The best dividend aristocrat stocks to buy amid the COVID-19 recovery include Chicago’s Archer Daniels Midland (NYSE: ADM).

The seven stocks to buy offer strong dividend yields for investors and each has boosted its dividends annually for at least the past 25 years. To qualify as a dividend aristocrat, a stock also must be listed in the S&P 500 and have a market capitalization of at least $3 billion.

Best Dividend Aristocrat Stocks to Buy Now Include — Archer Daniels Midland (NYSE: ADM)

One of the best dividend-paying stocks to buy is Archer Daniels Midland, a global food processing and commodities trading corporation that offers a 3.65% dividend yield. It also ranks among the elite Dividend Aristocrats that have maintained rising dividend policies that income investors love.

As a worldwide nutrition company, Archer Daniels Midland was among the businesses that continued to generate cash holdings during the economic slowdown of the COVID-19 crisis. The company amassed a strong quarter-end balance of $4.7 billion in cash and cash equivalents, compared to $926 million the same quarter a year ago. This displays significant steps taken by ADM to enhance its business capabilities with a strong balance sheet and liquidity position.

Performance of Archer Daniels Midland as One of the Best Dividend-Paying Stocks to Buy

Archer Daniels Midland reported a 2.9% drop in its revenues for the quarter ended March 31, 2020, compared to the same quarter a year ago. However, it continued to generate earnings by increasing its net earnings to $391 million for the first quarter ended March 31, 2020, compared to $233 million a year earlier. The COVID-19 financial crisis did impact ADM’s net earnings during the quarter, as they fell 22.4% from a high of $504 million from the prior quarter that ended December 31, 2019.

Nevertheless, Juan Luciano, chairman and CEO of Archer Daniels Midland, touted the company’s critical role in supporting global food chains and customer needs during the global pandemic.

“Our performance is a testament to the resilience of our people, the strength of our business model, and the breadth and depth of our capabilities to fulfill customer needs, even in a market environment that is changing rapidly due to the COVID-19 pandemic,” Luciano said. “I’m proud that we are operating around the globe with very minimal disruptions.”

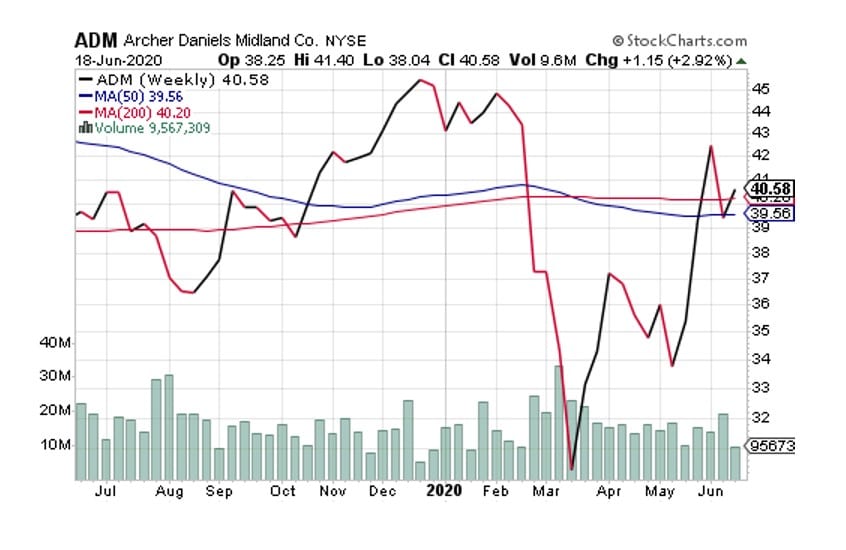

Chart courtesy of www.StockCharts.com

The Best Dividend-Paying Stocks to Buy Include a Company in Expansion Mode

The company has continued to invest in bettering nutrition with a goal to improve underperforming operating segments, expand its global presence, and continue its investment in human and animal nutrition. Its January 2020 acquisition of Yerbalatina Phytoactives is a significant step taken by ADM toward its commitment to animal nutrition.

ADM Boosted Payout 45 Straight Years as One of the Best Dividend-Paying Stock to Buy

With 45 consecutive annual dividend increases to its regular dividend, Archer Daniels Midland has been a Dividend Aristocrat for almost a decade. Its current quarterly dividend of $0.36 converts to a $1.44 annual distribution to offer its 3.65% forward dividend yield. That payment marks a 2.85% increase in its annual dividend from 2019 to 2020.

Price / Book Ratio

ADM currently trades at a 1.16 price to book ratio, so it is trading slightly greater than its book value.

Price / Earnings Ratio

ADM also has a 14.47 trailing price-to-earnings (P/E) ratio, which is much lower than the overall S&P 500 P/E ratio of 22.44, as of June 15, 2020. This valuation looks very compelling compared to the S&P 500 market index.

Recent Stock Price Performance

ADM’s stock price since the start of the year has fallen 12%, but the stock has recovered 38.1% from its low on March 23, 2020, as of June 17, 2020. Following a market crash due to the COVID-19 global pandemic, the stock slid from the $40 range in February 2020 to the $33 range in March 2020. Prior to this, ADM’s stock price showed consistent increases from the $40 range in June 2019 to $45 range at the end of 2019.

Other Major Events Include Acquisition of Yerbalatina Phytoactives

Archer Daniels Midland announced it had acquired Brazil’s natural plant-based extracts and ingredients manufacturer, Yerbalatina Phytoactives, on January 7, 2020. This acquisition expands ADM’s operations in Brazil and brings in more than 100 botanical products and solutions and the 13 animal nutrition facilities of Yerbalatina Phytoactives under ADM management.

Since that time, ADM’s stock price has fallen from $45.11 to its close of $40.49 on June 17, with a low of $29.31. However, the COVID-19 crisis contributed heavily to the plunge in ADM shares, as it did with many other public companies.

DividendInvestor.com rates Archer Daniels Midland a BUY for the following reasons:

- Although Archer Daniels Midland has clearly suffered financially due to COVID-19, its recent 38.1% stock price increase since the onset of the global pandemic shows the value of its business. The company was a critical player during the peak of the COVID-19 crisis by supplying numerous food supply chains and nutrition services.

- Its 45-year history of dividend growth and its 3.65% dividend yield add to ADM’s appeal. The company’s dividend and dividend growth history provide good indicators for the stability of its future payouts.

- The company’s P/E ratio is low compared to the S&P 500 market index.

Key Risks for the Company Include:

- Its business operations could still be vulnerable to adverse effects from the outbreak and spread of COVID-19 and other contagious diseases.

- While the company’s steps taken to improve its liquidity position are positive for future investments, the sudden increase in cash holdings could be an indicator of decreasing performance.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)