Invest in online sales growth to profit from a powerful trend that has gained momentum amid the COVID-19 pandemic, advises Kevin O’Leary, a wealthy panelist on the “Shark Tank” television program and chairman of O’Shares ETFs.

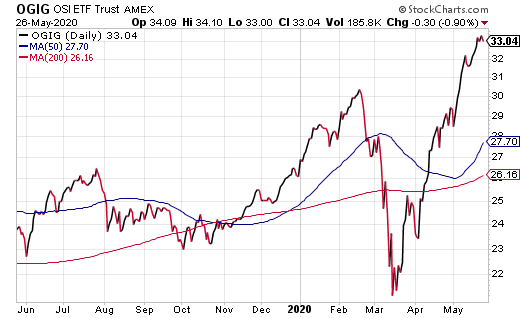

One way to invest in online sales growth is through the O’Shares Global Internet Giants ETF (NYSE ARCA:OGIG), described by O’Leary as his fund company’s “best-performing asset” with a 26.56% rise in its share price so far this year. O’Leary, who participated in a recent video conference call with ETF Trends, may be best known as “Mr. Wonderful” on the “Shark Tank” program. He shared a story about Lovepop, a pop-up greeting card company he agreed to help fund, that beat its expected April sales by going directly to its customers rather than sticking to its traditional retail sales channels amid an economic shutdown.

Chart Courtesy of www.StockCharts.com

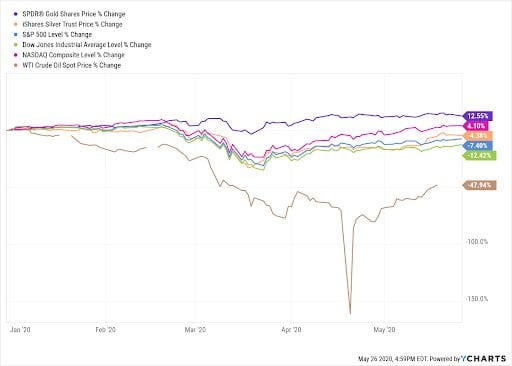

OGIG is among the market-leading technology investments that have beaten the performance of the major U.S. stock indexes so far this year, as well as gold, silver and oil. The fund has risen 5.5% more than the 21.06% gain of the technology category thus far in 2020.

Chart courtesy of www.YCharts.com

Large and small companies alike are showing it pays to invest in online sales growth, O’Leary said. Before the pandemic, a typical consumer goods company might have produced sales that came 50% from traditional retail, 40% from Amazon and 10% direct to the consumer through its website.

“That would be a typical model,” O’Leary said.

Paul Dykewicz meets with Kevin O’Leary for an interview before COVID-19 social distancing.

Investing in Online Sales Growth Identified a Clear Trend

Most retail companies, except for grocers, were considered non-essential, shut down and their revenues “collapsed” during the pandemic, O’Leary said. Going into the pandemic, online sales accounted for just 15.2% of the sales of consumer products companies, excluding autos, O’Leary added.

For example, O’Leary cited the sales of Lovepop, which he chose to help finance when its founders appeared on the “Shark Tank” television program to present their plans to the wealthy investors who choose whether to invest in a business. The company is seeking to disrupt the $7 billion greeting card industry by offering its unique cards featuring pop-up images when they are opened.

COVID-19 Crisis Led Greeting Card Business to Invest in Online Sales Growth

Lovepop is America’s “fastest-growing” greeting card company with locations at almost every high-traffic mall in the country, including Hudson Yards, an indoor shopping mall in New York City between 33rd Street and Tenth Avenue in Midtown Manhattan.

“Hudson Yards is the most expensive real estate on Earth,” O’Leary said. “You can’t pay more per square foot for a retailer anywhere on Earth than Hudson Yards.”

Lovepop started to market directly to its customer list to sell new products for Mother’s Day. The result is a 30% increase in margin by selling directly to its customers.

Mother’s Day Shows How and Why to Invest in Online Sales Growth

“When Mother’s Day came rolling around this year, most of the flower distributors were shut down for COVID reasons and it was very hard to get a dozen roses or whatever,” O’Leary said. “So, they came up with a new product.”

That product was a 3-D bouquet of roses that produced a “phenomenally successful outcome” for the company, even though it was a new product, O’Leary said.

“It almost replaced all of their retail sales,” O’Leary said.

Lovepop not only beat its expected performance in April, it is on track to do so again in May, O’Leary said.

Lovepop Defies Retail Tradition with Move to Invest in Online Sales Growth

“This company that I would have thought would be on my list of potential failures is actually one of my best-performing assets right now,” O’Leary said.

Lovepop “completely pivoted,” said O’Leary, who added that it has “very expensive” office space in Boston and its employees now are working remotely.

“The question now becomes, if we can be so successful remotely, why do we need all that office space,” O’Leary said. “Why don’t we find out what percentage of our staff can remain at home.”

Maybe they have an aging parent, a child at home or dislike the commute, O’Leary said. If 20% of the employees work from home and no longer need office space, the company may be able to use the money it saves to upgrade its workers’ home internet, to provide additional computer hardware and to enhance the security of the router that they use at home, he added.

“We think we can save 7% of free cash flow across the portfolio by cutting out use of retail and office space,” O’Leary said. “This is great news for American productivity.”

Wall Street Money Manager Sees Opportunity from Investing in Online Sales Growth

Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the Value Authority and GameChangers advisory services, said 2020 has become the year direct-to-consumer retail comes into its own. With so many stores closed and supply chains stretched thin amid the current public health crisis, many consumer brands have reconsidered why they need to sell through intermediaries, she added.

“They make the products,” Kramer said. “People still want the products. And the manufacturers already have websites. Why not use those sites to connect people to products and sidestep the entire retail loop? My favorite stock here is Shopify Inc. (NYSE:SHOP), which runs the stores and then integrates with the warehouses and shipping service providers.”

Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Investment in Online Sales Growth Leads to ‘Tremendous Productivity’ Advances

Nobody ever would have taken the risk of shifting to remote working, as people have done amid the COVID-19 crisis, unless they were forced to do so to protect “life and limb,” O’Leary said. Now that they have done so, he said “tremendous productivity” advances are ahead, except for the “poor real estate guys.”

“They had a great run, and now they’re going to give some back,” O’Leary said.

Money flows into ETFs during the last two months reflect O’Leary’s observation, as technology-related funds received an additional $10 billion, while real estate funds incurred an outflow of a couple of billion dollars, said Connor O’Brien, chief executive officer of O’Shares ETFs. Health care funds also have obtained money inflows, he added.

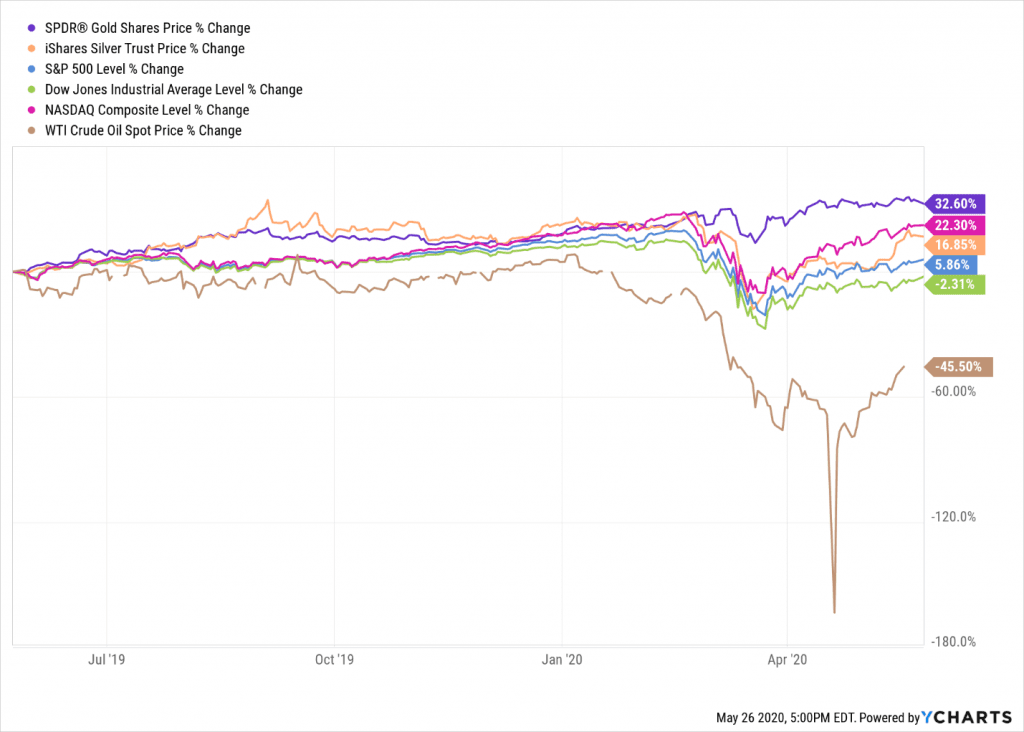

OGIG focuses on stocks that benefit from e-commerce, while seeking to track the performance, before fees and expenses, of the O’Shares Global Internet Giants Index. The fund, launched on June 5, 2018, is a rules-based ETF designed to let investors gain exposure to the largest global companies that derive most of their revenue from the internet and e-commerce sectors. The technology-heavy NASDAQ has been by far the best-performing major U.S. stock index in the past year with a 22.3% gain.

Chart courtesy of www.YCharts.com

Middle East Sovereign Funds Also Invest in Online Sales Growth

Sovereign funds in the Middle East need to make 6% a year to support the various countries they help, so they are increasing their use of equities, compared to fixed income investments, O’Leary said. In the past, the sovereign funds split their allocation of assets evenly between stocks and fixed income, O’Leary added.

Incremental dollars seem to be shifting to equity investments that offer dividend yields of at least 3-4%, as well as the chance for share price appreciation, said O’Leary, who added he expects that trend to continue for the next 36 months. If the federal government is pumping $5 trillion into the U.S. economy, investors will not want to own 30-year bonds, O’Leary said.

Shopify and DocuSign Inc. (NADASQ:DOCU) are among the online services that have found increased growth during the COVID crisis.

Real Estate Suffers as Companies Invest in Online Sales Growth

Real estate investment trusts (REITs) have been horrible investments for the last three months, said O’Leary, who added he is negotiating with REITs in New York, California, Texas and Florida where his portfolio companies have hundreds of locations.

Negotiating requests include deferring any rent payment for three months, O’Leary said. Only 35% of retailers are paying their rent and many businesses are asking their landlords to tack the months of deferred rent onto the back end of a lease, he added.

“I think there is further trouble ahead,” since many renters have figured out how to sell directly to their customers outside of retail stores, O’Leary said.

In addition, O’Leary has told the landlords they are willing to negotiate a reduction.

“We intend to save 7% of free cash flow and our portfolio makes 15% pre-tax,” O’Leary said. “That’s a huge win if we can pull this off.”

“Real estate has been great for 30 years,” O’Leary said. “Okay, now it’s in trouble.”

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said the pandemic has sped up several trends that otherwise would have taken five to 10 years to go mainstream.

“Increased use of technology, remote work and less need for retail and office space are foremost among those trends,” said Carlson, who also leads the Retirement Watch advisory service.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Kramer said real estate remains will remain “depressed” until Wall Street figures out what happens with rents over the coming year.

“Tenants are not going bankrupt en masse,” Kramer continued. “They’ll get back to paying rent now that they’re reopening. And while developments like Hudson Yards are expensive, technology companies that were eager to sign massive long-term leases a year ago have not dramatically changed focus.”

O’Shares Emphasizes Producing Income, Preserving Wealth and Capital Appreciation

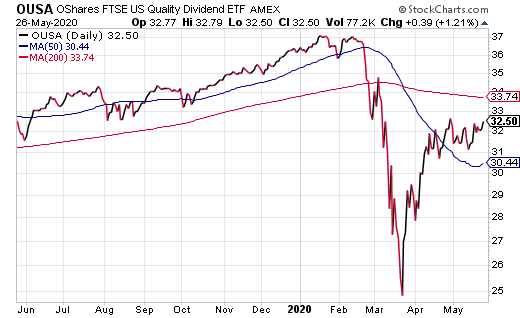

O’Leary told me he launched O’Shares Investments to offer exchange-traded funds that model his personal investment priorities of producing income, preserving wealth and delivering capital appreciation. Since the first of the four O’Shares exchange-traded funds (ETFs) only launched in July 2015, none of them have a lengthy track record to measure their performance against other ETFs.

However, O’Leary said that among the roughly 1,700 ETFs that existed, none adhered to his three core investment principles of income, wealth preservation and capital appreciation, so he decided to launch his own. His inaugural ETF, O’Shares FTSE U.S. Quality Dividend ETF (NYSE ARCA:OUSA), is now listed on the New York Stock Exchange and was envisioned by O’Leary to address his long-term investment objectives of owning a diversified portfolio of quality U.S. stocks that pay dividends and have low volatility.

Chart Courtesy of www.StockCharts.com

COVID-19 has disrupted retail, real estate and other industries as the novel coronavirus has caused 5,685,886 cases and 352,227 deaths globally, along with 1,725,275 cases and 100,572 deaths in the United States, as of May 26. With America reporting the most cases and deaths of any country across the globe, including China where COVID-19 originated, it is not surprising in hindsight that businesses have discovered the rising importance of investing in online sales growth.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. Endorsements for the book come from Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Dick Vitale and others. Follow Paul on Twitter @PaulDykewicz.