The Dickensian aspect. That’s a phrase sometimes used when one explores the financial, social and moral turmoil in a culture the way that Charles Dickens did in his masterwork, A Tale of Two Cities.

Here’s the epic opening to that novel. Once you read it, you’ll know why I chose it to describe what’s happened in markets and the economy through the first two quarters of the year:

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way…”

As I wrote in the last issue of The Deep Woods, so far, 2020 is shaping up to be the worst year ever.

We’ve been hit with the worst global viral pandemic in over a century, a virtual shutdown of the American and global economies and we witnessed a gut-twisting plunge in the S&P 500 of some 30% in just a matter of weeks.

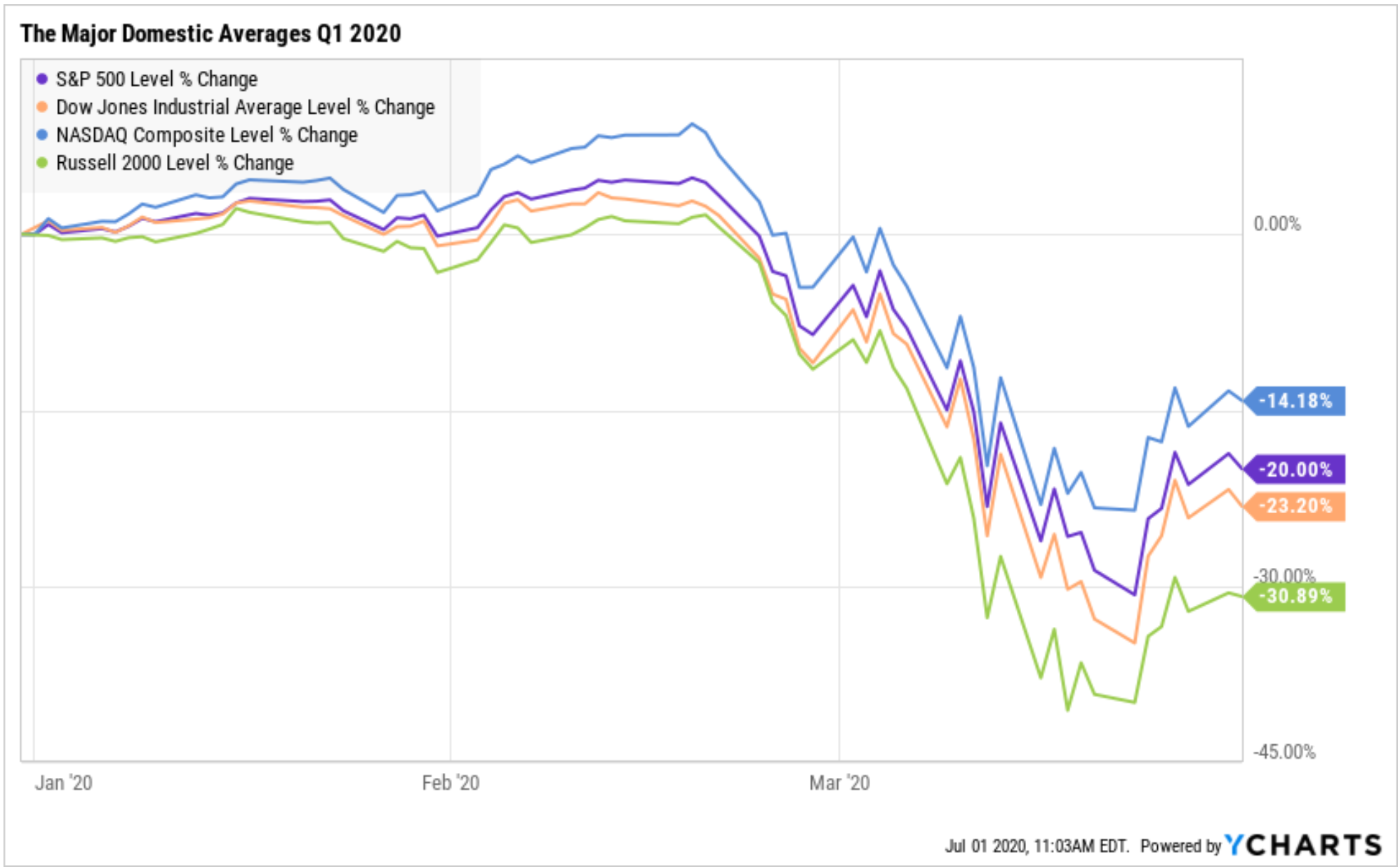

All of this pain was reflected in the worst first-quarter performance for markets since 1938. That drubbing can be seen here in the chart of the major domestic averages in the first three months of this year.

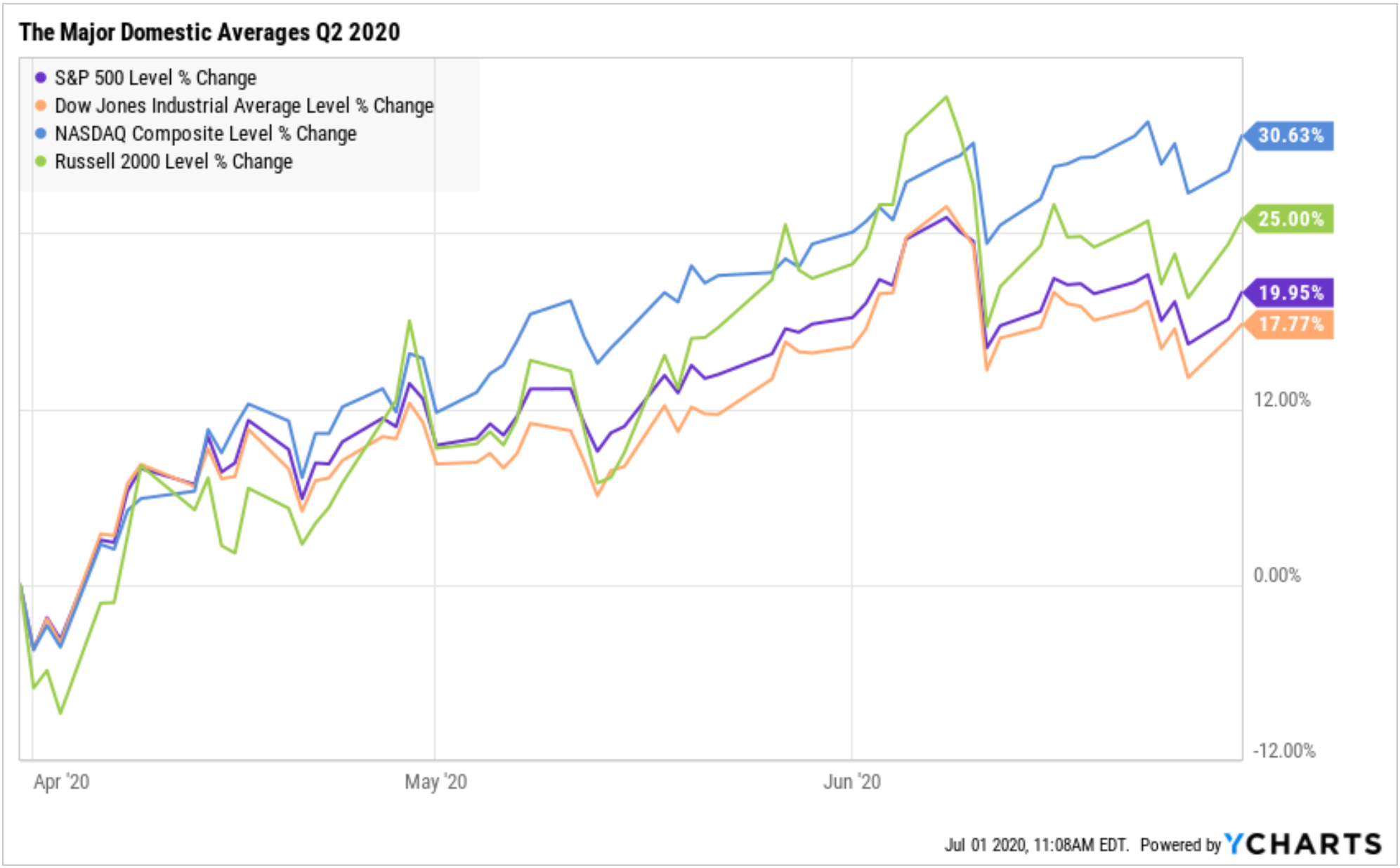

Yet through these “worst of times,” individuals, acting in pursuit of their own rational self-interest, took action and have largely ushered back in the “best of times” during the second quarter. The chart here of the major domestic averages in Q2 shows a virtual reversal of the big selloff in Q1.

Of course, it wasn’t just individuals who acted to pull the market up by its bootstraps. In March, the Federal Reserve announced unprecedented and virtually unlimited money printing that was designed to “rescue” the economy and the markets. Then, we had the federal government step in to issue massive, multi-trillion-dollar stimulus via beefed-up unemployment checks and Paycheck Protection Plan (PPP) loans to businesses.

Those combined efforts helped extricate stocks from their downward spiral. Though the trajectory in Q2 was occasionally volatile, by and large, the market staged a near-complete reversal of fortune from April through June.

Finally, let’s look at the widened view of the major domestic averages through the first half of this crazy year. As you can see, while the NASDAQ Composite is firmly in positive territory, the Dow Jones Industrial Average, S&P 500 and Russell 2000 remain in the red year to date.

As you can see, 2020 has been a year riddled with tumult, and one can easily apply the Dickensian aspect here, as it is been the best of times and the worst of times for markets.

So, what’s in store for the second half of this extraordinary year?

I think any real speculation here is mere folly, as the winds of change in this market are as unpredictable as the hot summer Santa Ana winds that blow through my beloved Southern California mountains.

Yet one thing I think we can say with virtual certainty is that this market, this economy and this society will continue to experience the best of times, and the worst of times.

Consider yourself forewarned.

*********************************************************************

The Sweet Taste of Adversity

“Sweet are the uses of adversity, which, like the toad, ugly and venomous, wears yet a precious jewel in his head.”

–William Shakespeare, “As You Like It”

If there’s anything that this year has taught us, it’s that adversity is omnipresent and always boiling under the surface of existence like the hot magma in the Earth’s inner core. And while that adversity has come to the surface via a global pandemic in 2020, we don’t have to completely bemoan it. Instead, we can learn from this ugly and venomous circumstance — provided we acquire a taste for the sweetness of adversity.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods