Six COVID-19-proof stocks to buy now include recreational vehicle manufacturers and component suppliers, an outdoor sports and activities equipment maker and a company that offers cushy chairs and sofas known for their comfort.

Even though the six COVID-19 stocks to buy have been on an upswing, they have managed to rise despite the National Bureau of Economic Research declaring that the U.S. economy peaked in February 2020 to end a 128-month expansion that began in June 2009. The research bureau explained that Q4 2019 marked the peak in quarterly activity as the COVID-19 crisis caused the lockdown of non-essential businesses throughout much of the world.

However, the May U.S. jobless rate dropped to 13.3% with employers unexpectedly adding 2.5 million jobs to mark the largest monthly gain in new jobs since the U.S. Bureau of Labor Statistics began tracking the data series in 1939. The labor market surprised analysts by rebounding from April, when 20.7 million jobs were cut and the U.S. unemployment rate jumped to 14.7% as many businesses in America closed during the COVID-19 lockdown.

COVID-19 has caused 7,318,131 cases and 413,648 deaths globally, along with 2,045,549 cases and 114,148 deaths in the United States, as of June 9. America has the most cases and deaths by far of any country in the world, including China, where COVID-19 originated.

6 COVID-19-Proof Stocks to Buy Now Include Thor Industries

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment opportunities.

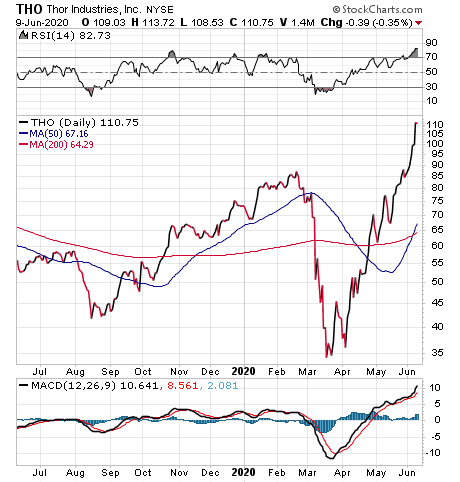

Before the opening bell on June 9, recreational vehicle (RV) maker Thor Industries (NYSE:THO), of Elkhart, Indiana, reported an unexpectedly strong fiscal third-quarter profit of 43 cents per share, even though its revenue fell 33% from the same quarter the prior year to $1.68 billion. But the results beat the expected loss of 40 cents per share, based on analysts’ consensus forecasts, on predicted revenue of $1.42 billion.

Thor Industries, recommended by the Fast Money Alert trading service led by Jim Woods and Mark Skousen, PhD, also has a strong backlog of orders that consists of $857.9 million for its North American towable products, $548.0 million for its North American motorized vehicles and $803.5 million for its European RVs. Bob Martin, chief executive officer of Thor Industries, issued a statement indicating every North American dealer he has spoken to in the last few weeks expressed excitement about the sales pace of RVs.

“Many of our dealers are reporting a significant improvement in sales from April to May and are excited about the sales potential for June and beyond,” Martin said. “Because of this improved outlook and the relaxation of many stay-at-home restrictions, we began to restart production in the first week of May in North America. We have been successful in safely bringing our people back to work, and we are ramping-up production in a measured way in order to keep our team members safe and product quality high, while also fulfilling dealer orders as quickly as possible.”

Chart courtesy of www.StockCharts.com

Thor Industries Beats Forecasts as 1 of 6 COVID-19-Proof Stocks to Buy Now

“In Europe, with over 1,200 dealer-partners in Germany and across the continent, our brands have one of the strongest dealer and service networks, and our long-term outlook for future growth in retail sales remains positive, Martin said. “More and more people are discovering RVs as a way to support their lifestyle of independence and individuality, as well as using the RV as a multi-purpose vehicle to escape urban life and explore outdoor activities and nature. While we are optimistic about the long-term growth of the RV market in Europe, the outlook for European RV retail sales for the remainder of the calendar year depends upon the economic conditions in the countries in which we do business.”

The COVID-19 crisis has hurt Thor Industries’ sales, but Martin said its outlook for the rest of the fiscal year and the calendar year has markedly improved.

“We’re seeing an influx of first-time buyers, which bodes well for the long-term health of the RV industry,” Martin said. “When the COVID-19 pandemic started, we saw many people start to work at home. One new trend we are seeing is an evolution from ‘work at home’ to ‘work from anywhere’ as RV buyers use their new RVs as their office wherever they are, or wherever they want to be. Our channel checks tell us that many of our independent RV dealers are seeing a significant resurgence in their sales, and their inventory levels, which were already down 20% year-over-year, are further declining.”

Amid strong demand for the company’s products, Thor Industries can quickly ramp up production, Martin said. The company also offers a dividend yield of 1.44%.

“We remain steadfast in our confidence in the long-term outlook for not only our business, but the entire RV industry, and we continue to look forward to a bright future.” Martin said.

Woods and Skousen recently opted to sell half of the September 2020 Thor call options they recommended in Fast Money Alert for about a 200% profit, while boosting the stop price on the stock to preserve a double-digit-percentage gain. Woods, who also leads the Successful Investing, Intelligence Report and Bullseye Stock Trader advisory services, told me he likes to recommend stocks that are doing well and ride them as their share prices surge.

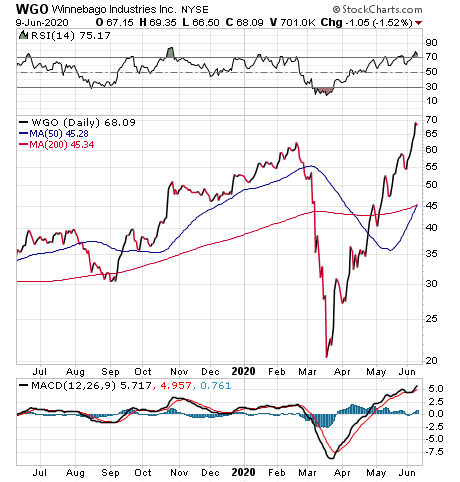

Winnebago Makes List of 6 COVID-19-Proof Stocks to Buy Now

Winnebago Industries, Inc. (NYSE:WGO), of Eden Prairie, Minnesota, manufactures outdoor lifestyle products and commercial vehicles under the Winnebago, Grand Design, Chris-Craft and Newmar brands that primarily are used in leisure travel and outdoor recreation activities. The company, which offers a current dividend yield of 0.64%, produced $2 billion in revenue during fiscal year 2019 by building motor homes, travel trailers, fifth wheel products, boats and commercial community outreach vehicles.

Chart courtesy of www.StockCharts.com

Winnebago’s share price has soared, even after it was downgraded on April 29 by Sidoti & Company, LLC, a Wall Street equity research firm that generally focuses on companies with market capitalizations below $3 billion. Winnebago’s share price closed at $45.47 that day but leaped 49.74% through the end of trading on June 9. The company’s stock price has zoomed 92.33%, compared to 54.51% for the recreational vehicle industry, during the past three months.

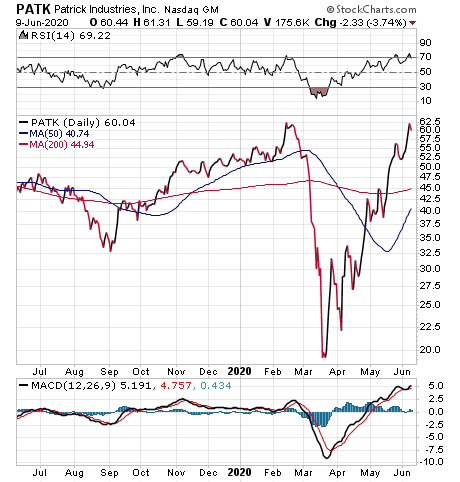

Patrick Industries Ranks Among 6 COVID-19-Proof Stocks to Buy Now

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, cautioned that recreational vehicle stocks have “appreciated quite a bit” since the market’s bottom.

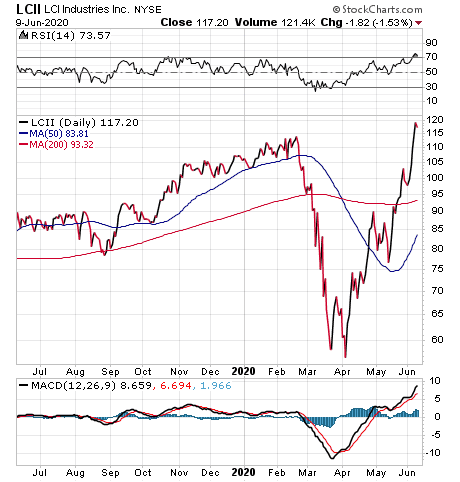

A “better bet at this point” is on the key component suppliers to all the RV companies: Patrick Industries (NASDAQ:PATK) and LCI Industries (NYSE:LCII), both of Elkhart, Indiana, said Carlson, who also leads the Retirement Watch advisory service. Both pay dividends, with Patrick Industries providing a current yield of 1.60%, while LCI Industries is offering 2.18%.

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

“Their stocks haven’t appreciated as much, but these companies will benefit from a continuing boom in RV sales,” Carlson told me.

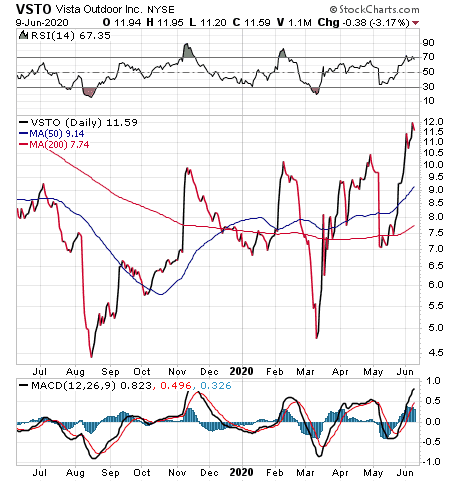

Vista Outdoors Earns Spot as 1 of 6 COVID-19-Proof Stocks to Buy Now

Carlson also advised investors to “look at” Vista Outdoors (NYSE:VSTO), an outdoor sports and recreation company. The stock does not pay a dividend, but the company’s share price is on the rise.

Chart courtesy of www.StockCharts.com

“It sells a lot of different equipment people will buy if they’re inclined to spend time outdoors,” Carlson said. The company’s customers include hunters, recreational shooters, golfers, skiers, members of law enforcement and military professionals.

Vista Outdoors provides sporting ammunition, outdoor products, personal hydration solutions, sports optics, golf rangefinders, action sports helmets and goggles, footwear, cycling accessories, stand-up paddle boards and accessories. It also sells outdoor grills, stoves, snow sport equipment and binoculars, as well as owns a diversified group of name brands for outdoor and recreation industries, Carlson added.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

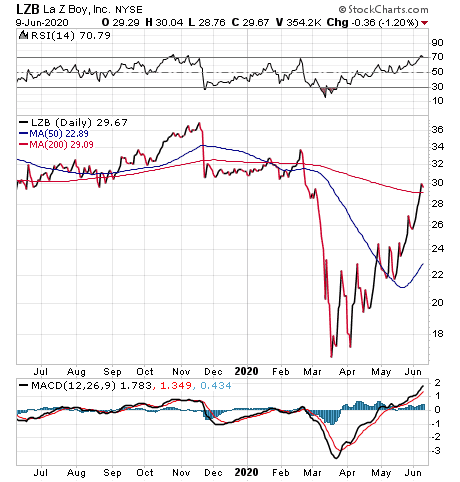

La-Z-Boy Is Another of the 6 COVID-19-Proof Stocks to Buy Now

“For the transition back to greatness on the consumer side, I’m a huge fan of La-Z-Boy Inc. (NYSE:LZB),” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the Value Authority and GameChangers advisory services. The company, a furniture maker based in Monroe, Michigan, with a current dividend yield of 1.86%, offers great products and has developed an “incredibly loyal customer base,” she added.

“Management has made the tough decisions and cut jobs as well as production to project the most efficient profile in a post-pandemic world,” Kramer said.

Chart courtesy of www.StockCharts.com

“We’ve seen how narrow margins can get. Last quarter, the company ran at a loss and the stock dropped below $16,” Kramer said. “Now, even if sales drop 10% in the next year, enough profit still flows to pay the 2% dividend. I don’t think sales will drop that much. When people are stressed and trapped at home, they need a comfortable chair more than ever. I’d rather have this stock than Peloton Interactive Inc. (NASDAQ:PTON).

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

These six COVID-19-proof stocks to buy now offer opportunities for investors who may be unsure about what the market will do next. The Wall Street adage of “sell in May and go away” would have caused followers of that advice to miss out on a great month of returns for many equities in May, but these six COVID-19-proof stocks to buy now should do well this summer and beyond.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Paseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.