Seven media stocks to buy now feature five new media standouts and two traditional broadcasting giants that investment experts identified as strong candidates to outperform the market amid its ongoing recovery from the COVID-19 pandemic.

Heavy weighting of the seven media stocks to buy now toward social media companies shows that the giants of the past are not helped much by size alone as new media entrants have focused on becoming best-of-breed providers in their respective niches. One common benefit to all seven of the media stocks to buy now is that they will be able to compete for advertising dollars that had been delayed or left uncommitted with the U.S. economy slipping into a recession caused by COVID-19.

A positive sign about the economy came when retail sales surged 17.7% in May to mark the largest monthly jump since 1992, according to the U.S. Commerce Department. The rise more than doubled estimates of economists as states began easing coronavirus-related restrictions and trillions of dollars in federal stimulus started to take effect, following retail sales drops of 14.7% in April and 8.3% in March.

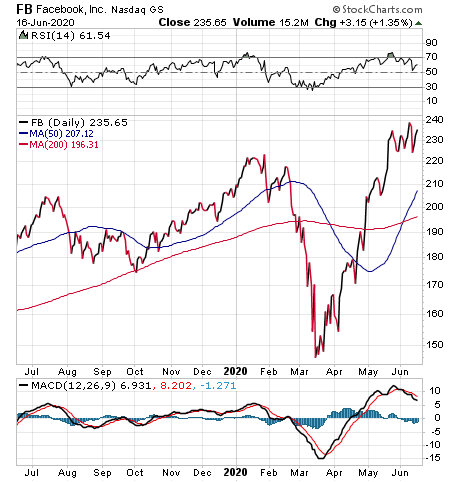

Facebook Ranks Among 7 Media Stocks to Buy Now

Facebook Inc. (NASDAQ:FB) is the media stock recommended by Jim Woods, who leads the Successful Investing, Intelligence Report and Bullseye Stock Trader advisory services.

“That stock is outpacing 97% of all other publicly traded companies in terms of relative price strength,” said Woods, who uses that measure as part of his premium Bullseye Stock Trader advisory service.

Woods advised that Facebook is one of the social media companies that has become a popular target for politicians.

“When both sides of the political aisle are gunning for your company, you know you’re doing something right,” Woods said.

Criticism from Politicians Aimed at 7 Media Stocks to Buy Now

The political left wants social media companies to “fact check” what President Trump tweets, while the political right has accused the companies of deep political bias that skew public opinion and silence popular voices that dissent from liberal talking points, Woods said.

“I think both of these premises can be true at the same time, but that’s a story best dug into another time,” Woods said. “The more important point for us, today, is that while both sides of the political aisle love to bash social media — both sides are doing it, ironically, via social media.”

Woods asked the following rhetorical question: “After all, who would bother to criticize a company that nobody uses or cares about?”

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment ideas.

Facebook has been a “juggernaut” of late, with the stock spiking 11% year to date, and more than 56% since falling to its most-recent low on March 16, Woods told me.

The surge in Facebook shares has come despite falling ad revenue, Woods told me. However, the COVID-19 shutdowns are by no means normal, and shelter-in-place orders by governors throughout the United States have led to record social media usage, he added.

“But because of the contraction in the economy, there’s been a major contraction in advertising spending in all media — and social media is no exception,” Woods said.

Yet the decrease in revenue is easily explained away by many businesses that normally advertise on these platforms enduring virtual shutdowns in their respective revenue streams, Woods said. One of their first expenses to cut involved social media ad buys — since “non-essential” brick-and-mortar stores were locked down and it was pointless to advertise for customers who could not leave their homes for anything other than essential travel, he added.

Chart courtesy of www.StockCharts.com

“I suspect that once the economy gets back to normal, social media companies will be the first to see ad revenue come back,” Woods said. “The reason is simple — social media advertising is effective, targeted and measurable. Think about those so-called ‘direct response’ ads.”

Anyone who frequents Facebook or other social media platforms such as YouTube or Twitter (NYSE:TWTR) is bombarded by direct response ads for products that individual users are predisposed to buy, according to ad algorithms, Woods continued.

Financial fundamentals also favor Facebook, Woods said. As far as earnings growth, Facebook’s last quarter produced a 101% year-over-year earnings per share (EPS) jump, he added. Unfortunately for income investors, the stock does not pay a dividend.

One reason is Facebook is in the top 4% of all public companies in terms of current and annual earnings growth, Woods said. Technically, Facebook’s 38.5% gain in the past 52 weeks has vaulted it into the top 11% of all stocks in terms of relative price strength, he added.

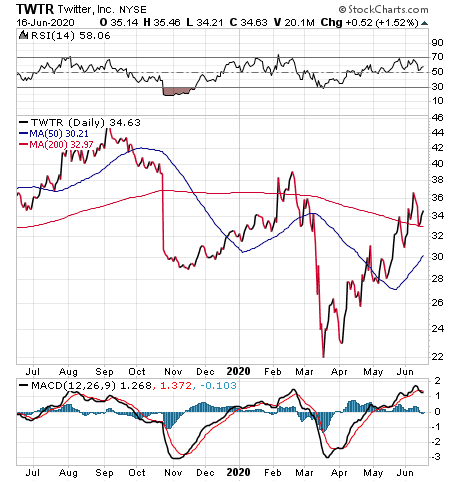

Twitter is One of the 7 Media Stocks to Buy Now Favored by Kramer

“If we do get an improving ad economy, I still like Twitter,” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the Value Authority and GameChangers advisory services. Even though Twitter does not pay a dividend, the company keeps growing and ultimately could emerge as a potential acquisition target, she added.

Chart courtesy of www.StockCharts.com

Kramer indicated she would not be surprised if “upfront” purchase of advertising is “dead” in a post-COVID-19 world.

“The crisis taught marketers that they need to be nimble and responsive,” Kramer said. “Long lead times are out. Ad hoc ad buys are in. That rewards the next-generation ad platforms that were already making serious inroads on conventional competitors and barely even registered disruption elsewhere.”

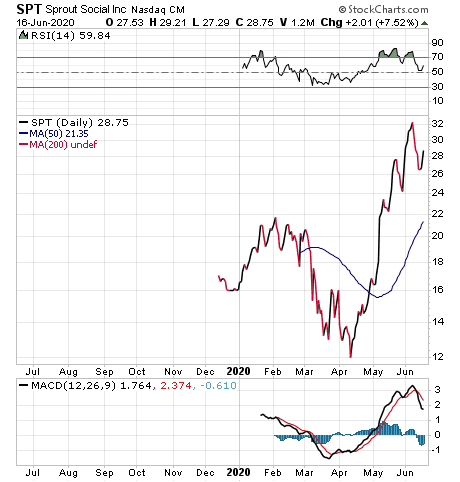

Recent IPO Propels 1 of the 7 Media Stocks to Buy Now onto the List

Sprout Social Inc. (NASDAQ:SPT) is a stock that has risen 33% in just four months as a holding in Kramer’s premium IPO Edge advisory service. The company, a non-dividend payer, went public late in 2019 and still has much “upside” left to chase, she added.

Chart courtesy of www.StockCharts.com

“Social media is like another world compared to cable TV,” Kramer said. “The business didn’t even flinch in the pandemic, with sales jumping 30% in 1Q20 compared to the previous year.”

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

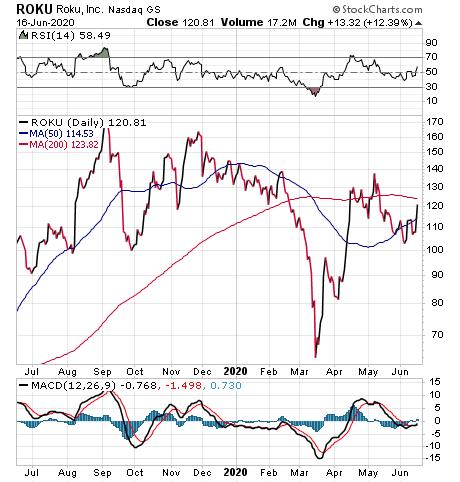

Roku Joins 7 Media Stocks to Buy Now

Kramer also singled out Roku Inc. (NASDAQ:ROKU), another non-dividend payer, for its streaming video ad business.

“Remember, subscription TV doesn’t run ads, so the rise of Netflix, HBO, Disney+ and other paid channels leaves the advertisers in the cold unless they pay Roku for exposure on the menu screen,” Kramer said. “That’s practically a $1 billion annual revenue stream already and it’s extremely profitable. While the outbreak set ad sales back a bit last quarter, the year-over-year growth curve hasn’t softened at all.”

Chart courtesy of www.StockCharts.com

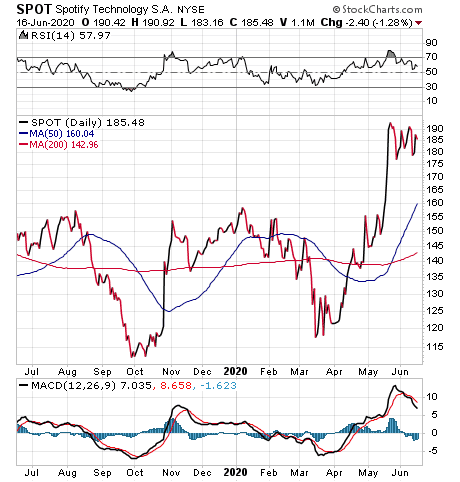

Spotify Technology SA (NASDAQ:SPOT) is another non-dividend-paying media stock that bears watching, Kramer said.

“Ads remain a sideshow next to the core subscription music service, but unlike a lot of conventional platforms, this alternative to terrestrial radio is holding up relatively well,” Kramer said. “Watch its numbers closely as the political season heats up. Remember, Twitter has banned campaign ads and a lot of messaging remains controversial on Facebook, so this is a logical place for outside-the-box messaging.”

Chart courtesy of www.StockCharts.com

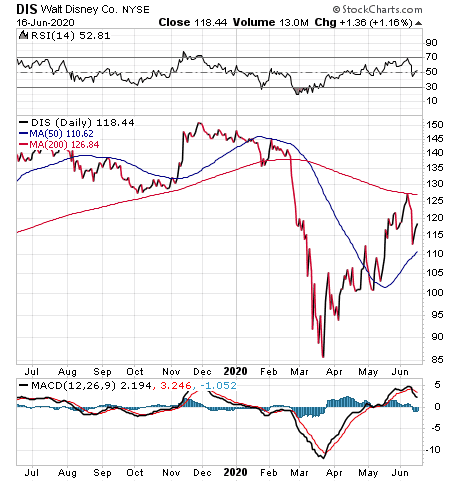

Disney Brings Its Magic as 1 of 7 Media Stocks to Buy Now

Jessica Reif Ehrlich, an analyst at Bank of America/Merrill Lynch, wrote a positive note about Walt Disney Co. (NYSE:DIS) on Monday, June 15, keeping her buy rating on the stock but boosting her price target 18.7% from $123 to $146.

Disney shares are trading at 21 times 2021 EPS and 19 times 2022 EPS, offering a “compelling entry point” to buy a best-in-class stock, Reif Ehrlich wrote in her research note.

Even though the global COVID-19 pandemic will slow Disney’s near-term outlook, it is posed to “grow stronger through the crisis,” she opined.

Disney does not currently pay a dividend but offers an attractive risk/reward profile, based on her new, in-depth financial model of the company’s outlook. Reif Ehrlich now estimates an adjusted EPS of $0.74 and $3.30 in fiscal year 2020 and fiscal year 2021, respectively, versus $1.67 and $5.15 previously.

Chart courtesy of www.StockCharts.com

Optimism for Disney is warranted based on its planned re-opening of the company’s global theme parks, including Walt Disney World and Disneyland, this July. Plus, Disney is expected to resume feature film releases, including “Mulan,” in late July.

On the sports programming side, the company’s ESPN paid-television service is likely to begin broadcasting NBA games when they start again in late July.

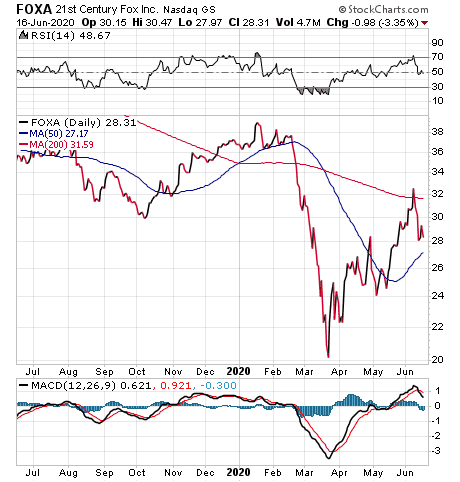

Broadcaster Fox Earns Spot Among 7 Media Stocks to Buy Now

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, recommended broadcasting powerhouse Fox (NASDAQ:FOXA). Fox is the only one of the seven media stocks to buy now that pays a dividend. The dividend yield currently is a respectable 1.57%.

Chart courtesy of www.StockCharts.com

The stock has not fully participated in the rally since the March lows, said Carlson, who also leads the Retirement Watch advisory service. Fox also stands to benefit considerably from a rebound in sports-related programming, the resumption of new programming and economic recovery in general, he added.

“Investors punished the stock too much in the downturn and haven’t noted its merits in the rebound,” Carlson said.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

The stock market has showed volatility lately. For example, the major U.S. stock indexes plunged about 6% in one day earlier this month, after Federal Reserve Chairman Jerome Powell warned that the labor market may need years to overcome the pandemic and that millions of newly unemployed Americans might not be rehired for their former jobs. The market drop also stemmed partly from the June 10 announcement by the Organization for Economic Cooperation and Development (OECD) that the COVID-19 pandemic has triggered the “most severe recession” in nearly a century, may include a second wave of illnesses and cause huge damage to people’s “jobs and well-being.”

The negative outlook accompanied data that showed 1.5 million Americans applied for unemployment benefits in the week through June 6, continuing a decline from a recent peak of almost 7 million applicants in the week through March 28. Plus, the May U.S. unemployment rate dropped to 13.3% with employers unexpectedly adding 2.5 million jobs to mark the largest monthly gain in new jobs since the U.S. Bureau of Labor Statistics began tracking the data series in 1939.

The labor market surprised analysts by improving from April, when 20.7 million jobs were cut and the U.S. unemployment rate jumped to 14.7% as many U.S. businesses closed during the COVID-19 lockdown.

COVID-19 has caused 8,257,535 cases and 445,986 deaths globally, along with 2,208,400 cases and 119,132 deaths in the United States, as of June 16. America has more than twice as many cases and deaths as any other country, including China, where COVID-19 originated.

These seven media stocks to buy now give investors a choice of equities ranging from established broadcasting giants to growth-oriented social media companies. Anyone who followed the Wall Street adage of “sell in May and go away” would have missed out on last month’s market resurgence, and these seven media stocks to buy now appear well positioned to rise more than the market in the months ahead.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Paseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.