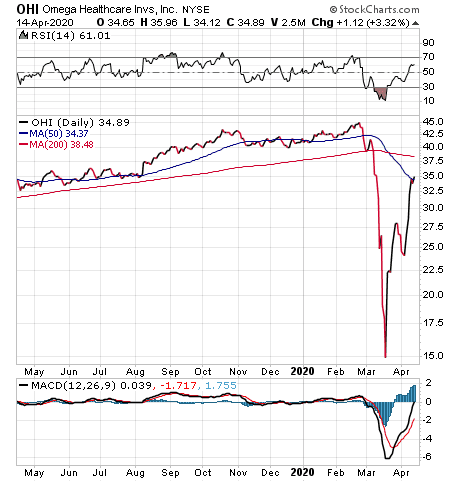

Health Care REIT Ranks as Stock Market Crash Recovery Investment

Omega Healthcare Investors (NYSE:OHI), a Hunt Valley, Maryland-based real estate investment trust (REIT) focuses on senior health care facilities and offers a current dividend yield of 7.94%. Omega Healthcare has demographics on its side, since the aging “baby boomer” population, composed of those born between 1946 and 1964, increasingly will need the skilled nursing and assisted living facilities that the company offers through its roughly 1,000 properties.

The Census Bureau’s projection shows positive demographic trends for health care REITs. The baby-boomer generation will total 61.3 million in 2029, when the youngest in that cohort reach age 65. If those born before 1946 are included, people age 65 and older in 2029 will total 71.4 million, or 20 percent of the U.S. population, compared to just under 14 percent in 2012.

Industry data indicate the use of skilled nursing facilities begins to increase more meaningfully when people reach 75 years old and climbs each year thereafter. The first of the baby boomers turned 75 in 2015 and a 20-year tailwind of favorable aging demographics for the industry seems to be underway.

Risk of Default on REIT’s Loans Dim Stock Market Crash Recovery

The fear is that Omega Healthcare will see defaults on its triple-net-lease loans to nursing homes and assisted living facilities, as occurred in Texas a few years ago, Skousen said.

“Until this crisis, Omega was doing extremely well, with profit margins of 37%,” Skousen said. “The stock hit $42 a share in January. Suddenly, it fell in half. Nonetheless, on Thursday, March 19, Omega Healthcare rallied almost 50% in one day. That’s how crazy this market has gotten.”

The health care REIT supports the goals of skilled nursing facility and assisted living facility operators with financing and capital. It partners with more than 70 operators in the United States and United Kingdom to propel their growth strategies with a $1.25 billion unsecured credit facility and access to public equity and debt markets worldwide.

Chart courtesy of www.StockCharts.com

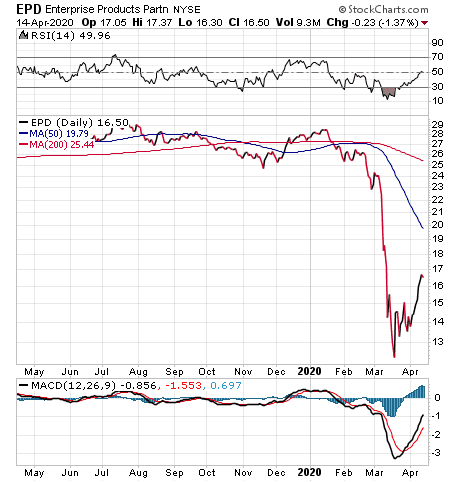

Oil Partnership Gains Nod as Stock Market Crash Recovery Opportunity

Sharply lower oil prices have slammed oil pipeline companies, such as Houston-based midstream energy producer Enterprise Products Partners, L.P. (NYSE:EPD). But the reduced share price of EPD has boosted its current dividend yield to 10.79%.

President Trump brought the feuding oil producers of OPEC, Russia and other non-OPEC countries together for talks that led to an agreement this week to cut output. The deal calls for a production cut of 9.7 million barrels per day (mb/d) from May 1-June 30, then 7.7 mb/d from July 1-Dec. 31 and finally 5.8 mb/d from Jan. 1, 2021-April 30, 2022.

However, WTI crude futures dipped 2.0%, or $0.45, to $22.42/bbl., indicating that investors were not convinced that the production cuts alone would bailout an industry still facing demand problems caused by COVID-19, said Bryan Perry, a former Wall Street trader who tracks high-dividend-paying stocks in his Cash Machine advisory service. Low prices have hurt oil stocks severely so far this year.

Gold Glides Higher in 2020, While the S&P 500 Is Down and Oil Is Leaking Badly

Chart by Ned Piplovic

However, Enterprise Products Partners announced on March 18 that its board of directors declared a 1.7% distribution increase to $0.455 per common unit to be paid in first-quarter 2020, equaling $1.78 per unit on an annualized basis. The quarterly distribution will be payable on Tuesday, May 12, 2020, to unitholders of record as of the close of business on Thursday, April 30. So far, EPD is staving off a need to cut the dividend to preserve cash.

“Enterprise is currently reviewing its capital expenditure program due to the potential impacts of lower commodity prices and demand on our customers,” said A.J. “Jim” Teague, co-chief executive officer of Enterprise’s general partner. “While substantially all of our major growth capital projects are supported by long-term bi-lateral agreements, we are in discussions with our customers and evaluating opportunities to reduce or defer capital expenditures, as well as continuing to explore joint venture opportunities with strategic partners. We will provide an update to our 2020 capital expenditure guidance in our first-quarter 2020 earnings announcement.”

That first-quarter 2020 earnings report is expected on Wednesday, April 29, 2020, before the New York Stock Exchange opens for trading.

Enterprise Products Partners remains a preferred dividend investment of Skousen, who views it as in “much better financial shape” than ExxonMobil (NYSE:XOM). He predicts that EPD will rebound sharply once the current crisis passes.

In addition, Zacks reported that EPD is “seeing solid upward earnings estimate revision” and is a “great company.” Skousen said he doubts Enterprise Products is at risk of cutting its dividend, since it has increased its payout for 62 quarters in a row.

Chart courtesy of www.StockCharts.com

Late last month, investment firm RBC recommended Enterprise Products Partners as a super bargain, selling at only 6.6 times earnings. Skousen called EPD “a core holding” with a rising dividend policy for the past 11 years.

“The biggest challenge is the glut in oil production due to a slowdown in demand in the past month,” Skousen said.

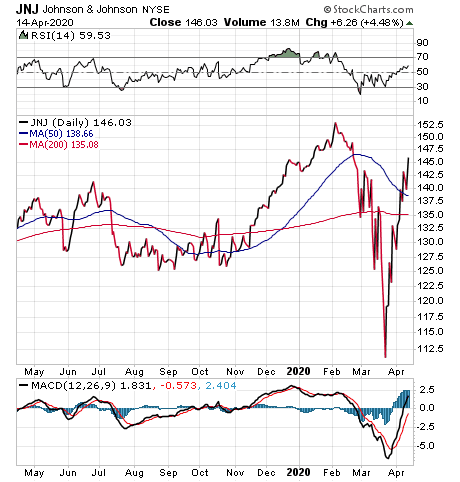

Stock Market Crash Recovery Stocks Feature Johnson & Johnson

“Dividend stocks can be a good way to play this volatile market downturn,” said Jim Woods, who leads the Successful Investing and Bullseye Stock Trader advisory services. “However, you must purchase the right dividend stocks. The reason why is because the likely very deep recession caused by the COVID-19 shutdown of the economy could pressure many good companies into either not raising their dividends this year or even cutting their dividends just to survive the massive loss of revenue.”

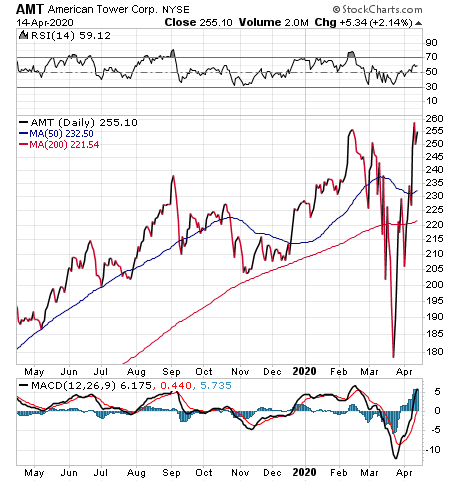

Two dividend stocks Woods recommends are ones he tells me are “largely immune” to the virus. They are diversified health care giant Johnson & Johnson (NYSE:JNJ), of New Brunswick, N.J., with a new annualized dividend yield of 2.89%, and Boston-based cell phone and data tower real estate investment trust American Tower REIT (NYSE:AMT), offering a 2.14% dividend yield.

Johnson & Johnson ranks as one of 30 companies known as Dividend Kings that have boosted their annual payout for at least the past 50 years. Johnson & Johnson announced on April 14 that it raised its dividend from 95 cents a share to $1.01, up 6.3%, beat Wall Street’s earnings and revenue expectations, while scaling back its full-year 2020 financial guidance to adjusted earnings per share of $7.50-$7.90 from $8.95-$9.10.

Stock Market Crash Recovery Prospect Aims to Offer COVID-19 Vaccine

The company is among those in the pharmaceutical industry that are vying to develop a vaccine to combat COVID-19. Officials at Johnson & Johnson announced that the company already has a prospective vaccine for the coronavirus and expects to begin Phase 1 Human Clinical Studies by September 2020, possibly leading to use as soon as 2021 if testing convinces regulators at the Food and Drug Administration (FDA) to approve it as an “emergency” pandemic treatment on a not-for-profit basis.

“With Johnson & Johnson’s century-plus history of leading in times of great challenge, we are mobilizing our resources across the company in the fight against the COVID-19 pandemic,” said Alex Gorsky, chairman and chief executive officer. “Johnson & Johnson is built for times like this, and we are leveraging our scientific expertise, operational scale and financial strength in the effort to advance the work on our lead COVID-19 vaccine candidate.”

Despite the company’s stock receiving a reduced price target to $150 from $165 by Wells Fargo on April 2 and to $153 from $161 by Raymond James on April 9, those pre-earnings downgrades did not stop the stock from rising $6.48, or 4.48%, to $146.03, on April 14, after it reported first-quarter 2020 net earnings of $5.8 billion, jumping 54.6%. Its Q1 revenues of $20.7 billion increased 3.3% from the same quarter a year ago.

Chart courtesy of www.StockCharts.com

Cell Tower Company Rises as a Potential Stock Market Crash Recovery Investment

American Tower has been a stalwart performer for years, yet in mid-March, AMT saw its share price tumble — and it wasn’t just the wider market selloff that prompted the decline, Woods told me. Instead, traders negatively reacted to the rather abrupt resignation by its Chief Executive Officer Jim Taiclet on March 16, 2020. He made the move to take the CEO position at Lockheed Martin (NYSE:LMT), and that created understandable angst on the part of AMT shareholders, Woods opined.

“The reason why is because in addition to having a business model perfectly positioned for future growth — cell phone companies enter into long-term leases with real estate companies that include rent escalators — along with ever-increasing demand for mobile data, AMT also was considered the best-run company in the business,” Woods said.

Yet AMT’s board is filled with “very smart people,” Woods continued. They knew continuity was key to calm investor fears and to continue to run the company in the same winning manner as Taiclet.

“So, AMT’s board immediately named longtime CFO Tom Bartlett as new permanent CEO,” Woods said. “That decisive move calmed investors, and along with the wider risk-on bid in stocks, allowed AMT shares to recoup all of its post-Taiclet losses,” he added

Both JNJ and AMT have been longtime recommendations in the Income Multipliers portfolio of the Intelligence Report advisory service that Woods leads.

Chart courtesy of www.StockCharts.com

The stock market crash recovery offers five reliable dividend-paying stocks, including three focused on health care. In an age of sacrificial service from health care providers caring for coronavirus patients, these stocks offer a chance to buy shares of companies that not only pay dividends and have a chance to appreciate, but also try to help others.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.

![[gold pill]](https://www.stockinvestor.com/wp-content/uploads/3022618543_9ab124cc98_b.jpg)