The snapback rally of the past two weeks has been nothing short of incredible, and the depth and speed of the correction show that emotional headlines simply got the best of the algorithms.

Forced selling by index funds and exchange-traded funds (ETFs) in utilities and consumer staples caused those sectors to fall 38.9% and 26.5%, respectively, before investors came to their senses. Those big drops indicate that much of what drove market rationale in the past can be summarily thrown out the window.

We live in a very different world when the “safe stuff” in the equity markets gets treated like trailer trash and investment-grade bonds get kicked to the curb like bums in a tenderloin district. Yes, these are different times, because the stock market is acting like Terminator 2’s liquid metal T-1000, who just keeps coming after getting pumped full of 12-gauge rounds at short range.

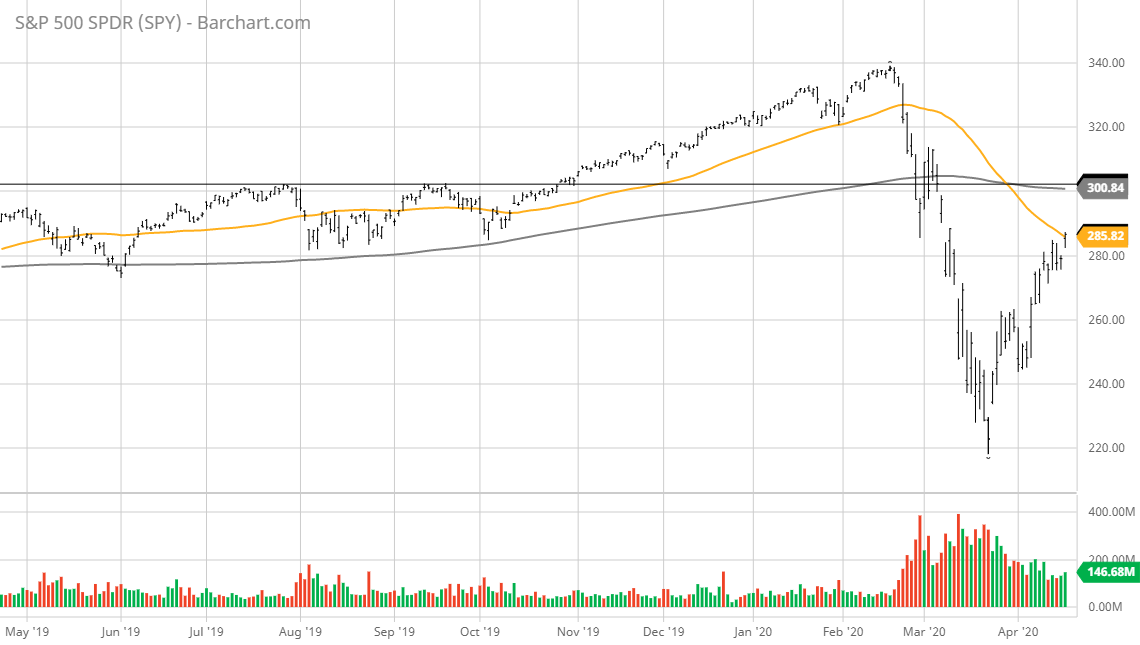

Consider what happened when the market topped out on Feb. 20, then crashed more than 35% to its March 23 lows, before rallying back as of last Friday to within 15.3% of the previous all-time highs for the S&P and 9.2% for the Nasdaq. It has been exactly one month from top to bottom and back up again, with food lines in major cities consisting of 5,000+ cars and the number of unemployed people about to break all records. These are surreal times, for sure.

The coronavirus outbreak could cost 47 million jobs next quarter, according to estimates by the Federal Reserve Bank of St. Louis. That would translate to an unemployment rate of 32.1%, well above the 24.9% rate it was at during the Great Depression. But like many of the COVID-19 models that are now being debunked as grossly inflated, it seems Mr. Market is confident these numbers are also super temporary, and people will be back at work in big numbers faster than first perceived.

Stocks have rallied fiercely in front of the meat and potatoes of earnings season, when all the mega-caps that rule the world of index and ETF investing report their numbers. It will be quite a show to see if big money rushes back into the stocks known as FAANG, featuring Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ:NFLX) and Google’s parent, Alphabet (NASDAQ:GOOG), and MAGA equities Microsoft (NASDAQ:MSFT), Amazon, Google’s parent Alphabet and Apple. Plus, the headiest of health care hotties will be able to build on what has been nothing short of a torrid snapback rally betting 100% on a “V-shaped” recovery.

The economy is much more inclined to undergo a “U-shaped” recovery over the balance of 2020 with the fourth quarter really picking up steam. Let’s face it, the economy and the stock market have just experienced the equivalent of a head-on collision at 75 miles per hour. After the adrenaline wears off, after surviving the initial impact, the effects of whiplash take hold.

So, if there is any relevance to technical analysis anymore, then the one-year chart above of the S&P would suggest that we are about to enter a serious stock picker’s market. As I see it, the rally back for the S&P to the 2,850-2,900 level will pose a stiff test for the index ETF bulls to overcome without some well-deserved back-and-filling. I am not referring to a retest of the lows, just some well-deserved and constructive light-volume “selling on the news” when the best-of-breed companies report.

It is abundantly clear that with the monetary system in full firehose mode, the so-called Powell Put, named after the current Fed chairman, solidly is supporting credit markets, including the junk bonds. Thus, the path of least resistance for the yield on the 10-year Treasury of 0.65% is up. Cheap money is rocket fuel for business investment, household formation and consumer spending, but I, for one, will be surprised if the level of consumer confidence is restored to its previous level anytime soon.

It might for the top 1-10% of wage earners that operate with cutting-edge cloud capability out of their remote home offices. I’m sure all those Sandals Resorts commercials during the evening news hour have tens of thousands of top-end earners booking post-quarantine getaways like white on rice, or white on sand, to these and much more exotic destinations.

For the other 90% of the folks that make up the consumer-driven American economy, I’d say that just maintaining the home they live in will be job #1, building an emergency fund will be job #2 and spending on extras will be curtailed. FactSet’s latest Earnings Insight Forecast paints a crystal-clear picture of why, going forward, this is a stock picker’s market, as well as why passive investing might hit a brick wall in the months ahead.

As of April 17, 2020, FactSet reports that the S&P is trading at a forward 12-month price-to-earnings (P/E) ratio of 18.5. This P/E ratio is above the five-year average of 16.7 and above the 10-year average of 15.0. Here are the latest figures:

Earnings Update: Analysts Expect Earnings Decline of 12.3% for 2020

In Q1 2020, S&P 500 companies are reporting a decline in earnings of 14.5% and revenue growth of 0.6%.

In Q2 2020, analysts are projecting earnings to decrease 26.6% and revenue to dip 5.7%.

For Q3 2020, analysts are expecting earnings to fall 13.3% and revenue to slip 1.6%.

For Q4 2020, analysts are forecasting earnings to slide 4.8% and revenue to grow 1.1%.

For full-year 2020, analysts are predicting earnings to dive 12.3% and revenue to descend 1.2%.

Remember how 2019’s four straight quarters of declining earnings didn’t matter because 2020 was going to be the year of a major earnings expansion that would justify all-time highs for the major averages? That base case has now been pushed out to 2021, according to the data noted above. With forward corporate guidance about as clear as a San Francisco fog bank, investors should lend an ear to proven stock pickers going forward, with a heavy emphasis on dividend growth companies.

In some years, when the weather is perfect for growing season, most all the fruit on the tree makes it to market. But in years when there has been a swarm of locusts, relatively few pieces make it to market, and they command a very high price. Such will be the stock market for the balance of 2020 through the lens of my crystal ball.